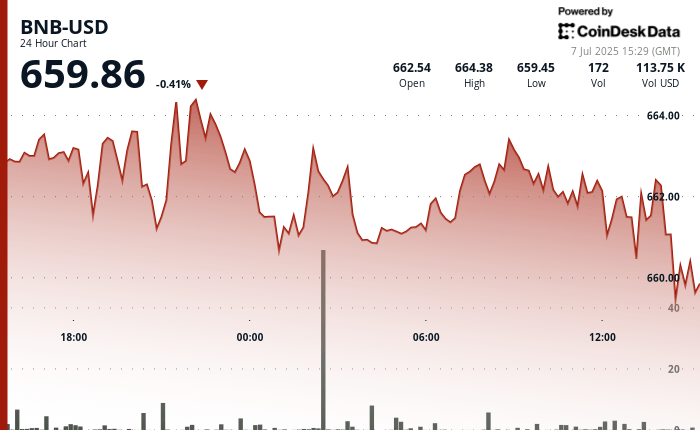

BNB native token (BNB) Held stable nearly $ 660, moving in a narrow band of less than 1% in the last 24 hours. The lack of volatility highlights a consolidation model.

BNB is negotiated at $ 659.61, down 0.5% for the day, buyers are speaking several times at around $ 659.45. The sellers, on the other hand, blocked advances beyond $ 664.38, a price ceiling that traders consider a potential launch for an escape if macroeconomic pressures facilitate, according to the Technical Analysis model of Coindesk Research.

The data on the chain indicate a mixed feeling among traders. The funding rates, the costs paid between traders in perpetual term markets, have dropped lower, a signal that traders hide rather than running after the recent Bitcoin gathering greater than $ 109,000.

The adoption of companies is nevertheless growing, the Nasdaq chip market, Nano Labs, recently acquired around 50 million BNB dollars as part of its plan to hold up to 10% of the global cryptocurrency supply.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.