Solana soil

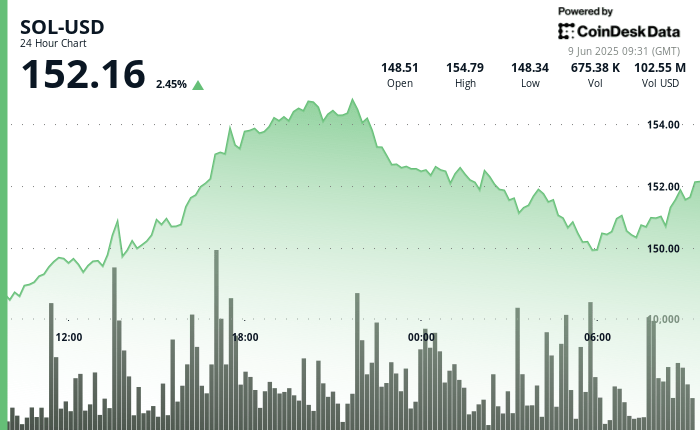

posted a solid recovery in the last 24 hours, increasing up to 4.83% before retiring to exchange around $ 152.16. While volatility remains high, the cryptocurrency has formed a lower diagram, suggesting an underlying resistance in the middle of a fragile macro discovery.

The wider market remains focused on the renewal of commercial talks between the United States and China, which started on Monday in London on Monday. The meetings bring together senior officials, notably the US Secretary of Commerce Howard Lutnick and the Chinese Deputy Prime Minister, He Lifeng, to combat longtime tensions on prices and technological restrictions.

While the two parties struck a temporary truce last month, the two have since accused of hindsight. Analysts say that rare earth export borders and controls of the ia fleas remain key snack points that could influence the feeling of the global market, including risk assets such as cryptocurrencies.

In the midst of this uncertainty, the Solana network continues to show expansion potential, certain institutions projecting price targets of up to $ 420 to $ 620 in 2026. In the short term, traders will probably monitor how macro developments affect the appetite for risk exchanges in assets and soil.

Strengths of technical analysis

- Sol went from $ 148.08 to $ 155.24 (range of 4.83%) before the retraced

- The price has formed an upward trend channel from 09: 00 to 21: 00 on June 8

- High volume support established at $ 152.03, resistance at $ 154.79

- Price stabilized nearly $ 150.91 after the correction

- Uprend Channel resumed on June 9, with a strong volume at 07:59 (54,590 units) and 08:02 (23,396 units)

- Resistance was raped at $ 150.85, followed by lateral consolidation

- Price awarded from $ 150.53 to $ 150.98 in the last time candle, reporting renewed force

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.