Near the protocol has been taken in the crossed currents of global economic uncertainty, its price action reflecting wider market turbulence while investors sail on complex geopolitical developments.

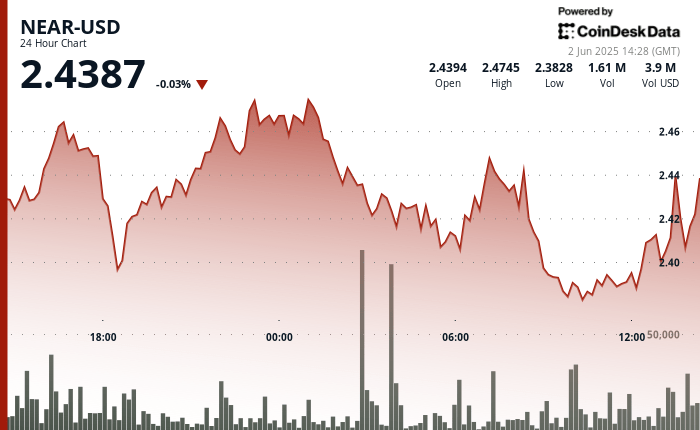

Cryptocurrency has experienced significant volatility in the last 24 hours, establishing a negotiation range between $ 2.38 and $ 2.49.

The performance of the token reflects tension on traditional markets, where the climbing of American-Chinese trade disputes threatens the world supply chains and create a particular uncertainty for technology-oriented assets.

Meanwhile, the signals of the European Central Bank on potential rate drops in the middle of slowing inflation provide a mixed perspective for digital assets as monetary policy moves to large economies.

Adding to the complexity of the market, the intensification of conflicts of the Middle East has sparked new sanctions affecting oil prices, contributing more to the volatility of the market reflected in the fluctuations in prices of Narch.

Technical analysis

- The high volume support area formed approximately $ 2.38 to $ 2.40, with a coherent intervention by buyers during the period of 09: 00-11: 00 over a volume greater than the average exceeding 2.5 million units.

- The descending resistance trend established after reaching $ 2,481 to 1:00 a.m., indicating persistent shoulder momentum despite recovery attempts.

- An upward rise of $ 2,399 to $ 2,439 (gain of 1.67%) in the last hour, with a significant resistance breakthrough at $ 2,420, followed by consolidation nearly $ 2,435.

- Poll Sharp at $ 2,399 at 2:00 p.m. before going back to $ 2,414, which suggests a high purchase interest in support of $ 2,400.

- The stabilization of prices in a narrower range indicates the potential continuation of the movement up if the volume support remains solid.

Warning: Parties of this article were created using AI.