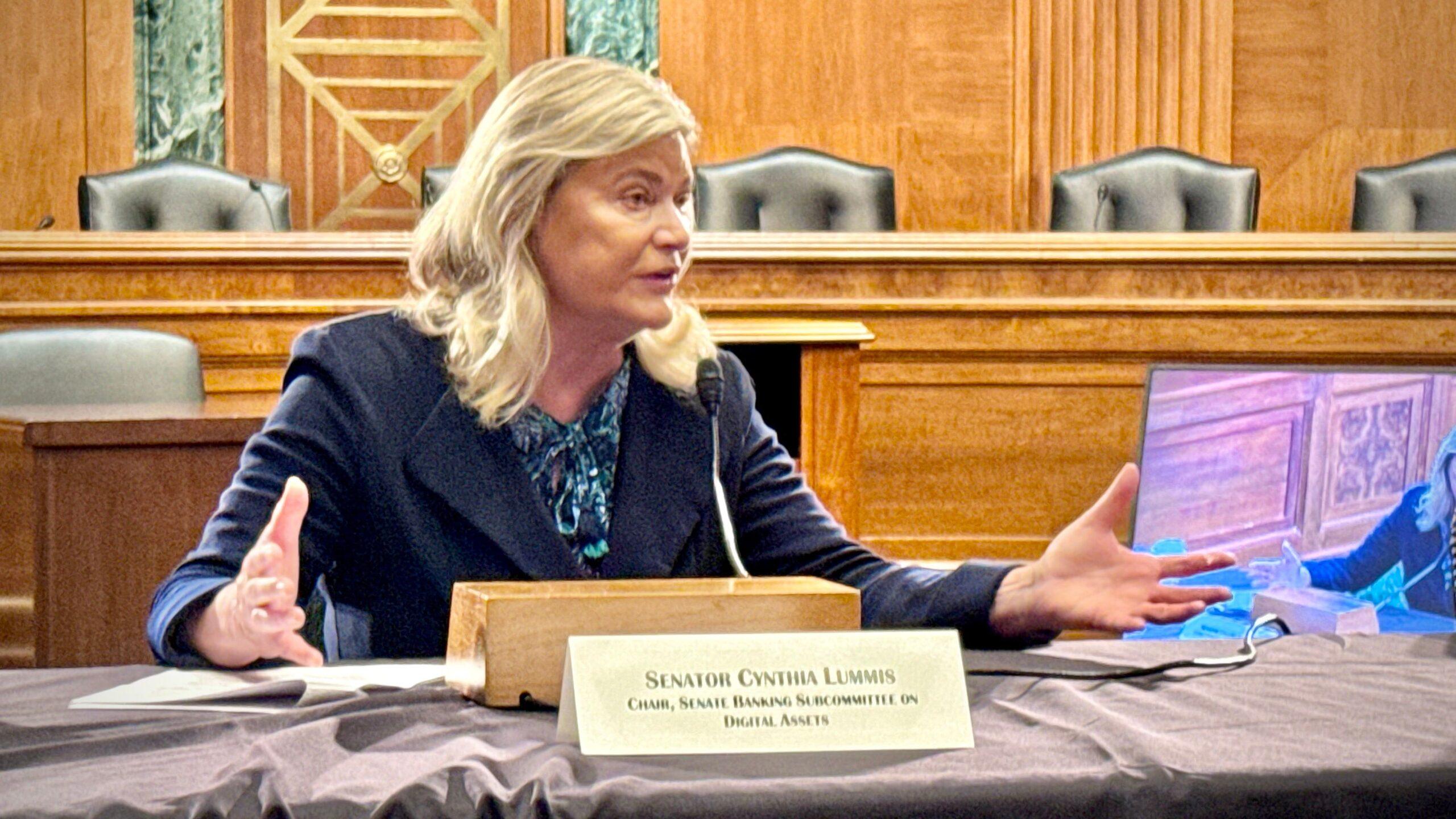

American senator Cynthia Lummis seeks to slide an important cryptographic tax measure in the massive budget bill which supports a large part of the agenda of President Donald Trump, trying to reduce the tax consequences resulting from the fundamental activities of cryptocurrency.

Lummis sought on Monday to insert a language in the “big bill” of the Big Beautiful of Congress which, among other things, will give up taxes on small cryptographic transactions below $ 300 and, according to the industry, would rationalize a fiscal approach which currently has people for taxes on front and rear assets.

The idea of making small tax franchise transactions (Cappé at $ 5,000 in global transactions each year) Would eliminate a large part of the burden of the development of capital gains for people who only engage in a small amount of digital active activity. This could erase a lot of headache for those who hesitated to try the crypto, supports the industry.

The amendment pushed by Lummis, which has not yet been presented for a vote, also addresses tax problems with cryptographic loans, washing sales and charity contributions.

While the digital chamber said it on Monday, the decision to extraction, development and other ways of obtaining cryptographic assets would repair “a careful error for a long time on the way in which these rewards are dealt with for tax purposes”. “The disposition of Senator Lummis resolves this by taxing the awards only during the sale, aligning the policy on real income.”

The so-called validators in a blockchain receive rewards to join their assets, providing them with a yield to lock their cryptocurrency differently. It is taxed when they receive the rewards and on gains when they sell these assets. Critics of the industry of this approach push the change to a system that would only tax assets than during their possible sale.

The cryptography intermediary works in the same way, with assets created in the digital extraction process, then sold later. The active ingredients obtained at Aidrops and Forks would also obtain the same treatment as part of the Lummis amendment, only imposed when they are finally sold.

The amendment could also address the sinks at the escape of washing that legislators have sought for years to close. Under current rules, cryptographic investors can conduct a “tax loss harvest” strategy by strategically selling investments at a loss and buying them immediately.

The senatorial process has gone through a process of unlimited amendment known as “vote-a-rama” which started on Monday morning, and Lummis sought to throw this amendment in the mixture. The challenges are raised for the Republicans of the Congress on the Large Bill Bill, but the leaders of the Party had difficulty keeping all their members in the column yes while the Democrats unite against this, bypassing the potential reductions of Medicaid, green energy initiatives and other aspects of the legislation of almost 1000 pages.

The House of Representatives of the United States barely adopted its own version of the spending bill last month, and it should do so again if the Senate approves it by changes. Analysis of the measure concluded its provisions could add more than 3 billions of dollars to the American budget deficit.