Calculate the laboratories, a startup that transforms industrial quality GPUs which feed data centers on the AI tokens fractionalized yield, and the AI cloud company of the Nexgen Cloud company, united their forces to start distributing the property of a “public safe” of $ 1 million “, the companies announced on Wednesday.

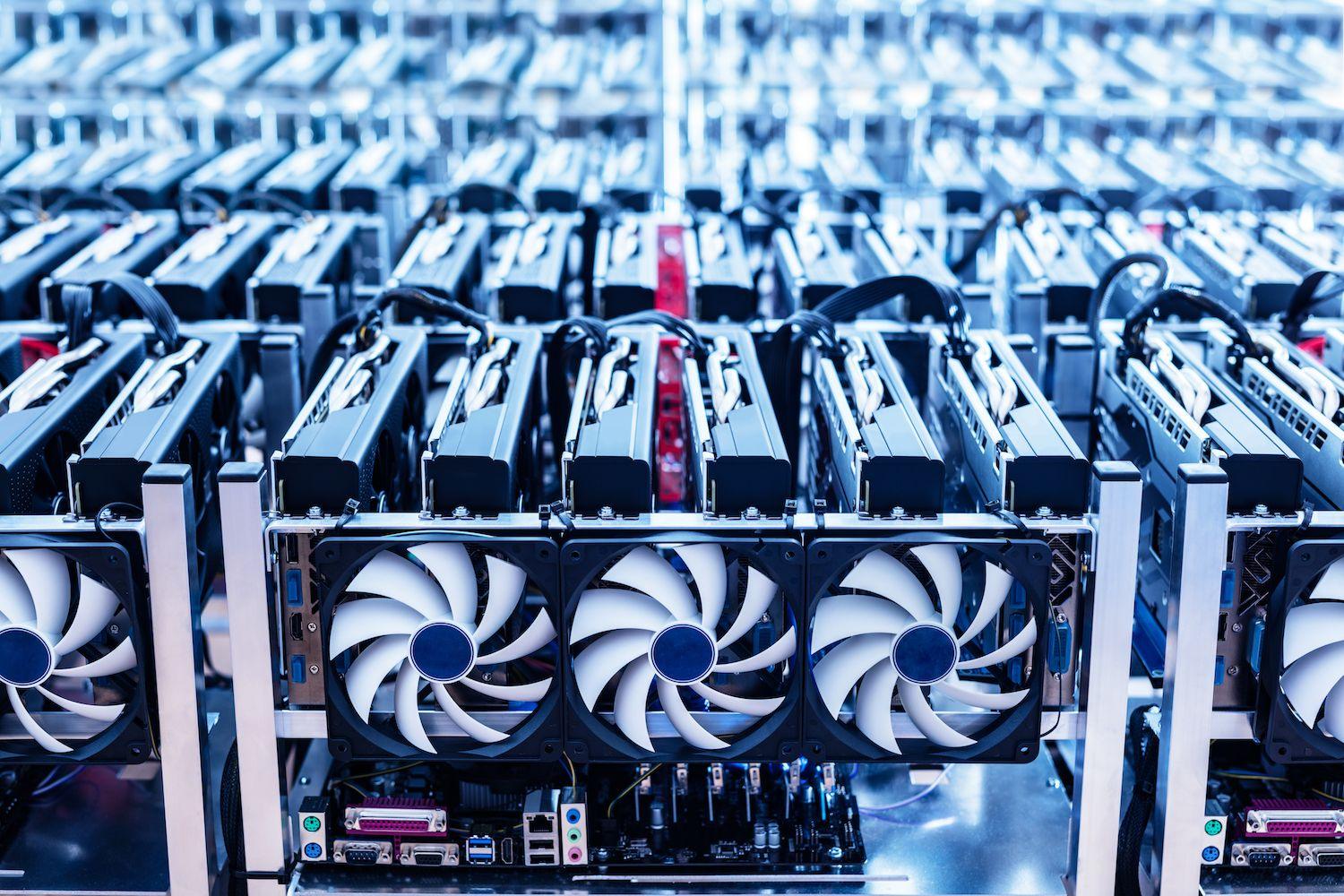

The power and profitability of AI infrastructure is largely centralized and generally confined to hyperscalers like AWS or large companies supported by a company. However, Compute Labs attempts to bring his tokens holders to direct access to the potential to gain corporate equipment such as the NVIDIA H200 GPUs, which would sell at $ 30,000 for a single unit.

“For investors, this pilot [project] represents the very first opportunity to win a stablecoin return directly from the calculation of the AI live without having to manage the equipment or to rely on overvalued public actions, “said Labs calculates in a press release.

Nexgen d’Europe, which gives its customers access to IA computer power and had lifted $ 45 million in April, will manage initial funding thanks to its Investment Arm Infrahub Compute.

How does it work

The funds collected will be used by Infrahub to buy GPUs, which will then be fractionalized for investors and customers, according to the press release.

The first “vault” has already raised $ 1 million from investors. The initial safe will have high-end Nvidia GPUs, which are currently used for “the training and inference of the AI”, said the firm. Companies plan to have a return in USDC, which could exceed 30% per year on the basis of active GPU rental agreements.

Nikolay Filichkin, Director of Compute Labs Affairs, talks about the type of data centers operators who could have an additional floor space and who seek to add additional capacity; The equivalent of the “mom and pop stores,” he said in an interview with Coindesk.

“When the data center uses the GPU belonging to an investor, says Labs manages that through its protocol and its balance sheet, and rents the GPUs to the data center,” said Filichkin in an interview. “Net income, less things such as accommodation and energy costs, go back to the investor who has a GPU processing power.”

Tokenize companies and fractionalize these GPUs within the chests, which can then be offered to individual investors by increments of a few hundred dollars. NFTs are also used to distinguish the variable types of tokenized GPU material investments.

Compute Labs is supported by Protocol Labs, Okx Ventures, CMS Holdings and Amber Group, among others. The company operates with a flat structure at 10% of costs through token, asset management and performance performance.

“This model attributes a concrete and negotiable value to each GPU cycle, rationalizing the AI market by removing the speculation of investors and directly linking the supply, demand and prize,” said Youlian Tzanev, co-founder and head of strategy at Nexgen Cloud.