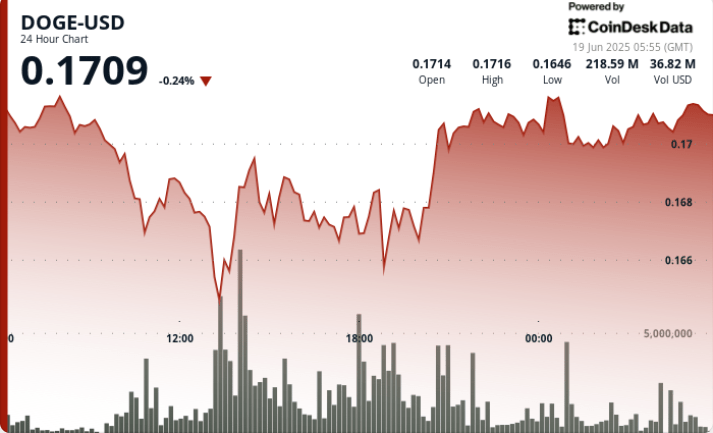

DOGECOIN (DOGE) recovered from a minimum intrajournalier of $ 0.164 to end almost $ 0.171, displaying a bounce of 4.7% in accordance with a larger weakness on the market. This decision suggests that institutional buyers can discreetly accumulate at lower levels as market participants are preparing for continuous volatility.

New context

- Dogecoin’s rebound comes in the wake of an intense sale pressure triggered by the climbing of geopolitical tensions between Israel and Iran. The high correction on a market scale, which sparked mass liquidations, briefly pushed more than 7% intraday on Wednesday.

- Meanwhile, the macroeconomic opposites persist. The American federal reserve continues to maintain a restrictive monetary policy, maintaining the rates of 4.25% to 4.50% while actively reducing its assessment – a dynamic which has historically weighed on risky bets such as DOGE.

- However, the same remains one of the most liquid assets in cryptographic space, with daily turnover nearly $ 1.37 billion and market capitalization exceeding $ 24.7 billion.

- Elsewhere, technical indicators show that DOGE entering the territory of occurrence and the data of the social feeling of Lunarcrush reveal a positive tone of 86% in more than 16,000 mentions, suggesting a continuous community conviction even in the midst of price volatility.

The short-term perspectives of DOGE can depend on regulatory developments, including a potential decision of the ETF of American points, as well as the continuous adoption on the DEFI platforms such as the basic Coinbase network where Doge enveloped is gaining ground.

Action

DOGE saw its highest decline in 1:00 p.m., going to $ 0.164 over a volume of 591 m – the highest of the day.

The solid rebound that followed pushed prices over $ 0.171, where the same has found a short-term balance.

Price action has since consolidated in a tight band between $ 0.170 and $ 0.1696, with small shards of volume suggesting accumulation at lower levels.

Summary of technical analysis

- DOGE displayed a 4.7%resumption, from $ 0.164 to $ 0.171.

- A large sale focused on liquidation occurred at 1:00 p.m., with a volume culminating at 591 million units.

- Support based on the volume established at $ 0.164; The resistance remains firm almost $ 0.172.

- Recent candles show signs of accumulation, especially during period 02: 00–02: 02 (volume of 3.4 m).

- RSI at 33.29 suggests that DOGE can approach the territory of occurrence.

- The price is just consolidated above short-term support of $ 0.1696.

- If DOGE exceeds $ 0.1750, the following resistance zone is at $ 0.1820; Not doing it could trigger a retest of $ 0.1640, or even $ 0.150 in a risk environment.

- The technical models indicate a descending triangle – generally a lower – but reduced volatility suggests stabilization.

Warning: Parties of this article were generated with the help of AI tools and examined by the Coindesk editorial team for precision and membership of our standards. For more information, see the complete Coindesk AI policy.