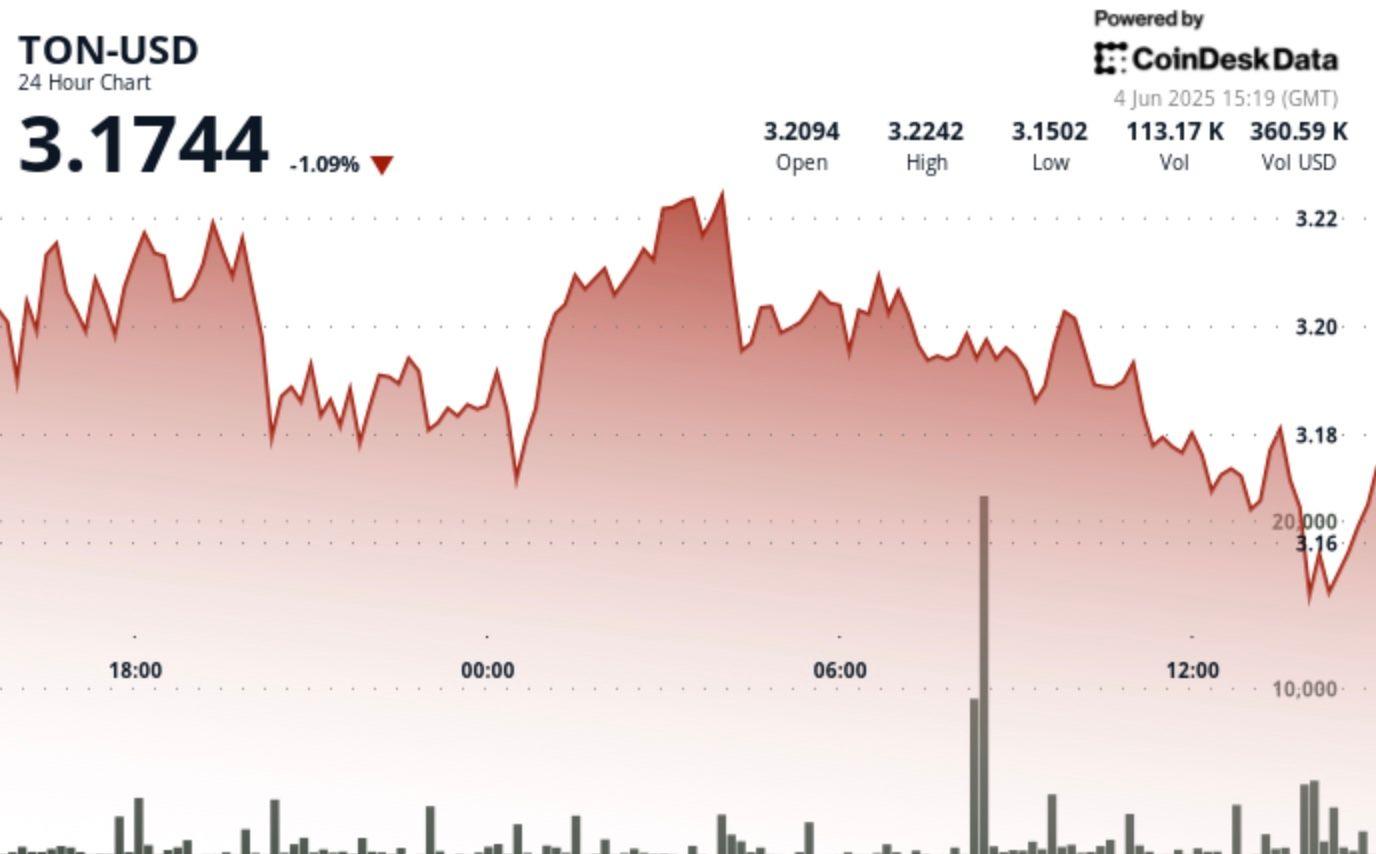

The recent price action reveals that tone’s struggle to maintain stability, with an attempted escape missed at $ 3.22, followed by an accelerated sale during advanced negotiation hours, according to the Technical Analysis model of Coindesk Research.

This decision comes as the larger market index, Coindesk20, has remained flat.

Technical indicators paint a potential downward image on the short -term time because the formation of lower ups and lower stockings suggests creating a lower momentum.

The ventilation of the level of support of $ 3.16, confirmed by the high volume sale, opened the door to another potential drawback while global economic tensions continue to reshape the priorities of investors in traditional markets and cryptocurrencies.

Strengths of technical analysis

• Failure of the escape attempt at the level of resistance of $ 3.22, followed by a coherent sales pressure.

• Accelerated sale with volume above average.

• A notable support appeared at $ 3.16, where buyers were previously intervened with a high volume.

• The formation of lower ups and lower stockings because the rejection of $ 3.22 suggests a downward momentum.

• A short -term double top pattern formed at $ 3.18 before decomposing.

• High volume sales lowered prices to $ 3.16, confirming the ventilation of the support level of $ 3.16.

• 1.2% of the price swing an hour shows an increase in market instability.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.