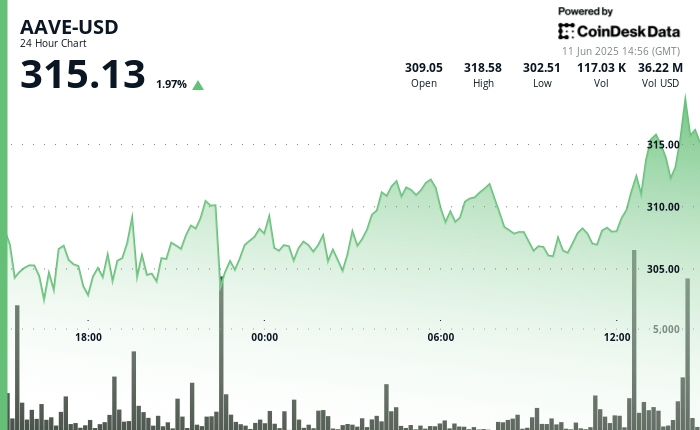

The recent Aave price action demonstrates a remarkable force, climbing another 3.8% in the last 24 -hour period and now up 25% since Monday.

The token has crossed key resistance at $ 311.50 with an exceptional volume, suggesting a continuous increase in movement.

This technical break was supported by important fundamental developments in the decentralized financial space (DEFI). The American Commission for Securities and Exchange organized a round table on the sector on Monday with participating key figures. There, the president of the SEC, Atkins, suggested exploring the regulatory exemptions for the companies of Defi, stimulating optimism for the future of Defi.

Market analysts remain optimistic about the long -term Aave potential, with certain fixed targets up to $ 1,000 per token, although such predictions should be approached with caution. The solid fundamentals of the platform and the growing adoption position it as an important player in the evolving DEFI landscape.

Technical analysis

- Aave has established a large high volume support area around $ 302.35 to $ 302.52, while breaking the resistance at $ 311.50 during the 12:00 UTC hour with an exceptional volume (179,461 units) which exceeded the average of 24 hours of more than 140%.

- The overall range of 20.37 points (6.73%) highlights an increase in volatility, the action of prices forming an upward channel model and finding a dynamic after consolidating between 305 and $ 310 for several hours.

- A descending channel model was formed after the sale 13:30 which saw the volume increase to more than 6,100 units at 13:32, the support of the correction nearly $ 312.00, representing a fibonacci rebuilding of 38.2% of the previous ascending movement.

- Consolidated price between $ 312.00 to $ 312.60 in the last 15 minutes on a reduction in volume, which suggests potential stabilization before the next directional movement.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.