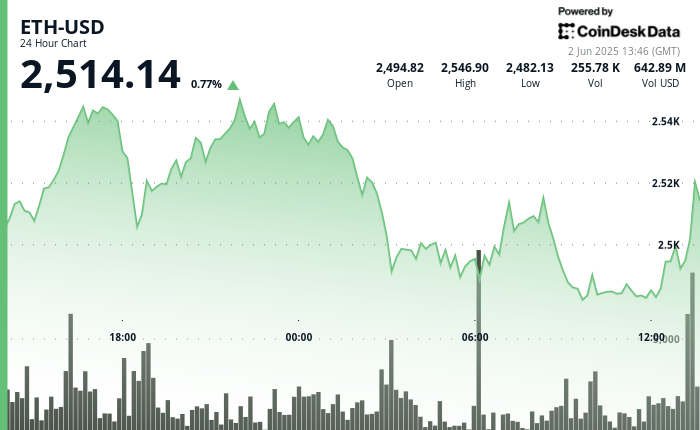

Ethereum continues to demonstrate notable resilience in the midst of growing economic opposite, by maintaining its sole above the support level of $ 2,500 despite intensified volatility on the market.

The assets rebounded strongly from $ 2,472.84 to a session summit of $ 2,547.92, with a price currently holding nearly $ 2,514. The technical momentum remains intact while higher stockings persist, supported by high demand around the area from $ 2486 to $ 2,490.

Trade tensions between the United States and China and the recent ascent of yields of the US Treasury have weighed heavily on risk assets, but Ethereum has resisted relatively well.

Meanwhile, the ETF spot inputs have added a rear wind, with $ 3 billion in net investment in the last three weeks, pointing to supported institutional interest.

While the increase remains capped by resistance almost $ 2,550, the price of the prices of the ETH reflects a solid conviction for buyers in the middle of macro uncertainty.

Strengths of technical analysis

- Ethereum presented a notable 24 -hour fork of $ 67.47 (2.72%), with a price action marked by a noon recovery of $ 2,472.84 to a peak of $ 2,547.92.

- The assets established solid support in the area from $ 2486 to $ 2,490, confirmed by volume above average during 3:00 am.

- The resistance emerged nearly $ 2,540 to $ 2,547, where coherent profits capped further.

- A decisive rebound compared to the level of $ 2,488, supported by 172 137 ETH in volume, reinforced the bullish momentum despite the consolidation at the end of the session.

- The ETH has gone from $ 2,506.05 to $ 2,515.16 in the last hour, forming a clear rise in trend between 07: 05–07: 18 supported by a strong volume (4,730 ETH).

- A decline at $ 2,502.42 held firm, the Bulls intervene to defend the region from $ 2,504 to $ 2,506 and prevent a breakdown.

- The last minutes saw a renewed force, with Stron going up to $ 2,514, highlighting current purchase interests despite previous volatility.

External references