The native token of Hedera

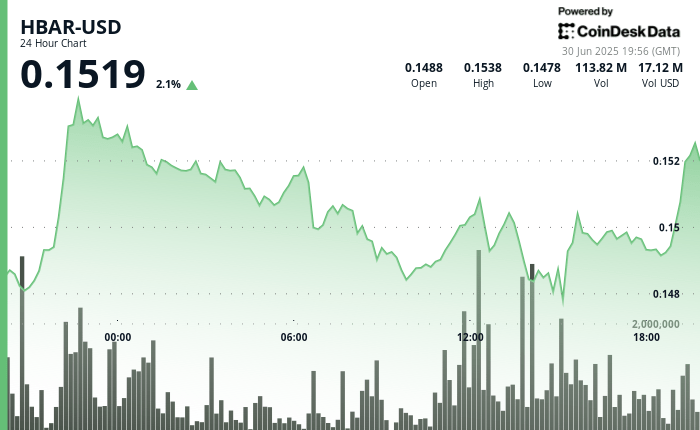

extended its rally on Sunday, running away from 2.1% to $ 0.1519 at 19:56 UTC on June 30, according to the Technical Analysis model of Coindesk Research.

This decision follows a wave of ecosystem updates that widen the company of Hedera and strengthen its growing imprint in AI, games and sustainability.

June 24, blockchain for energy (B4E)A non -profit organization focused on the management of sustainability data in the energy sector, has officially joined the Hedera Governance Council. B4E already manages its carbon monitoring platform on the Hedera network, and its addition brings an expertise in the field in the declaration of emissions and the digital MRV (Measurement, report and verification) Standards. As a member of the Council, B4E manages his own node and will contribute to governance decisions, in particular those aligned with environmental transparency and business responsibility.

Two days later, Hedera unveiled its AI studio, an open source software development kit designed to help developers create decentralized applications powered by artificial intelligence. The continuation includes an agent kit that fits into Langchain and allows AI agents to interact directly with the consensus and Hedera token services using natural language orders. The objective is to reduce the barrier of AI-Native applications while maintaining auditability, transparency and regulatory alignment.

On the front of the game, the Hedera Foundation announced on June 19 a partnership with The Binary Holdings (TBH)A web infrastructure company3. The collaboration aims to provide HEDERA-based games based on mobile users in Southeast Asia via Onewave, the decentralized TBH app. Integrated into native telecommunications platforms through Indonesia and the Philippines, Onewave should take more than 169 million users with integrated web3 rewards and an onchain verification.

Meanwhile, in mid-June, the American Securities and Exchange commission began an official exam by the Canary Hbar ETF, which would offer direct exposure to Hbar via a regulated investment vehicle. A period of public comments is now open before the deadline of July 7 of the sec. If it is approved, the ETF could catalyze broader institutional access and further legitimize the role of Hbar on capital markets – although regulatory control remains high and analysts remain divided on a long -term token utility.

Strengths of technical analysis

- Hbar exchanged in a range of 4.1% from 0.1478 to $ 0.1538 between June 29, 19:00 UTC and June 30, 18:59 UTC.

- A strong escape occurred during 10:00 p.m. on June 29, with a price increasing to $ 0.154 over a volume of 104.5 million units.

- A major support was formed at $ 0.148 between 14: 00 and 15: 00 UTC on June 30, with 80.6 million units exchanged.

- From 18: 00 to 18: 59 UTC on June 30, Hbar showed a V -recovery, diving at $ 0.149 before rebounding.

- During the window of 18: 20-18: 21 UTC on June 30, the price stabilized with 1.3 m of volume, forming a short-term support at $ 0.149.

- At 19:56 UTC on June 30, Hbar exchanged $ 0.1519, up 2.1% for the day with a resistance observed at $ 0.1538.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.