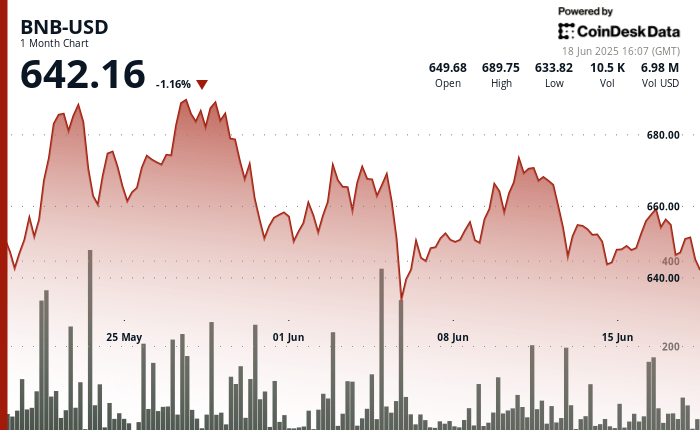

The BNB stumbles under a rigid level of resistance of $ 654, according to the Technical Analysis model of Coindesk Research, with price swarms driven by a wave of world discomfort after the current war between Israel and Iran.

The token collapsed after having briefly exceeded $ 650, showing signs of stress, while the wider market gauge. The Coindesk 20 index remained stable in the last 24 hours of negotiation. The drop in BNB prices occurs while the cryptography market is shaken on Donald Trump’s call to Iran’s “unconditional surrender”, after declaring that the country’s chief was an “easy target”.

In the prediction market market, the chances of American military action in the region before the end of the month increased to 61%. If the calendar is extended until next month, the chances are 69%.

However, a bullish feeling remains in the wider market of cryptography. The American Senate adopted the legislation on stablescoin this week, a sign of increasing regulatory clarity that some in industry are a turning point.

The purchase of corporate bitcoins also seems to have demand, even if short -term volatility increases.

Preview of technical analysis

BNB is currently consolidated in a volatile fork, showing signs of accumulation and hesitation among traders.

- The asset exchanged in a 24 -hour 2.53%range, from $ 641 to a maximum of $ 654 before rejecting rejection.

- A potential resistance area formed nearly $ 653.5, confirmed by repeated failures to break higher and an increase in sales activity and volume around this area.

- A significant level of support emerged at $ 638, marked by the highest volume peak of the day which indicates a strong interest of buyers.

- The price touched a hollow of $ 637 before showing signs of stabilization. Since then, BNB has displayed three consecutive highest lows, referring to a potential and renewed double background of purchasing interests.

- Market players could look at if BNB can keep above the support line of $ 640.

- A sustained movement above may require cleaning resistance at $ 654 with a stronger conviction, while a break below $ 637 could trigger a deeper withdrawal.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.