The release queue of the Ethereum validator inflated Tuesday to its longest waiting time in more than a year, which could report a rush among the stakers to draw funds after a major price rally (ETH).

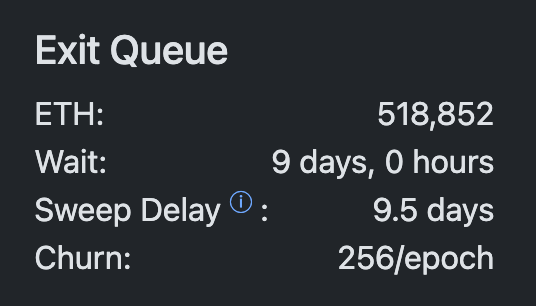

There were almost 519,000 ETH from Tuesday afternoon, worth $ 1.92 billion at current prices, online to leave the network, according to data from Validatorqueue.com.

That the largest amount of the exit queue since January 2024, extending withdrawal delays over 9 days, according to data source.

Congestion is due to the dynamics of the Ethereum stage proof model, which limits the speed with which validators can reach or leave the network. Validators are entities that put tokens to help secure the blockchain in exchange for a reward.

Profit after the Eth rally

The current exodus is probably due to the profits from those who have marked the ETH at much lower prices and have now obtained the withdrawal of the ETH 160% from the hollow of the beginning of April.

“When prices are increasing, people destroy themselves and sell to lock profits,” said Andy Cronk, co-founder of the wake service provider. “We have seen this model for retail and institutional levels through many cycles.” He also added gap peaks that could also occur when large institutions move the guards or change their wallet technology.

In particular, there was a wave of validators entering the network in March and early April, a period when the ETH exchanged between $ 1,500 and $ 2,000.

ETH’s ignition request also rises

Although the wave of tokens is disturbed, strong sales pressure may not materialize because there is a consistent demand to widen tokens and activate new validators.

There are more than 357,000 ETH, worth 1.3 billion dollars, waiting to enter the network, stretching the line of entry beyond six days, its longest since April 2024.

Behind this opposite dynamic could be “a mixture of older stakers capturing profits as well as stakers going to a cash strategy,” said David Shuttleworth, associated with Anagram.

Indeed, part of this new request can come from the new wave of business treasury bills such as Sharplink Gaming, which has acquired more than $ 1.3 billion ETH since its pivot at the end of May and marked the tokens as part of its strategy.

In addition, the Securities and Exchange Commission (SEC) specified on May 29 that the implementation does not violate American securities laws, which have strengthened institutional appetite.

Stressing the trend, the number of active validators has increased by 54,000 people since the end of May to reach a record summit of almost 1.1 million, by Validatorqueue.com.

“Given that the SEC provided advice on the milestone in May, the figure experienced an increase of more than 100% of Ethereum’s display delegations of institutions and an increase of more than 360% + Ethereum waiting times, which is online with the price increases that we have seen in ETH,” said Cronk Coindesk.

Read more: the institutions lead the “return” of Ethereum