Solana (soil)

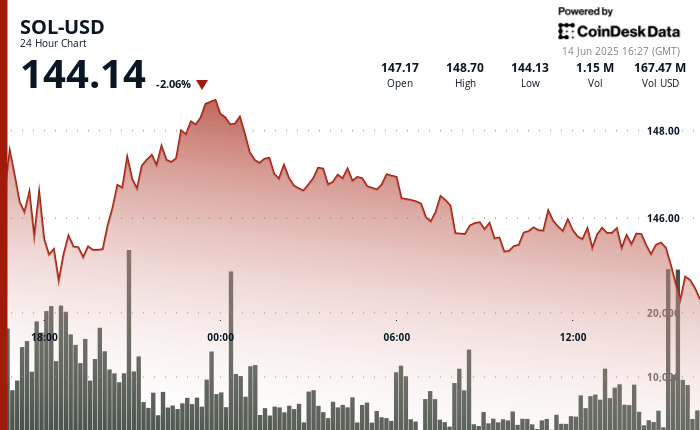

Exchanged at $ 144.14 on June 14, down 2.06% in the last 24 hours, but has shown that resilience as long -term institutional activity compensates for retail. The price action remains pinned near the lower end of its recent consolidation zone from $ 145 to $ 149, following a wider correction of several days on the cryptographic markets linked to the increase in geopolitical tension.

Despite recent weakness, two major institutional developments suggest deepening the commitment with the Solana ecosystem.

First of all, James Seyffart de Bloomberg confirmed on Friday that this week that the seven emitters of Solana Etf Solana-that is to say, in particular Fidelity, Grayscale, Vaneck, 21Shares, Franklin, Bitwise and Canary Marinade-subjected to update the S-1 deposits with the dry. Each deposit now includes provisions for jealizing, which makes them structurally aligned with the solana chain economy.

Secondly, Defu Development Corp, a treasury company in Solana Treasury, listed at Nasdaq, announced Thursday that it had concluded an agreement of $ 5 billion on the credit line (ELOC) with RK Capital. The installation allows Devi Dev Corp to issue actions gradually to finance an additional soil accumulation, rather than counting on a single fixed price offer.

This follows a minor regulatory setback: Wednesday, the company asked for the dry for the withdrawal of the registration declaration on the S-3 form. He said he wanted to withdraw a previous S-3 deposit due to technical eligibility problems reported by the SEC. The company said that it would file a declaration of registration of resale in the future to increase the capital it needs.

Despite the deposit hiccup, the company stressed its continuous commitment to develop its soil treasure, which currently holds more than 609,190 tokens – worth more than $ 97 million. CEO Joseph Onorati said Thursday’s press release that the new capital structure offers a “clean strategic path” to develop the exhibition while aggravating the performance of the validator.

The soil price seems to stabilize as these institutional tail winds are strengthened, even if the retail activity remains moderate.

Strengths of technical analysis

- Soil exchanged a 24 -hour fork of $ 4.57 (3.08%), from $ 144.13 to $ 148.70.

- The initial resistance has been, the derivising price to the level of support of $ 144.

- The resistance remains firm nearly $ 149, while short -term rejection reached $ 145.78.

- A high volume sale occurred between 13: 41–13: 47 UTC, with a clear drop of $ 145.95.

- An increase in volume at 13:23 UTC was aligned with the failure of failure.

- The accumulation of whales continues below $ 146, although the follow -up remains limited.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.