Sui

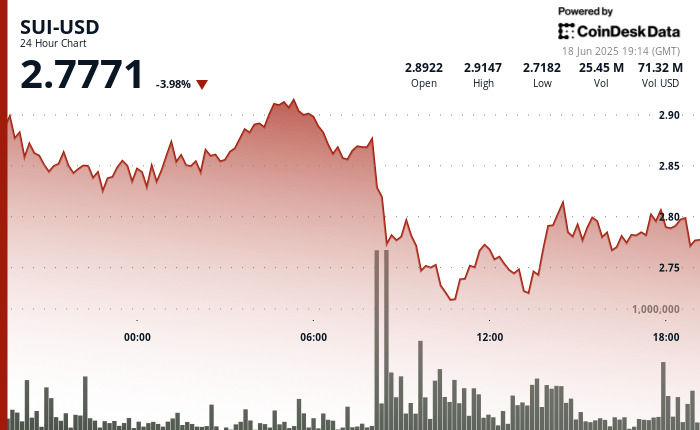

experienced a 24 -hour turbulent negotiation window marked by strong intraday oscillations and heavier commercial activity than usual. After initially plunged $ 2.71, the token set up a brief gathering to $ 2.92 before meeting with high resistance almost $ 2.82. This area capped the recovery, triggering a rapid reversal which brought the prices to the area from $ 2.78 to $ 2.79.

What made the move more notable was the sharp increase in the volume of negotiation 24 hours a day, which increased by 11% above the average of 30 days. This level of participation has amplified volatility, with fast evolution price oscillations exposing both bulls and bears to rabbit movements. The rejection of $ 2.82 and unsuccessful attempts to resume this level prepared the ground for a more prudent short -term exchange.

The support around the region from $ 2.72 to $ 2.75 proved to be durable, the bouncing price several times. While the volume cools down and the consolidation is tightening, SU can enter a waiting period while the traders re -assess the short -term management after the failure of the escape and the unusually active session.

Strengths of technical analysis

- SUP exchanged in a range of 7.3% between $ 2,919 and $ 2,710 during the 24 hour window.

- The heavy sale struck at 8:00 am because the price dropped by 9.1% from $ 2,878 to $ 2.765.

- An attempt to rebound around 6:00 p.m. sent to 1.5% to $ 2,824 over a volume of 1.4 m.

- The rally was immediately reversed, the price falling to $ 2.784 and confirming the resistance nearly $ 2,82.

- The support maintained nearly $ 2.72 to $ 2.75 despite several tests and consolidation throughout the session.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.