Bitcoin Cash

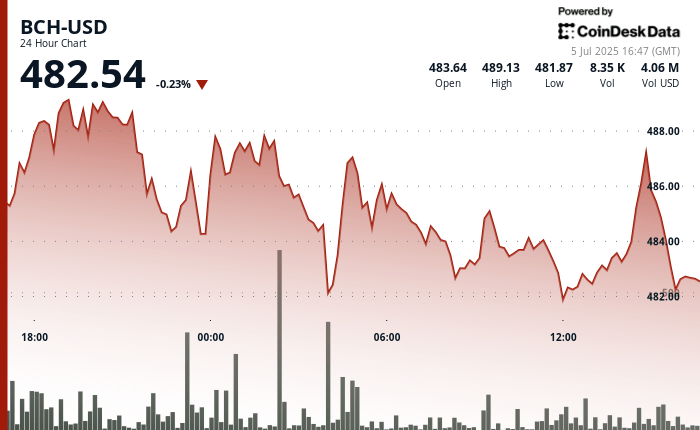

Exchanged at $ 482.54 on July 5, down 0.23% in the last 24 hours, after a wider retirement from its recent summit of several months, according to the Technical Analysis model of Coindesk Research. As for the wider cryptography sector, with regard to the Coindesk20 index (CD20)It increased by 0.27% during the same period.

On July 1, BCH reached $ 526.5 – its highest price in eight months – because the enthusiasm of the market, the accumulation of whales and speculative entries helped to propel the token by more than 75% more in the last three months.

The rise in power, briefly taking the BCH greater than $ 528, coincided with a substantial increase in the daily negotiation volume, which tripled at more than 120,000 tokens exchanged in a period of 24 hours. A large part of the purchase interest was attributed to the rotation of capital in medium-sized cryptocurrencies, because investors have sought earnings beyond the majors during a wider period of force of the cryptography market.

The fundamental chain principles remain dull, however. The daily active BCH addresses fell to a six -year hollow, which suggests that the rally is more caused by speculation than by an increased utility of the network. Despite this disconnection, technical indicators indicate an increase potential. At the end of June, gold crossing training appeared on the time table of BCH – where the 50 -day mobile average crossed above the 200 -day MA – a historically bullish signal.

Adding to the speculative momentum, the interest open for BCH derivatives increased by 27.4% last week to $ 578 million. Analysts look closely at the range of $ 478 to $ 508, considering it as a key support area which could stabilize the current withdrawal.

On July 4, the Intotheblock analysis company declared a 122.45% increase in large whale transactions involving more than $ 100,000 in BCH, totaling 957,440 tokens worth around 482 million dollars. This sharp increase in high value transfers has echoed the previous activity peaks observed in February, May and the end of June, all preceded the major price movements.

A separate development on July 5 has increased more intrigue, when a transaction of 10,000 BCH worth around 5 million dollars was reported just before the historic movement of 80,000 Dormant BTC – worth more than $ 8.5 billion. Experts suggest that the BCH transfer may have served as a key test for the portfolio before running the massive Bitcoin transaction, which was the largest in more than a decade.

Meanwhile, Bitcoin Cash Foundation has published its July 1 update highlighting the release of Knuth V0.68.0, which unifies the node code base and lays the basics of future UTXO efficiency levels. Although no big adoption visit has emerged this week, small community projects continue to explore BCH and NFT micropaies. Roger Ver, a longtime supporter of Bitcoin Cash, remains publicly active in the promotion of BCH as an evolutionary alternative to Bitcoin, although his recent plea was not accompanied by new launches of institutional products.

Strengths of technical analysis

- BCH exchanged in a $ 7.52 (1.57%) Growing between $ 481.83 and $ 489.35 from July 4 3:00 p.m. July 2:00 p.m.

- Strong support was observed at $ 481.83 with a high volume during 4:00 am on July 5.

- The resistance was formed at $ 489.43, where repeated sales gains.

- From 1:06 p.m. to 2:05 p.m. UTC on July 5, BCH won $ 1.20 (0.25%)Briefly exceeding $ 483.25 on the increase in volume.

- Support in the last minutes of the session was formed between $ 483.35 and $ 483.45, the price peak at $ 483.81 at the candle 14:03.

ISCLAIMER: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.