President Donald Trump sent an excitement race in the cryptography industry when he ordered his administration to get to work to put aside cryptocurrencies as long-term investment for the US government. But there has been little to see this effort, so far, and those responsible behind work seem to suggest that the wait could be considerable.

Trump’s March Directive to start the stock has brought a delay now expired for the Treasury Department to understand how to set up the Bitcoin reserves and other cryptographic assets that the government has at its disposal. Currently, the administration is supposed to have a plan for “accounts in which the Bitcoin strategic reserve and the stocks of digital assets of the United States should be located and the need for any legislation to operationalize any aspect of this order”, according to the president’s directive, which called to two distinct heaps of crypto – one for Bitcoin only and the other for all other digital active.

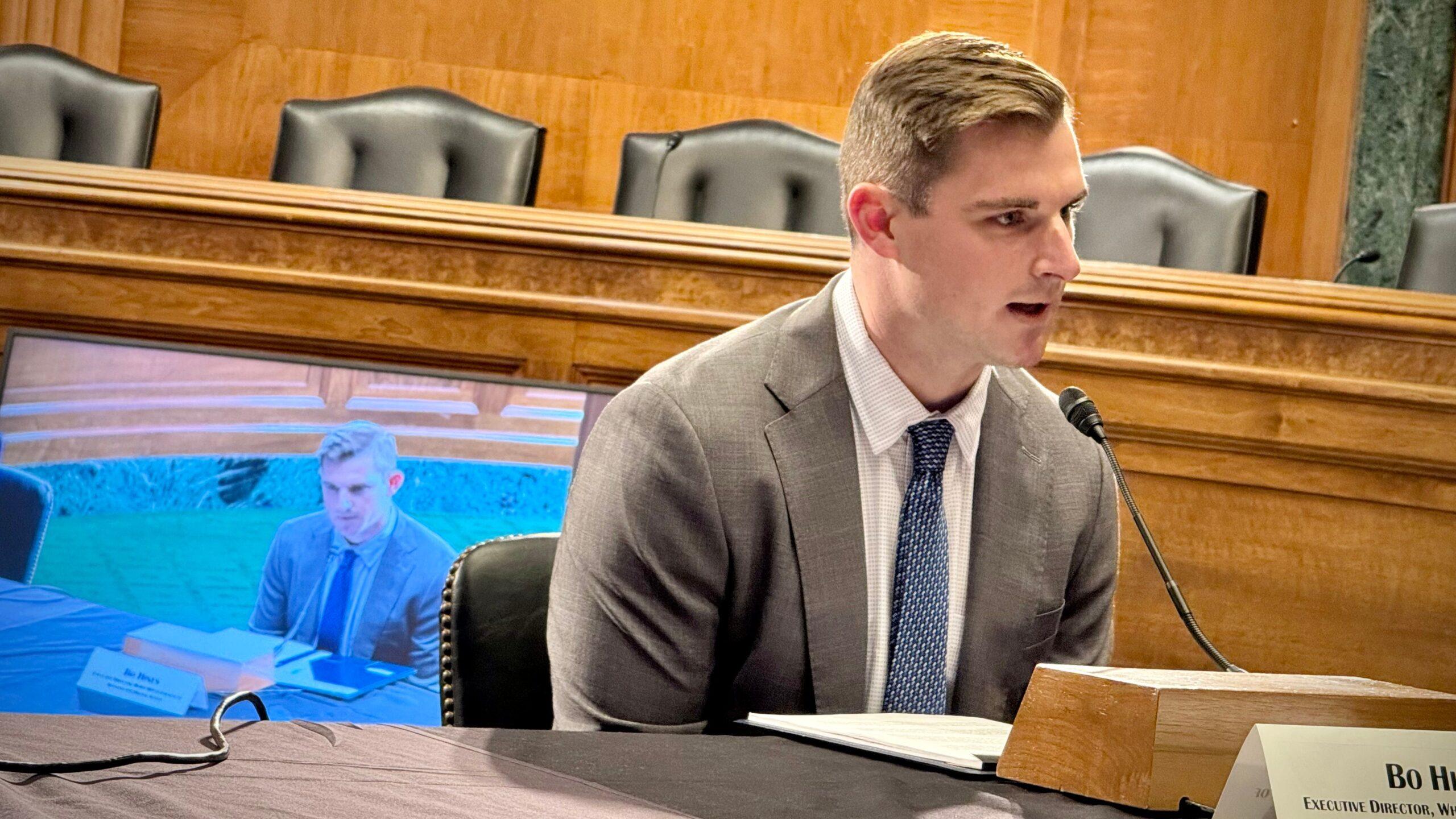

Such a plan has not yet been revealed by Trump’s main crypto advisers, including Bo Hines, who pointed out last week that “there is nothing in the [executive order] This requires that this report become public, “said Hines about the document that was due in early May, although he added that the administration could” choose to make it public at some point “.

But Hines offered an audit update on the government level which aimed to determine the assets that the various federal agencies – including the US Marshals Service – had gathered civil and criminal crises.

“They received the figures from the various government entities,” he told journalists during an event on Capitol Hill, referring to Trump’s requirement that federal agencies report their cryptographic assets in early April. “Now the process begins in terms of reserve establishment, the actual infrastructure behind.”

Trump’s decree had affixed another federal approval cachet on cryptocurrency after years of resistance from the previous administration and its regulators who considered the field as subject to risks and carefreeness that could endanger investors. The price of the BTC has increased by 25% since it expressed the prescription.

“President Trump’s proclamations have thrown a powerful basis, but it is now time to go from vision to execution,” said Hailey Miller, director of government relations to the digital power network of the digital chamber, in an email suggesting that people in the industry stand to help. “The momentum is real. What we need now is coordinated follow -up.”

The administration playing its cards near the vest, the clearest opinion is on the legislators who try to make invoices to “operationalize” the order, as indicated by Trump. Senator Cynthia Lummis took the lead in the Senate with her strengthening of innovation, technology and competitiveness thanks to optimized investments (Bitcoin) Act aimed to “transform the president’s visionary action in management matters into sustainable law”.

Transforming the United States into a disproportionate Bitcoin investor has been a Wyoming Republican project for some time now, and it thinks it is the response to the country’s tax worries. But Lummis, which presides over a subcommittee of digital assets in the Senate, and others in favor of reserves understand that there are more urgent priorities in cryptographic legislation.

Representative Nick Begich, an Alaska republican, pushing counterpart legislation to the House of Representatives, has given that other cryptography efforts to establish rules for markets and Stablecoins must come first.

“But I hope very that after these, we can turn attention to the Bitcoin law and start to have a serious discussion on the reasons why it is important for the United States to have a diverse reserves that includes Bitcoin,” he said during a recent event in Washington.

Because the structure of the market and the stablecoin invoices are on uncertain deadlines, despite Trump’s previous ambition to do both before the long break in the congress in August, it is not clear how long the legislators will have a window to consider the reserves. Senator Tim Scott, president of the Senatoric Banking Committee, posed a new September 30 objective on the potential adoption of the bill on the cryptographic market structure, but depends a lot on a chamber strategy for the two bills that has not yet emerged.

Begich spoke of his efforts from the room as if he was still trying to take off, asking the cryptographic initiates to help convince their members of the Congress to coparraine the bill.

Get more sponsors “sends a signal to the committee management that it is something that has the potential to go into law,” he said.

“The president’s support is extremely important,” said Senator Lummis. “So I hope that we can convince more of the Congress to understand the fundamental principles of Bitcoin.”

While the president was clear that he did not want taxpayer money spent to build Crypto reservations, Trump’s order called on the administration to find other ways to buy digital assets. Hines said that federal officials are already working on several ideas to ratify “digital gold”.

“We have certainly loved the idea of accumulation,” he said. “I think we will start moving very quickly on this.”

The government has systematically estimated that around 200,000 bitcoins, although no other public accounting has yet emerged. The Bitcoin act pushed by Lummis and Begich would seek to buy approximately 5% of the world Bitcoin supply – one million pieces – over a period of five years, “reflecting the size and scope of gold reserves held by the United States”. To do this, he would try to unlock new financing approaches to avoid hitting taxpayers.

“There are several mechanisms available for the acquisition of Bitcoin,” said Begich, in particular the rewriting of the rules for the stabilization of exchanges to be able to acquire Bitcoin and update the modern market value of the gold certificates of the Federal Reserve to take advantage of Bitcoin purchases.

Begich argued that the main digital asset is not only a niche financial instrument, but something that the government must adopt as a pillar.

“We like to talk about Bitcoin as if he were somehow separated from the rest of the economy,” he said. “Bitcoin really becomes a class of assets that represents the economy.”

One of the conceptual challenges of this digital “strategic reserve” is that the underlying idea for a government investment of purchase and maintenance means that this stock is not supposed to be a strategic reserve in the traditional sense. Other goods reserved at the national level, such as oil, can be released when the nation has a special need. It is not the Bitcoin plan in the mind of Trump and its legislative allies.

But also enthusiastic as they are, the legislators of the state have taken ahead of their federal counterparts in the establishment of reserves based on the state. Trump’s order seemed to act as a firearm for efforts across the country to devote public money to cryptography investment. While the federal government is continuing its work, states like Texas are already building their stocks.

Read more: Trump orders the Bitcoin reserve stock of Fort Knox “and digital assets