What to know:

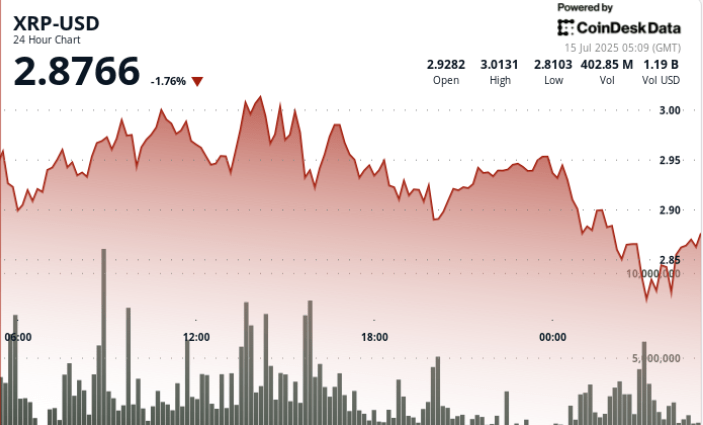

- XRP fell 8% from $ 3.02 to $ 2.78 between July 14, 06:00 and July 15, 6:00 p.m., displaying an intraday beach of 7% between $ 2.80 and $ 3.02.

- The morning volume culminated at 216.12 m during a push coordinated at $ 3.02, before taking systematic profit.

- A resumption at the end of the session of $ 2.82 to $ 2.87 (+ 2%) occurred during the window 04: 09–05: 08, with 112.75 m of volume – indicating the start of the company in support.

- The withdrawal aligns with institutional desire before the launch of the XRP Futures ETF proshares of July 18.

New context

The framework of digital assets still presolved of the SEC continues to dominate institutional risk models, forcing treasury bills to balance early exposure to the optics of conformity.

The next ETF of PROSHARES XRP FUTURES – scheduled for launch on July 18 – has introduced a new vector of capital allowance, in particular for retirement and endowment wallets.

In the middle of this configuration, business flows increased in both directions: buy early $ 2.95 to $ 3.02 and sell strongly at night while risk management protocols have launched.

Summary of price action

- Range: $ 3.02 → $ 2.80 | Volatility: 7%

- Rush time: 13:00 – The volume struck 216.12 m while XRP affected $ 3.02

- Breakdown area: $ 2.95 – $ 2.90 did not last for 00: 00 to 03: 00 session

- Recovery of the last hours: XRP went from $ 2.82 → $ 2.87 (+ 2%) from 04: 09–05: 08

- Volume support: 112.75 m confirms the reallocation of companies nearly $ 2.87

Technical analysis

- The price failed $ 3.02 in heavy volume; The structure has become down on the lower ups

- The night failure saw the algorithmic sale of $ 2.95 to $ 2.80

- Closing recovery suggests an accumulation of corporate cash at $ 2.82 to $ 2.87

- $ 3.00 remains the psychological resistance that the bulls must recover

- Key levels: support = $ 2.80 / resistance = $ 2.95 – $ 3.02

What traders look at

- Can XRP maintain above $ 2.87 before the launch of proshares and the flows related to ETF?

- The recovery of $ 3.00 would validate the upward institutional theses linked to a payment utility

- Continuous regulatory noise could remove up until the clarity of the ETF emerges

- Treasury offices remain cautious but active – promoting low exposure accumulation around volatility bands

Take away

The 8% drop in XRP reflects more than volatility – its business positioning in real time.

While the whales and treasury bills sold in force greater than $ 3.00, the fence and the ETF chronology suggest that the back -to -school configurations are formed.

If the companies of regulatory clarity and the proshares vehicle gain ground, XRP can see renewed entries-but until then, expect tight exchanges at risk of institutions.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.