What to know

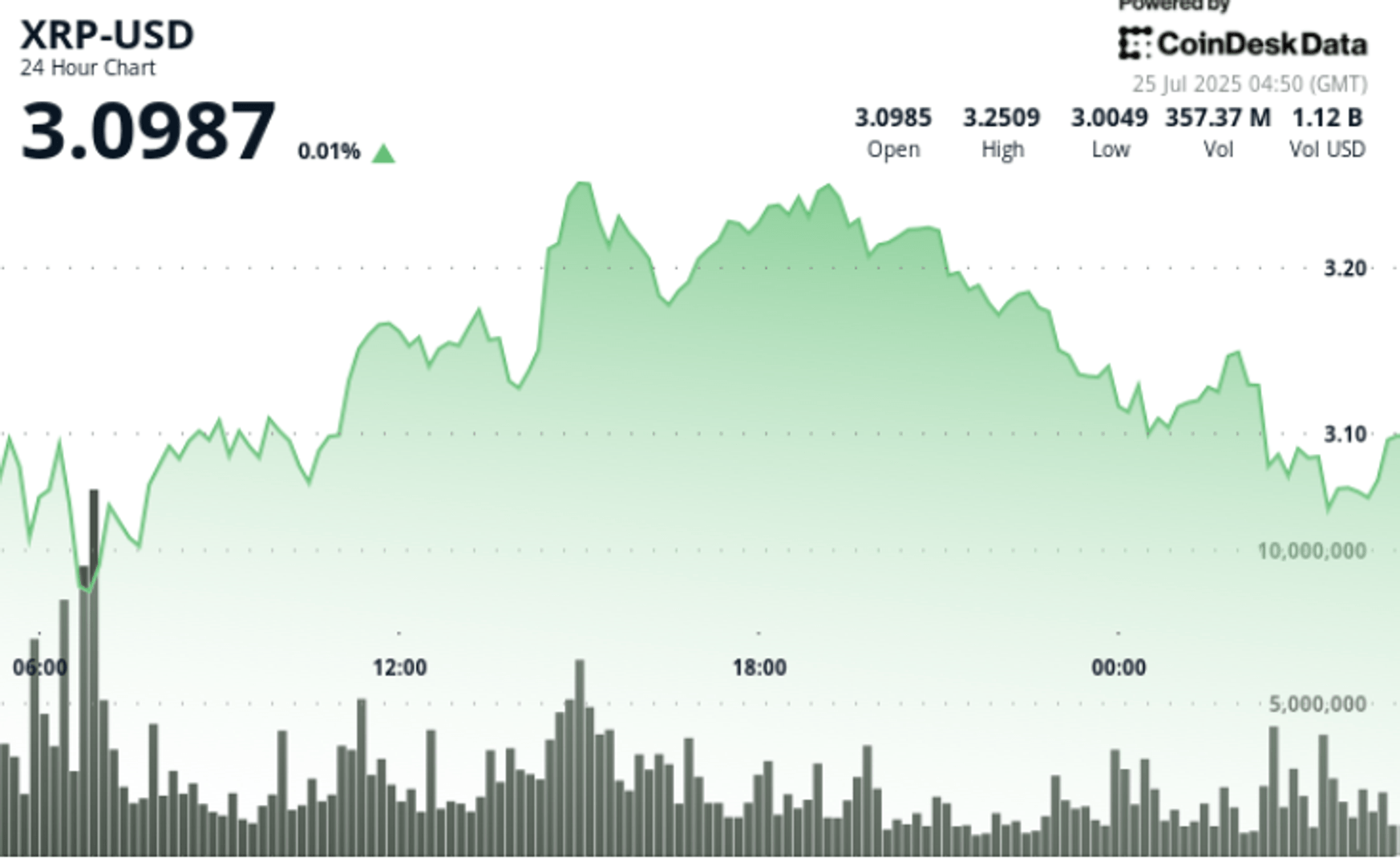

XRP displayed net losses during the session from July 24 to 25, lowering 8% while the token exchanged in a range of $ 0.30 from $ 2.96 to $ 3.26.

An early session rally was brought after taking the profits intensified near the level of resistance, while a sudden liquidation wave has destroyed more than $ 100 million in long positions.

Despite the sale, a key support of $ 3.06 to $ 3.10 has passed repeated tests, with an end -of -session price showing signs of potential stabilization.

The miracle of nature and the green of Brazil made the headlines with new strategies based on XRP, but institutional sellers dominated the band in the midst of fears that ETF approvals can face delays.

New context

• XRP exchanged in a range of 7.85% between $ 2.96 and $ 3.26 over 24 hours from July 24 at 5:00 am.

• Coinglass data showed more than $ 18 billion in total cryptographic liquidations during the session.

• Long Liquidations XRP exceeded $ 105 million, contributing to quick decreases.

• Nature’s Miracle announced an XRP cash plan of $ 20 million.

• VECT, based in Brazil, has deployed a $ 130 million blockchain solution built on the large XRP book.

Summary of price action

The session opened its doors to $ 3.13 and experienced a net drop at $ 2.96, followed by a rebound at a summit of $ 3.26 to 3:00 p.m. out of 175.94 million volumes – more than double the average. However, the resistance of $ 3.24 to $ 3.26 of capped gains. The price collapsed again late in the session, going to $ 3.05 during the window from 03: 00 to 04: 00 on a volume of 6.2 million, probably due to forced sales or liquidation flows. XRP has recovered modestly to close at $ 3.08.

Technical analysis

• Reduction of the range of $ 0.30 between $ 2.96 low and $ 3.26 high.

• Strong resistance confirmed at $ 3.24 to $ 3.26 after post -3:00 p.m. rejection.

• Critical support at $ 3.06 to $ 3.10 tested several times with rebounds on a volume.

• The last hour shows a failure at $ 3.05 before recovering $ 3.08 – a possible bullish reversal signal.

• Volatility focused on liquidation suggests an increased risk, but firm submission areas offer a short -term structure.

What traders look at

• If XRP can contain the area from $ 3.06 to $ 3.10 in the next session.

• Impact of new developments related to FNB from American regulators.

• Signs of institutional reinstatement or renewal of retail participation above $ 3.15.

• Watest stability in the cryptography market after liquidations of several billion dollars.