Flag

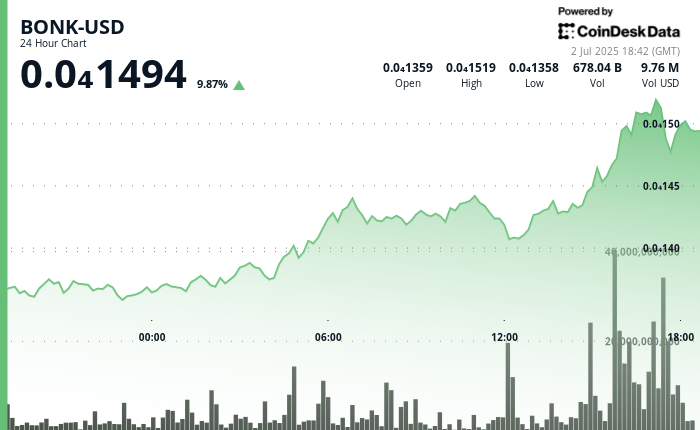

jumped from 9.87% to 0.0000001494 on July 2, extending recent gains through the token token space, according to the Technical Analysis model of Coindesk Research.

This decision occurred in the middle of a new attention on the 2x FNB of Bonk of 2x long tuttle capital, which took a step forward procedural but remains not approved.

Tuttle Capital initially filed an N-1A form on January 27, for a series of leverage, including a Bonk 2x long product. On July 1, the company submitted a post-effective amendment indicating that the ETF could enter into force as soon as possible on July 16. This means that the product could be launched after this date, pending regulatory authorization and operational preparation. The deposit includes exposure to 2x long similar for other assets, including Sol, Trump, Melania, XRP, ADA and LTC.

This update has rekindled the interest of investors for Bonk, reflecting the wider appetite for the structured exhibition of memes parts via traditional financial instruments. However, the FNB is not yet approved and the date of July 16 marks only the first possible activation under current dry procedures.

Elsewhere, Bonk’s developers have announced that the SAGA phone tokens buyback program will officially end on July 31. Of the 20,000 allowances, around 17,599 were claimed. Un requoned tokens will be returned to Bonk Dao and intended for the development of future ecosystems. This change coincides with the launch of the Solana Seeker phone, reporting a transition in the Solana Mobile device cycle.

Meanwhile, the Solana network continues to grow. DEFI DEVELOPMENT CORP has joined as a validator, stimulating the decentralization of infrastructure. The wider network has now exceeded 350 integrations on chain, increasing the visibility and usefulness of tokens like Bonk in the user cases of DEFI and web3.

Strengths of technical analysis

- Bonk went from $ 0.0000,136 to a peak of $ 0.0000,1524, up 12.1%, before ending at $ 0.00001494.

- The price broke out by resistance at $ 0.0000144 during the UTC hour of 4:00 p.m. on a high volume of 1.38 Billion.

- A head and shoulder pattern formed between 4:48 p.m. and 17:47 UTC, indicating potential exhaustion.

- A breakdown less than 0.00001500 saw heavy sales, with 73.9 billion volumes during candle 17:39.

- The support is now observed around $ 0.0000142, reinforced by high volume purchases for 1:00 p.m.

- Volatility and volume remain high, suggesting continuous short -term speculation.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.