At the time of writing the present

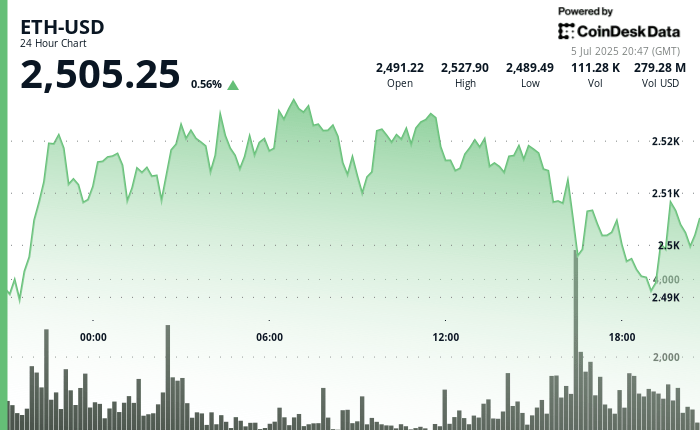

is negotiated at around $ 2,505, up 0.56% in the last 24 hours, according to the Technical Analysis model of Coindesk Research. As for the wider market of cryptography, with regard to the Coindesk 20 index (CD20)It increased by 0.34% during the same period.

Sharplink Gaming, Inc. (Sbet) is a pioneering online performance marketing company specializing in sports betting industries and Igaming. Based in Minneapolis, Sharplink operates his C4 platform fed by AI to provide personalized marketing content and data that improves customer acquisition and retention for sports operators and casino. The company has expanded thanks to strategic acquisitions and partnerships, establishing itself as a leader in the evolving sports betting ecosystem.

On July 4, 2025, Sharplink announced on X that it had become the first listed company to adopt ETH as the Principal Treasury Reserve. The company has described a complete cash strategy focused on the accumulation of ETH, the implementation and growth of ETH by sharing to create a value of long -term shareholders.

Sharplink stressed that its objective is not only to keep the ETH, but to actively deploy it through indigenous implementation, replenishment and yield strategies based on Ethereum. The company has highlighted the advantages of ETH as a business reserve ratio: it is productive via staunch rewards, composable through decentralized, rare, secure and aligned funding protocols on the infrastructure of the future Internet. This approach represents a bold redefinition of traditional treasury management, integrating the principles of decentralized financing in business financing.

This strategic pivot began with a private investment of $ 425 million announced on May 27, led by consensys and other eminent cryptography investors, to finance the acquisition of the ETH as the Principal Active of the Sharplink Treasury. Joseph Lubin, co-founder of Ethereum and founder of Consensys, joined the Sharplink board of directors as president after the closing of this placement, strengthening the company’s commitment to the blockchain innovation.

Since he officially launched his ETH treasury strategy on June 2, Sharplink has agreedly widened his Holdings Ethereum. Between May 30 and June 12, 2025, the company acquired around 176,271 ETH for around $ 463 million at an average price of $ 2,626 per ETH.

Following this, from June 16 to 20, Sharplink bought an additional 12,207 ETH for around $ 30.7 million, partly funded by 27.7 million dollars collected thanks to the market (ATM) Sales in shares.

On June 24, Sharplink’s ETH Holdings reached 188,478 ETH, with 100% of these reserves deployed in featuring solutions generating swimming rewards. And by July 1, the Treasury extended to 198,478 ETH, which gave more than 220 ETH by exercising awards since the creation of the strategy.

Joseph Lubin said that Ethereum’s integration at the heart of Sharplink’s capital strategy embodies technological progress and institutional trust, positioning the company to direct the evolution of digital trade. Meanwhile, the CEO, Rob Phythian, noted that the next Bell Nasdaq ceremony of Sharplink on July 7, 2025, will symbolize this new chapter, showing how digital assets can coexist with public market discipline and corporate governance.

The Sharplink Ethereum Treasury Strategy is uniquely positioned the company at the crossroads of sports betting, blockchain technology and decentralized finances, offering investors a regulated and transparent exposure to Ethereum growth potential while advancing Sharplink’s mission to innovate the Igamings industry of several billion dollars.

Strengths of technical analysis

- ETH won 2.2% from July 4 from 3 p.m. to July 5:00 p.m., from $ 2,475.48 to $ 2,530.02.

- A net sale between 1:06 p.m. and 2:05 p.m. ETH pushed $ 2,514.85 before buyers intervened.

- Solid support was formed between $ 2,480 and $ 2,500 during July 5 4:00 p.m., with 382,821 ETH exchanged.

- An bullish escape on July 4 at 10:00 p.m. raised ETH above $ 2,520, with confirmed resistance nearly $ 2,530.

- ETH consolidated about $ 2,515 with reduced volatility signs and an ascending recovery trend line after 13:40.

- The momentum remains neutral in the short term but structurally optimistic given the wider rise trend since the end of June.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.