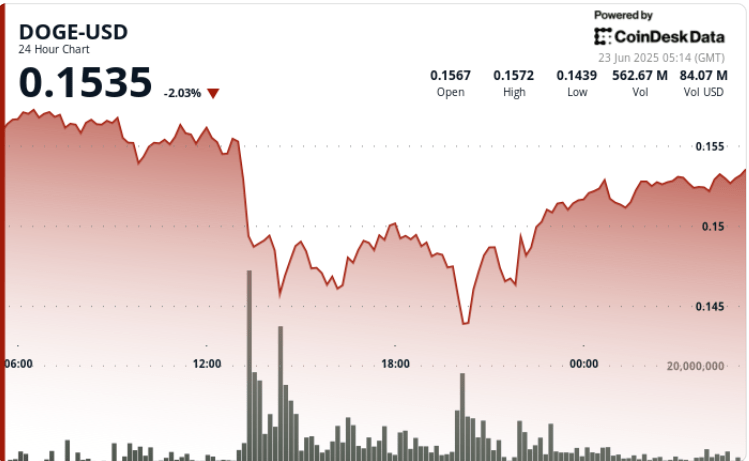

Dogecoin organized a net convalescence after a spectacular weekend sale, during which the token dropped to a minimum of $ 0.143 before bounced over $ 0.153.

This decision occurred in the midst of an increase in the volume of trading – more than five times the daily average – confirming the interest of buyers at critical support levels and referring to a potential momentum change while wider markets remain turbulent.

New context

- Global macroeconomic uncertainty continues to trace digital assets. Geopolitical tensions and commercial disputes between large economies have amplified volatility between risk markets.

- Meanwhile, inflation concerns and meticulous examination of the monetary policy of the federal reserve contributed to a prudent feeling in the crypto.

- The latest Doge rebound occurred during an intense sales period, but a solid support sustained in volume at $ 0.145 seems to have triggered a reversal.

- Although it is an asset with high beta, the recovery of dogecoin from its local stockings suggests a resilient market structure – in particular given the wider weakness observed through altcoins.

- Technical analysts look closely if DOGE can maintain its momentum over $ 0.153 and pierce short -term resistance as the bullish volume accelerates.

Action

DOGE displayed a volatile range of 9.1% compared to the 24 -hour window, from $ 0.157 to $ 0.143 before rebounding to close almost $ 0.153. Most dramatic sales occurred during the hours of 13 to 14, where the volume has increased the average by more than five times, establishing a firm floor at $ 0.145.

During the last hour of negotiation, Dogecoin went from $ 0.152 to $ 0.153, with a significant escape greater than $ 0.153432 after 4:58. The volume has jumped again at 05:11 (10.7 m), confirming the buyer’s strength and pushing Doge to a new local summit.

Summary of technical analysis

- DOGE went from $ 0.157 to $ 0.143 and rebounded at $ 0.153 – A swing of 9.1%.

- The volume for 13 to 14 hours of peak has exceeded the average of 5 times a day, confirming support at $ 0.145.

- Mastsed trend formed with higher hollows clear from $ 0.145 to $ 0.152.

- A break greater than $ 0.153 occurred after 04:58, pushing the price to $ 0.153432.

- The rise in volume at 05:11 (10.7 m) confirmed the resistance to the rupture.

- The last hour has shown a sustained upward dynamic and high consolidation greater than $ 0.152.

- Price Action now targets the area from $ 0.155 to $ 0.158, with $ 0.145 as a key support.