Ether

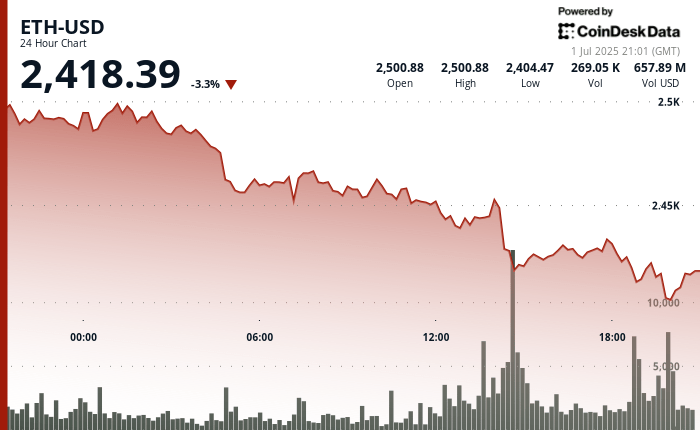

The price underwent renewed pressure on July 1, falling to $ 2,418.39 after a day of regular losses, according to the Technical Analysis model of Coindesk Research.

The drop in Ether prices came in the middle of a wider sale of the cryptography market. Coindecko data show that total market capitalization has decreased by 4.1% in the last 24 hours, driven largely by political volatility renewed in the United States

The slowdown follows a high level dispute between Elon Musk and Donald Trump on the tax and expenses of the former president, nicknamed “One Big Beautiful Bill”. Musk described the legislation as “totally crazy”, warning that it would deepen the national debt of $ 5 billions, incentives with reverse clean energy and would harm the employment. He also threatened to campaign against the republican senators who support him.

Trump responded by rushing personally, suggesting that Musk should be expelled – despite his American citizenship – and accused him of opposing the bill on personal interest linked to Tesla’s lost subsidies. The quarrel has increased the concerns of investors concerning budgetary policy, energy markets and regulatory stability – questions which historically influence the assessments of cryptography.

In the midst of this uncertainty, a list of rapidly growing companies buys ETH as a strategic reserve asset. Tuesday, Sharplink Gaming (Nasdaq: Sbet) published a press release indicating that it had acquired an additional 9,468 ETH – worth $ 22.8 million – between June 23 and 27. This carries his assets in Teth totals at 198 167, strengthening his position as the largest holder of the world checked on the stock market in Ethereum. The company noted that most funds came from a capital increase of $ 24.4 million via its market (ATM) ease.

Sharplink president Joseph Lubin, who also co -founded Ethereum, said that the company included ETH at the center of its assessment in the context of a wider push to align with the digital economy. He formulated Ethereum not as a speculative asset, but as a “strategic currency” for the future of digital trade.

The day before, Bitmin (NYSE American: BMNR) revealed a private investment of $ 250 million to finance an Ethereum treasury strategy. The agreement, which should be concluded by July 3, includes major donors such as Pantera, Founders Fund, Galaxy Digital, Kraken and DCG. Bitmin plans to designate the ETH as the main active in reserve of the Treasury and deploy it in the implementation and challenge protocols. President Thomas Lee underlined the domination of Ethereum in stablescoins and intelligent contracts, while CEO Jonathan Bates said that the company will associate with Falconx, Bitgo and Fidelity Digital to extend its assets.

Together, these developments reflect a broader change in institutional attitudes towards the role of Ethereum in the management of the Treasury – even if the action of the prices of the ETH remains under pressure.

Strengths of technical analysis

- ETH decreased by 3.3% in the last 24 hours, from $ 2,500.88 to $ 2,418.39, with a full swing of $ 96.41.

- The price broke below the level of support of $ 2,460 during the UTC 04:00 UT time, triggering a sustained drop pressure.

- The most steep decline occurred during UTC time at 2:00 p.m., when the ETH fell to $ 2,404.47 in the middle of the highest volume of the session of 379,855.

- The recovery attempts throughout the day stalled almost $ 2,430, with resistance forming about $ 2,445.

- Between 8:01 p.m. and 9:00 p.m. UTC, the ETH varied from $ 2,425 to $ 2,418 down the volume, suggesting a possible short -term exhaustion.

- The downward trend structure remains intact, with lower tops and lower stockings and no inversion indicator based on clear volume.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.