Signs of green shoots have emerged in the Shiba Inu

Market, with accumulation of whales and a candle of the inner week suggesting a recovery of upcoming prices.

The price of SHIB has dropped from almost 27% to 0.0000001160 since mid-May, reaching a lower of 16 months of $ 0.0000,1005 at a given time, according to Data Source TradingView.

The decline, however, prompted whales – investors with a capital offer and a capacity to move the markets – to do business. These entities recently bought 10.4 billions of shib tokens worth around $ 110 million, according to the IA Insights in Coindesk.

Meanwhile, prices rebounded 11% in the seven days until June 29, forming a “week of initiates” candle, reporting a break in the downward trend.

The model occurs when the trading range (pupil) A weekly candle is fully contained in the previous weekly candle range. It is a sign of indecision, with buyers and sellers little willing to carry out prices.

The occurrence of said model of candlestick after a prolonged downward trend, as in the case of SHIB, would represent the exhaustion of the seller and an increase in swing.

Key points

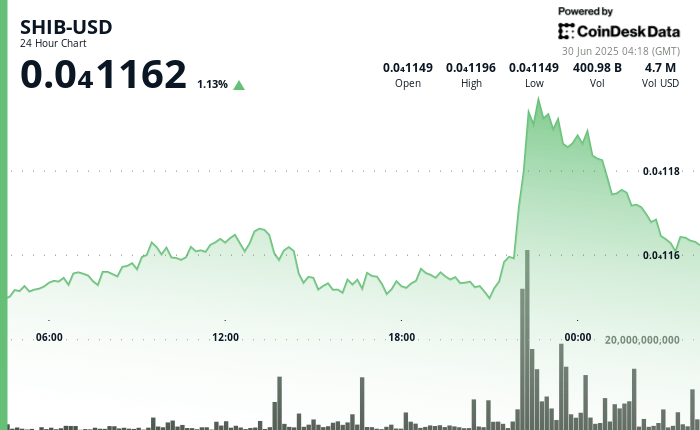

- SHIB experienced a price swing of 4.3% from 0.00001147 to $ 0.00001,198 during the 24 -hour period of June 29 04:00 to June 30 3:00 p.m.

- The largest price action occurred between 21: 00-22: 00 on June 29, when Shib was out of its consolidation model with a volume of 5.8x greater than the average.

- High volume resistance established at 0.0000001198, with subsequent profit gain leading to support at $ 0.00001160.

- The 24 -hour closing price of 0.00001164 represented a gain of 1.4% of the opening level.

- In the last 60 minutes of June 30, 02:53 at 03:52, Shib fell 0.3% from 0.00001167 to $ 0.00001164.

- Two separate phases marked the hourly period: a sharp initial decline at $ 0.000010,1056 between 03: 17-03: 28, followed by an attempted recovery culminating at $ 0.00001,165 around 03:45.

- Volume peaks greater than 8 million USDT took place at key inversion points at 03:35 and 03:49, suggesting institutional positioning.