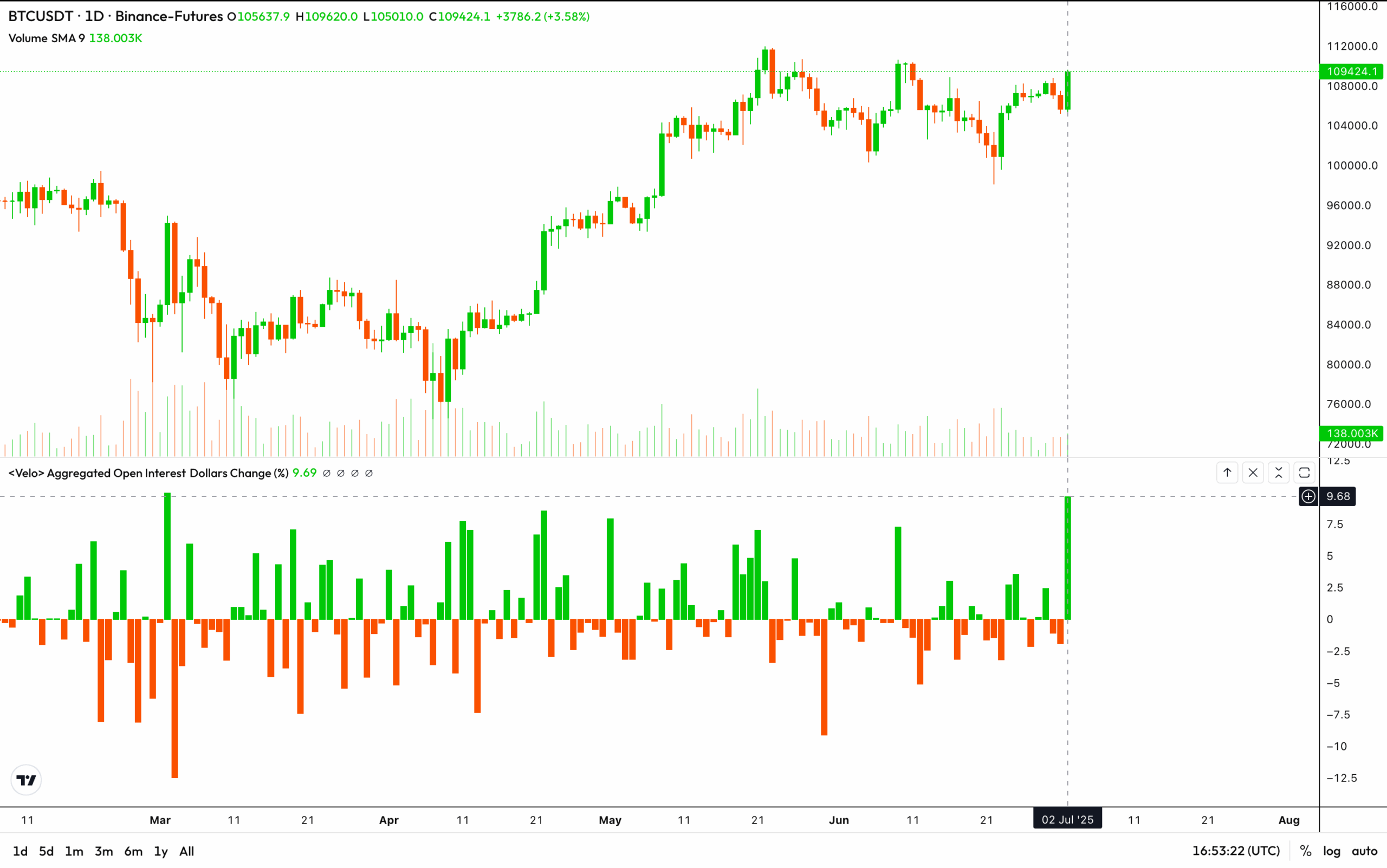

An open interest in perpetual Bitcoin term contracts increased on Wednesday in four months while the main cryptocurrency approached the $ 110,000 mark.

The open interest in perpetual term contracts listed on offshore exchanges increased by almost 10% to 26.91 billion dollars, the highest increase of one day since March 2, according to the VELO data source. The data monitoring website included an activity in the USD perpetuates and worded by the USDS listed on Binance, Bybit, OKX, Deribit and Hyperliquid.

Open interests refer to the number of active or open contracts, often expressed in terms of cumulative value labeled in dollars.

An increase in interest opened in parallel with an increase in prices would confirm the upward trend. The price of BTC jumped from 3.5% to $ 109,600 due to a multitude of factors, including the disappointing report of American ADP jobs, which has strengthened calls for Fed rate reductions, Trump’s trade agreement with Vietnam and the launch of Rex-Osprey Solana + (SSK).

In addition, perpetual BTC and ETH financing rates have slightly gone from a 5% annualized to more than 7%, which suggests a renewed demand for bruising games with leverage. DOGE and ADA financing rates have exceeded the 10%mark.

The BTC prices rally also led to a total of $ 300 million in liquidations or to the forced closure of long -speaking games due to margin shortages. Most forced closures were short hose positions, according to the source of quince data.

In total, 107,604 merchants have been liquidated in the last 24 hours, with the largest order, worth more than $ 2.32 million on hyperliquidal.