With the passage close to the law on engineering and a multitude of companies announcing Stablecoin initiatives, assets linked to the stable reserve were in tears.

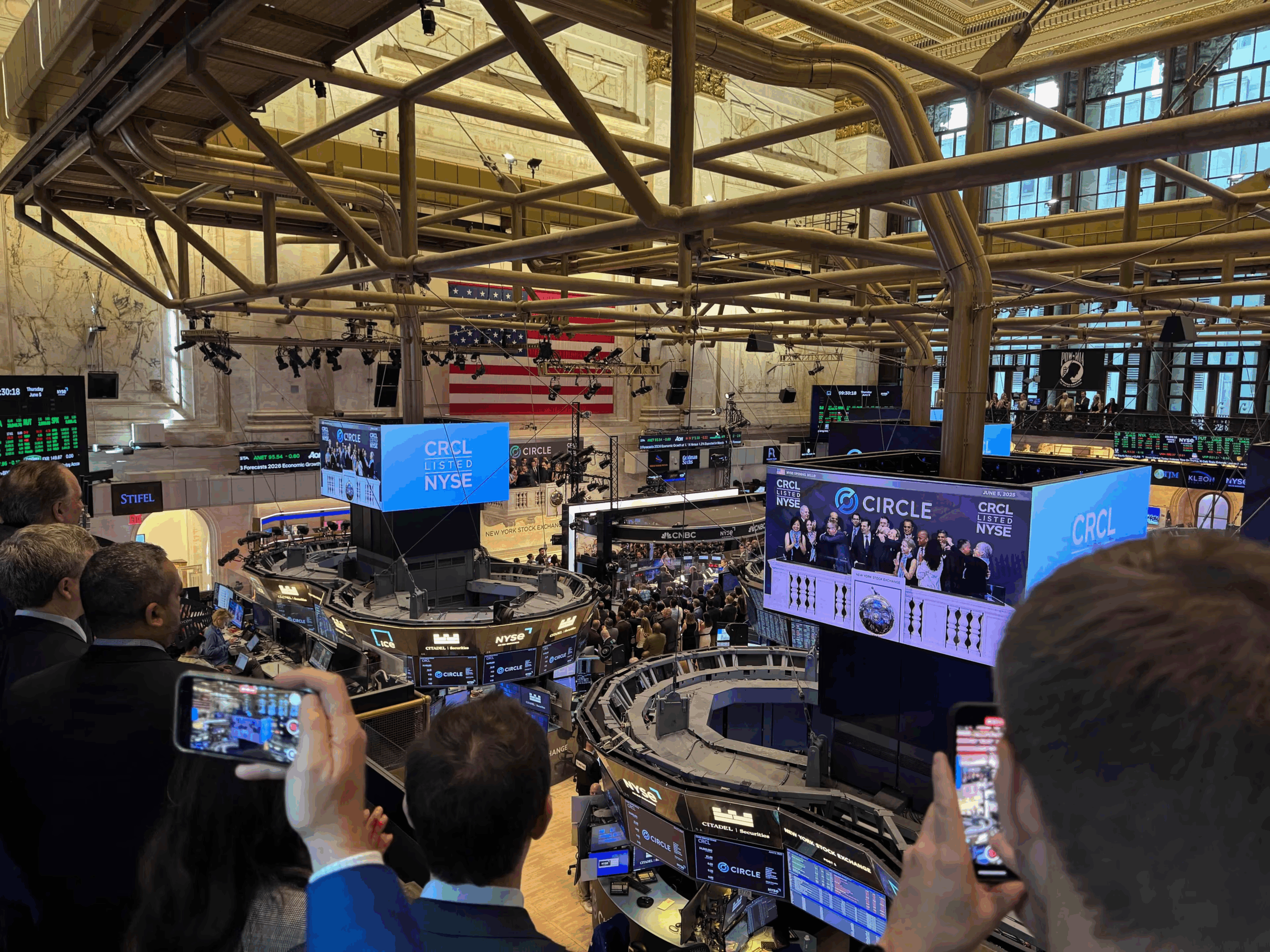

Circle, USDC transmitter, has seen its shares increase by around 500% since its inception on June 5. This week, the company was estimated at $ 77 billion, which is much higher than the total market capitalization of the USDC itself (about $ 62 billion).

Stablecoins’ bruise signals were all around:

CRCL is now the most popular foreign stock in South Korea.

The main Stablecoin transmitter, Tether, has so much spare money that he can afford to have a decisive participation in Juventus, an Italian football team.

Coinbase, which actually earns more money from the USDC than in the circle, saw its stock reach its highest level in four years.

Even the stablecoins supported by the euro, for a long time, a forgotten cousin of USD parts, increases. Combined, they increased by 44% over the year, led by Circle’s Eurc.

Stablecoins are the “silent winners” of prediction markets like Polymarket.

And so on.

The traditional payments of payments, such as Mastercard and Visa, responded to Stablecoin Mania by making a flood of announcements. Mastercard announced new links with Moonpay, ChainLink and Kraken this week.

In the midst of all the news of Stablecoin, we always had space for many other subjects.

Sei also jumped (although on Stablecoin news).

The federal reserve officially declared that the crypto no longer included “reputation risks” for banks, letting them provide all the financial services they wish to cryptographic companies.

World Liberty Financial, Trump’s family vehicle, has reversed a promise to make his token non -transferable.

During the summer months, it may sometimes seem that nothing happens. Not this year; Crypto is waiting for no one.