Bitcoin

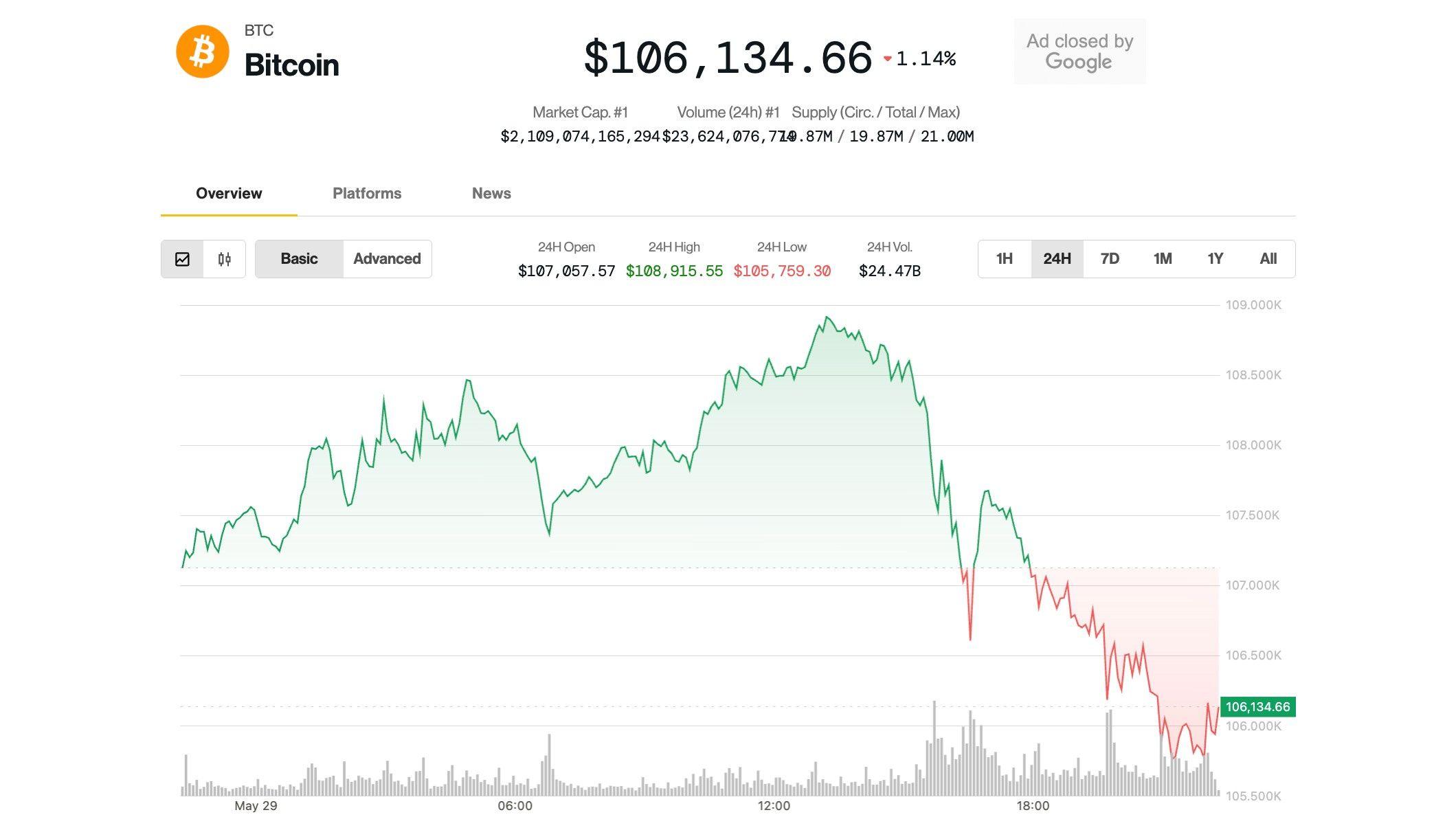

Thursday afternoon, cryptographic markets slipped quietly at its lowest price in nine days when the cryptographic markets were cooling after a rally of several weeks.

The upper cryptocurrency has reached a session hollow of $ 105,750 before bolishing at just over $ 106,000. It has dropped by 1.5% in the last 24 hours, but still at only 5% of record levels.

The Coindesk 20 – An index of the 20 best cryptocurrencies by market capitalization, with the exception of exchange parts, the same and stablecoins – dropped by 0.9% in the past 24 hours, with Solana

And the BTC underperforming avalanche with losses of 1.8% and 2%, respectively. Meanwhile, Ethereum’s ether and XRP challenged the downward trend with gains from 1% to 2%.

Crypto’s actions have had a relatively gourmet session. Coinbase (corner) is down 2.7% but the strategy (MSTR) increased by 0.8%. Bitcoin mining Cirms Bitfarms (BitF), Bit Digital (BTBT), Cleanspark (CLSK) and Greenidge Generation Holding (GreeE) have reserved about 4% losses.

A control over the traditional markets has shown that American actions restoring most of the gains in yesterday’s decision of the court which blocked the world prices of the Trump administration.

However, an American court of appeal has now reinstated the prices while the government has appealed the previous decision, perhaps adding to the uncertainty of investors.

The strategist of the LMAX group market, Joel Kruger, expects a volatile journey with the return prices in the home with the current attraction and the self-imposed deadline of July 9 for the approach of commercial transactions, but is always more upwards of digital assets.

“Bitcoin remains robust in the second half of the week, consolidating just below its recent overview while holding firmly above $ 100,000 for 20 consecutive days, stressing the persistent bullish momentum,” he said.

Ether shows strength, notes analysts

Kruger has also noted that Ethereum’s ether shows signs of breaking its multi -year decline against the BTC, while the Bonanza of the Corporate Crypto Treasury reached the second largest digital active ingredient with the 425 million dollars of Sharplink Gaming (SBET).

Arthur Aziz, founder and investor of B2 Ventures, said that ETH rolled up for an escape but warned against risks.

Sharing his technical analysis in a note, he said that the level of $ 2,750 has laid significant ceiling gains in recent weeks, while the zone from 2,550 to $ 2,450 appeared as a key support level. He noted that the ETH forms an upward triangle model, which has historically preceded rallies at higher prices.

“The scene for a future level escape of $ 3,000 is being adjusted right now,” he said. However, the lever effect “abusing” on the term markets could trigger a “net break” below the support zone of $ 2,550 to $ 2,450 in cascade sales.