Ether (ETH)

Derived about $ 2,770 in most of Tuesday up to around 20 hours, when the officials said that the negotiators in London forged an American commercial executive project. The plan – until the expectation of presidential approval – would see Beijing resuming rare land exports while Washington attenuates the borders of advanced technology sales.

At 8:04 am on Wednesday, former American president Donald Trump posted on Truth Social that “our agreement with China is made”, pending his official approval from President XI. Trump said that the agreement would leave American prices on Chinese imports effectively at 55% against 10% of Beijing, promised that China would be in charge of magnets and other materials of the rare land, and said that Washington would maintain concessions such as Chinese students’ continuous access to American universities, describing the bilateral relationship as “excellent”.

The hopes of a thaw in the dispute on multi -year prices have sparked an initial risk offer: the term contracts on global actions are refined, Bitcoin checked and ether pushed to around $ 2,780 on the expansion of turnover.

Risk appetite intensified for eleven hours later, around 8:30 a.m. on Wednesday, after the American Labor Department reported that the title may be the title and the basic ICC each increased by 0.1% per month, undervaluating forecasts by 0.2% of economists. Cold printing has fueled the expectations of the federal reserve to be able to reduce rates later this year, resulting in the treasury yields and the lower dollar while extending the gains in shares.

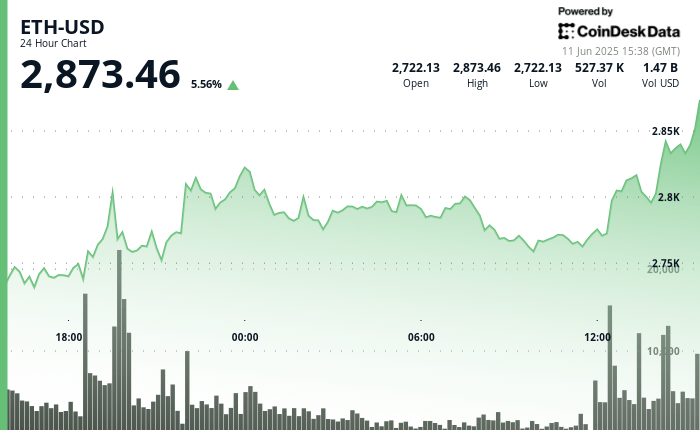

In this macro backdrop, Ether went from $ 2,780 to an intrajournual summit of $ 2,873.46, with an punctual volume inflating to around 527,000 pieces (~ 1.47 billion dollars), depending on the Coindek Research technical analysis model.

The structural tail winds remain strong. ETH marked climbed to a record of 34.65 million tokens (≈28.7% of the offer), the funds negotiated on the stock market recorded an entry sequence of 16 days almost $ 900 million, and the interests open to the long term printed a new plus above $ 21.7 billion – all stressing the stable institutional commitment. The accumulation of $ 500 million blackrock in the past ten days illustrates this theme.

Traders are now looking for a decisive fence greater than $ 2,900 to open a potential race at the psychological bar of $ 3,000, while keeping a decline to the support band from $ 2,750 to $ 2,760.

Strengths of technical analysis

- Orient yourself: Bas up higher since June 9 and a higher level of $ 2,873 confirm an accelerating channel up.

- Volume confirmation: A candle triggered by CPI printed the largest bar of the day (≈527 k ETH), validating the breakdown of Tuesday more than $ 2,800.

- Support / Resistance: Immediate support is $ 2,750 at $ 2,760; The upward objectives are $ 2,900 and the psychological area of $ 3,000, followed by a secondary obstacle close to $ 3,120.

- Momentum: The hourly RSI lies above 60, which indicates a place to extend before the emergence of the surety conditions.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.