Like Bitcoin

Pushed after the summits of all time and other cryptocurrencies have increased, the increase in stable supply offers a signal that this rally can have deeper roots.

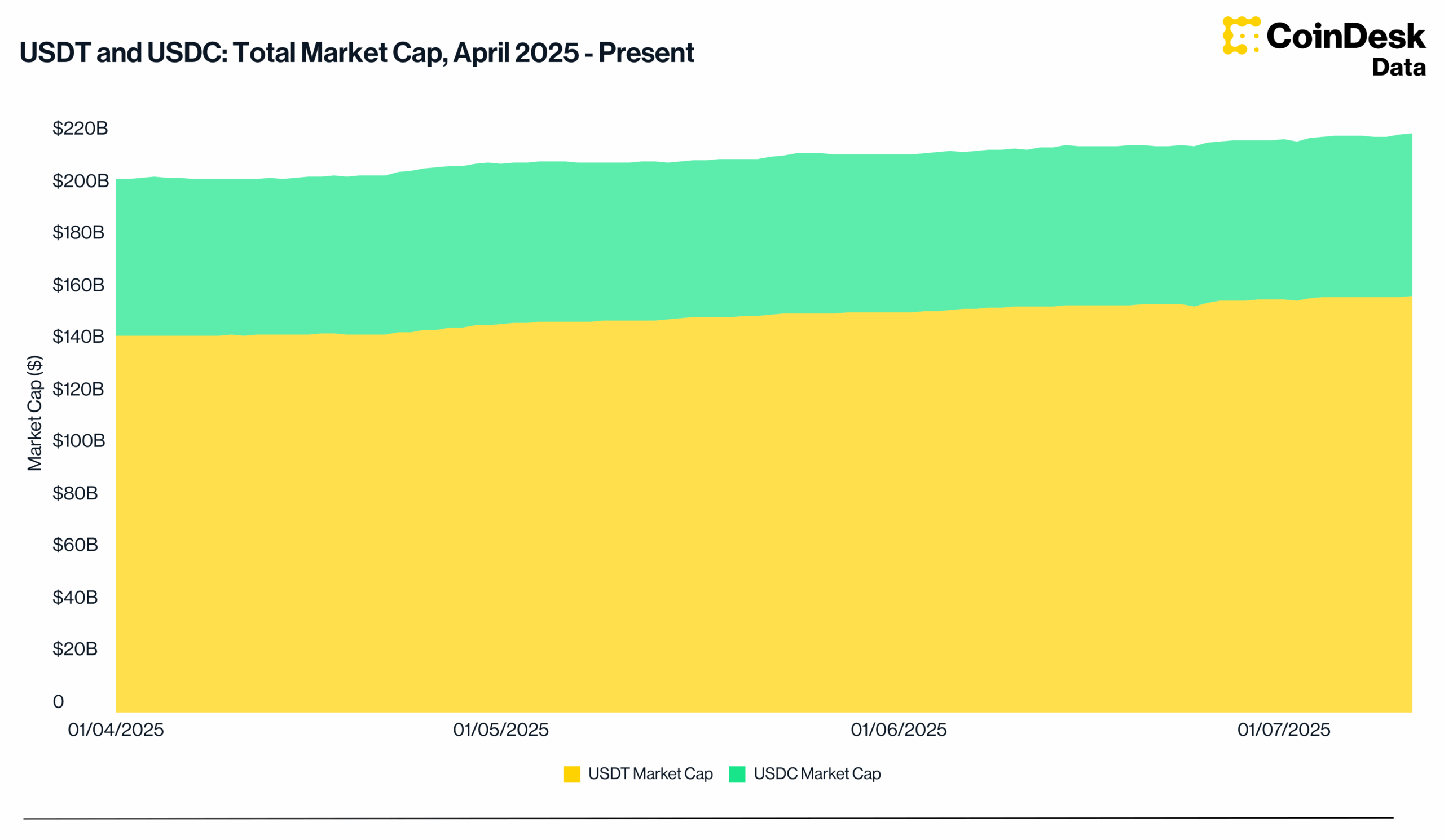

The USDT of Tether and USDC de Circle, the two largest stablescoins in Pius, each have reached new recording supplies this week, according to tradingView data. Since the beginning of July, the USDC market capitalization has increased $ 1.3 billion, reaching $ 62.8 billion, while the USDT added $ 1.4 billion to reach almost $ 160 billion.

Returning further in April, when the market reached a short -term hollow, growth is even more pronounced. The USDT increased by $ 15.2 billion, or 10.5% – and the USDC added $ 2.7 billion, or 4.6%.

Stablecoins are cryptocurrencies with prices related to an external asset, mainly to the US dollar. Although they have been more and more popular for payments, the asset class serves as a key source of liquidity and trading pairs on cryptography exchanges.

Consequently, analysts often treat their growth as a proxy for new capital entering into the economy of broader cryptography.

Previously, periods of acceleration of the growth of stablescoin are coincided with net rallies in Bitcoin, Caleb Franzen, founder of Cubic Analytics, stressed in a graph shared on X.

Read more: the rally of Bitcoin’s “low volatility” from $ 70,000 to $ 118,000: a history of transition from Wild West to Wall Street-Like Dynamics