Bitcoin

Quickly responds to developments in the Middle East.

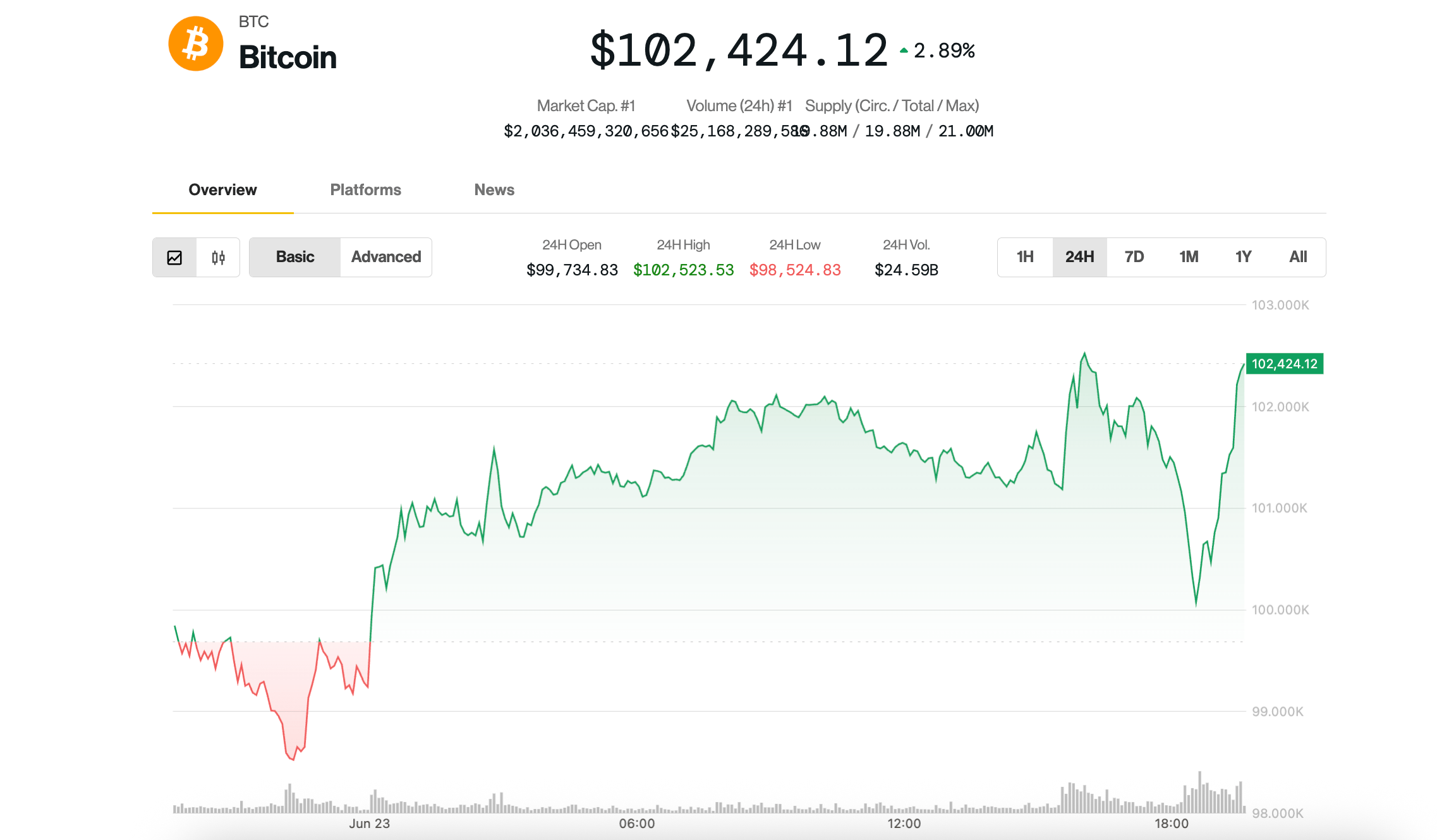

After briefly flowing at $ 99,500, Bitcoin rebounded 2.9% in the last hour and is now negotiated at $ 102,400. Digital assets are still up 2.5% in the past 24 hours, while the Coindesk 20 (an index of the 20 best cryptocurrencies by market capitalization, excluding stablecoins, even and exchange parts) increased by 2.1% in the same period.

The drop in Bitcoin occurred while Iran retaliated against the bombing of the weekend of the administration of the American president Donald Trump of three of his nuclear sites. The Middle East nation has made missile strikes against American bases in several Gulf countries, including Qatar, Kuwait, Bahrain and the United Arab Emirates. The attack on Qatar did not lead to any victim or injury, according to a Qatari official.

Investors seemed imperturbable by military action. Gold, a traditional haven, has barely increased to around $ 3,380, while crude oil prices dropped by 4% during the day.

“The crude is crushed. Good sign,” noted Sean Farrell, head of the digital active strategy at Fundstrat, in a post.

“Generally, with regard to war and other external factors that disrupt things on a global scale, there is tend to be heavy short -term drops that bounce back later according to gravity as well as the way things are communicated,” said Nicolai Søndergaard, research analyst at Blockchain Analytics Firm. “So far, I would say that we see the situation playing in the same way here.”

“Intelligent money always seems to go a little more risks,” he said, adding that exchanges have seen notable outings, suggesting that opportunistic investors have bought prices.