Native decentralized finance token (Challenge) lender Aave Tuesday, rallied at its highest price in three weeks, exceeding $ 290 while the DEFI loan sector warms up.

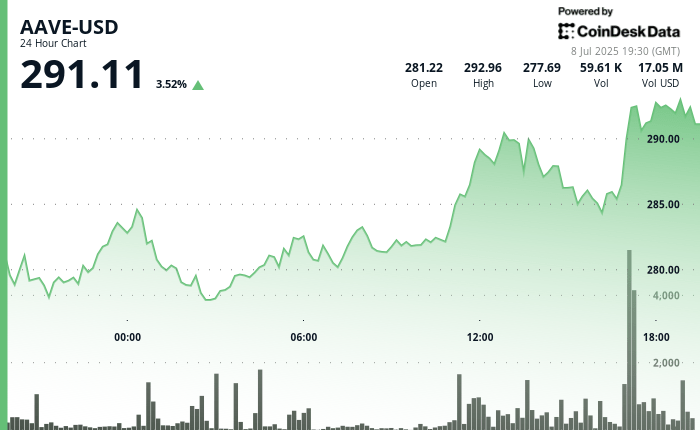

Aave experienced considerable volatility throughout Monday and Tuesday, bouncing Nadir from $ 277.57 to $ 291.11, winning some 5%, according to the technical analysis of Coindesk Research.

The volume models remained robust throughout the period, with notable peaks during the break-up phase of 12: 00-12: 13 exceeding 2,000 units, confirming an authentic purchase interest and validating the extended recovery of the previous session, noted the model.

The recovery model suggests substantial purchase interest at lower levels around $ 277.00 at $ 280.00, establishing potential support areas for future prices action, the model suggested.

This decision occurred while the wider DEFI loan space benefits from a renaissance. Total locked value (TVL) In the sector, has climbed new heights higher than $ 56 billion, exceeding the cutting -edge levels of 2022, according to Defilma data.

Aave plays a dominant role in the growing trend: the protocol commands $ 26.4 billion on TVL on seventeen blockchains, according to Defilma data. This means that Aave has more assets on the platform than the next 30 rival loan protocols completely, noted a market observer.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.