A key indicator flashes red for Shiba Inu (SHIB) while the recent price drop at two months shaken up bruise -effect betting.

The indicator in consideration is the long -term ratio derived from the perpetual term market. It measures the number of long active or bullish Paris compared to shorts, providing clues to the feeling of the market.

The ratio fell to 0.9298, indicating the lowering feeling among traders, according to information from IA de Coindesk. This follows the closure or forced liquidation of long positions worth more than 1.8 million dollars since June 12, according to Data Source Corglass. Exchange liquid positions due to margin shortages. The dollar value of shorts removed during this period is less than $ 500,000.

In the past 24 hours, the derivative market has shown increasing caution, open interests decreasing by 2.14% to 145.33 million dollars and long liquidations of $ 244,000, against only $ 57,000 in short liquidations.

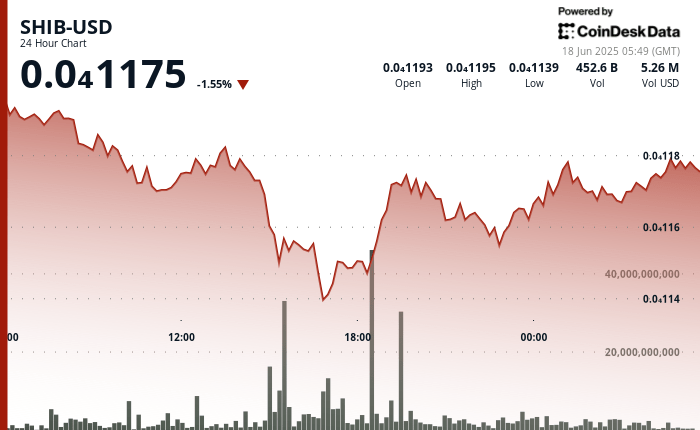

The price of SHIB has dropped from 10% to 0.0000001164 since June 12, according to Data Source Coindesk. The minor recovery from two months of Tuesday 0.00001134 of Tuesday provides optimistic advice on short -term prices.

AI key badges

- SHIB continues to maintain the support above the critical level of $ 0.00001100, indicating a potential tendency reversal.

- Technical analysis reveals a bullish divergence in the daily RSI, with MacD and signal lines approaching a Haussier crossing that could propel Shib to the level of fibonacci from 23.60% to 0.00001390 $.

- The volume greater than the average has confirmed the interest of buyers with the closing price of 0.00001170, which suggests stabilization above critical support.

- The hourly RSI indicates occurrence conditions, potentially being set up for a technical rebound if the level of support of 0.00001168 is valid.