Bitcoin (BTC)

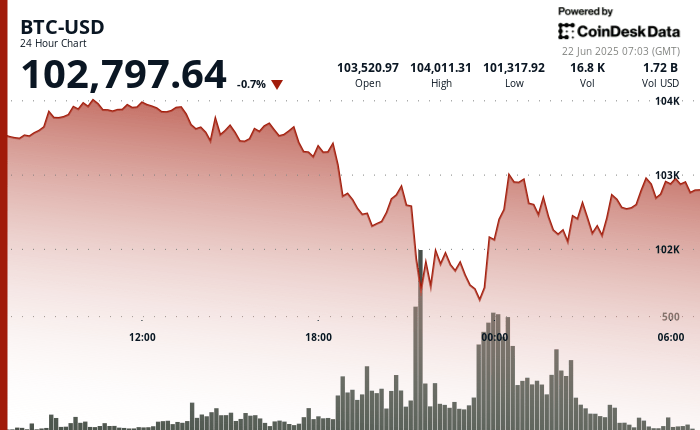

According to the Technical Analysis Analysis model of unusual analysis above $ 102,000 after a drop briefly less than $ 101,000 in a volatile session marked by a volatile session marked by a volatile session.

The market players reacted quickly to the DIP, which pushed the BTC near its one month’s commercial range.

The reversal gained momentum as the volume accelerated, leading to a strong rebound. This decision coincided with a strongly written position by James Lavish, a general partner of Bitcoin Opportunity Fund, who wrote on X: “If you sell bitcoin because of the possibility that the world is going to war, you have absolutely no idea of what you have.”

The $ 100,000 fork to $ 110,000 contained a price movement for almost a month. Chain metrics suggest a balanced market without accumulation of excessive benefits or accumulation, while derivative data indicate a prudent feeling with a continuous demand for downward protection.

Strengths of technical analysis

- A midnight push raised BTC above $ 102,800 with a volume of negotiations culminating at 17,906 BTC.

- Between 05:57 and 6:00, the BTC went from $ 102,767 to $ 102,912, supported by volume tips on 150 BTC per minute.

- The volume of the peak recovery period reached 184.24 BTC, which contributes to the price to $ 102,990.

- A tiny consolidation of around $ 102,680 to $ 102,720 preceded the escape.

- A higher level of support began to form almost $ 102,870 as volatility decreased.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.