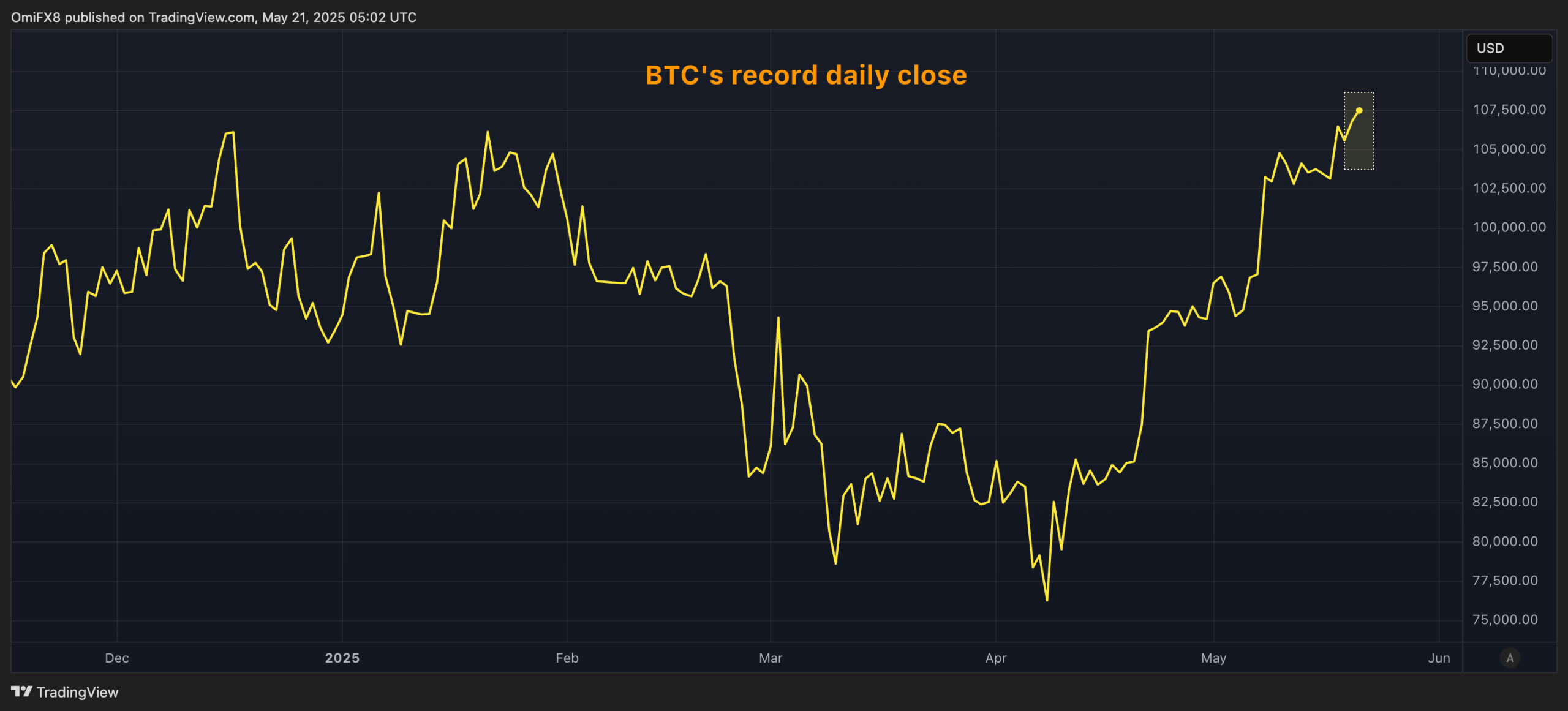

Although Bitcoin (BTC) can be exchanged 24/7, its candles open and close every day similar to exchange markets. The latest tradingView data show that Tuesday’s candle ended (UTC) at $ 106,830, the highest daily closing price.

The Haussier move came while investors have paid money into the funds (ETF) negotiated on the stock market in the midst of chaotic prices action on the bond markets which have suggested increased concerns concerning the budgetary health of major economies, including the United States

Analysts told Coindesk last week that the worsening of the budget debt situation could have increased well for the BTC and other assets such as gold.

The Coinbase Bitcoin Premium Bitcoin index, which measures the difference as a percentage between the price of Bitcoin on Coinbase Pro (USD pair) and the price on the Binance (USDT commercial pair), has remained positive, indicating a persistent purchase pressure of American investors.

With the current trend, the following key level to watch is $ 110,000. DRCITA BTC options, followed by Amberdata, show that dealers or market manufacturers have a large “negative gamma” net exhibition in $ 110,000.

Concessionaires holding a negative gamma are generally negotiated in the direction of the market to maintain their global exposure to Delta Neutre. This, in turn, amplifies the down and bullish movements.

In other words, the rally can accelerate on a potential break greater than the $ 110,000 mark. The options market has increased considerably over the past five years, coverage of the concessionaire adding to volatility several times.