Karachi:

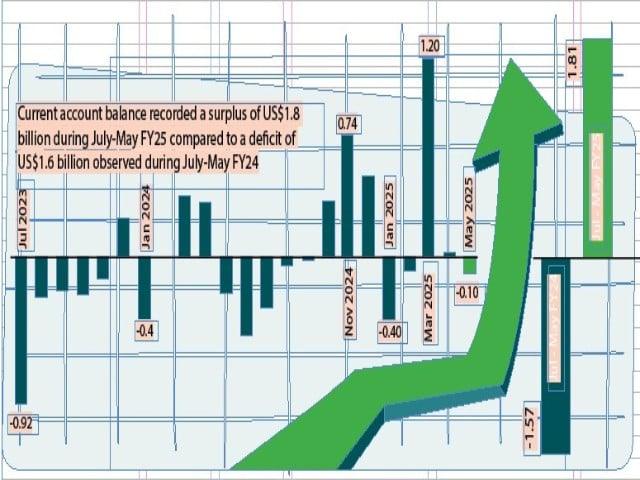

Pakistan recorded a current account deficit of $ 103 million in May 2025, shrinking with a deficit of $ 235 million in the same month of last year, but reversing the surplus of $ 47 million seen in April 2025.

Although Pakistan posted a rare current account surplus of $ 1.8 billion in the first eleven months of the 2010 financial year – marking a significant reversal compared to the deficit of $ 1.6 billion recorded during the same period last year – experts cautious that vulnerabilities in the underlying external sector remain a concern.

“The trade deficit widened in May 2025, going to $ 3.2 billion, compared to $ 2.2 billion in the same period last year,” Ahl wrote. The overall commercial balance posted a deficit of $ 27 billion in 11 MFY25, compared to 23 billion dollars during the same period last year.

“We expect the country to show a current account surplus of $ 1.6 billion in FY5 after 14 years,” said the brokerage house. “This growth is mainly due to an increase in funding from 26% in annual shift to 38.1 billion dollars, in our opinion.”

The surplus was largely fired by a 26% leap in annual sliding in the workers’ funds, which increased to $ 38.1 billion. This influx helped to amortize the impact of an extended trade deficit because imports of goods increased by $ 54.1 billion, exceeding the modest growth of 4% of goods exports which amounted to $ 29.7 billion.

Exports were supported in May 2025, sliding from 19% in annual sliding to 2.4 billion dollars, while technology exports, formerly considered as a potential growth engine, decreased from $ 329 million. This underperformance underlines the struggle of Pakistan to diversify and extend its export base.

Nasheed Malik of Topline Securities noted that Pakistan had recorded monthly computer exports worth $ 329 million in May 2025, reflecting a slight 1% drop in annual shift but an increase of 4% on a monthly basis. These exports were also higher than an average of 12 months of $ 314 million. This notably marked the first drop in annual shift in IT exports after 19 months of consecutive growth. The export product was on average $ 16.5 million a day in May 2025, compared to $ 15.9 million in April 2025.

Cumulatively, exports reached approximately $ 3.5 billion in 11 MFY25, showing a high increase of 19% in annual shift. This impressive growth is attributed to several key factors: the expansion of customers of Pakistani IT companies in the world, in particular in the CCG region; The relaxation of the State Bank of Pakistan (SBP) of the retention limit authorized in the specialized currency accounts of exporters from 35% to 50%; the allocation of investment in stocks abroad through these accounts; And the stability of the Pakistani Roupie, which encouraged exporters to repatriate a larger part of their earnings.

Pakistani IT companies have also actively committed to international customers, as their participation in major world events have demonstrated such as Leap 2025 in Saudi Arabia and at the Qatar 2025 web top, Malik said.

Significant development during financial year 25 is the introduction by SBP of a new category – Investment in stocks abroad (EIA) – in particular for IT companies oriented towards export. Under this provision, IT exporters can now acquire shareholdings in foreign entities using up to 50% of the product of their accounts specializing in currencies. This measure should further increase the confidence of computer exporters and encourage the repatriation of export gains in Pakistan.

Meanwhile, the service sector remains in deficit, displaying a gap of $ 2.7 billion for the period, as services exports have not compensated for the demand for persistent importation. The primary income deficit, largely reflecting the repatriation of profits and interest payments on external debt, amounted to $ 7.9 billion in 11 MFY25.

Adding to concern is the sharp drop in foreign direct investment entries (IDE), which fell to $ 1.98 billion, indicating a cautious position for foreign investors in the middle of the difficult economic and political landscape of Pakistan.

Analysts warn that the recent surplus is not structural but cyclic, strongly depends on the sending of funds and the import compression. “If imports bounce or slow down the growth in funding, the surplus could quickly reverse,” noted a market observer.

The prospects of the external account remain uncertain, with potential risks resulting from the volatile of world oil prices and the increase in debt service needs, which could both forge the fragile external position of Pakistan.

In May 2025, Pakistan’s primary income deficit was considerably reduced by 47% in annual sliding to $ 777 million, compared to $ 1,478 million in May 2024, largely due to the absence of rattriation of the profits recorded during the same period last year. However, on a monthly basis, the deficit widened by 31%.

At the same time, the balance on secondary income improved from 12% in annual shift, increased to 3.9 billion dollars in May 2025, against $ 3.5 billion in May 2024, supported by strong entrances such as workers’ shipments. On a monthly comparison, however, secondary income decreased by 13% against $ 3.5 billion recorded in April 2025.