Bitcoin volatility bulls (BTC) could soon get their wish because seasonal models in the Vix (VIX) volatility index suggest that Wall Street is ready for increased turbulence.

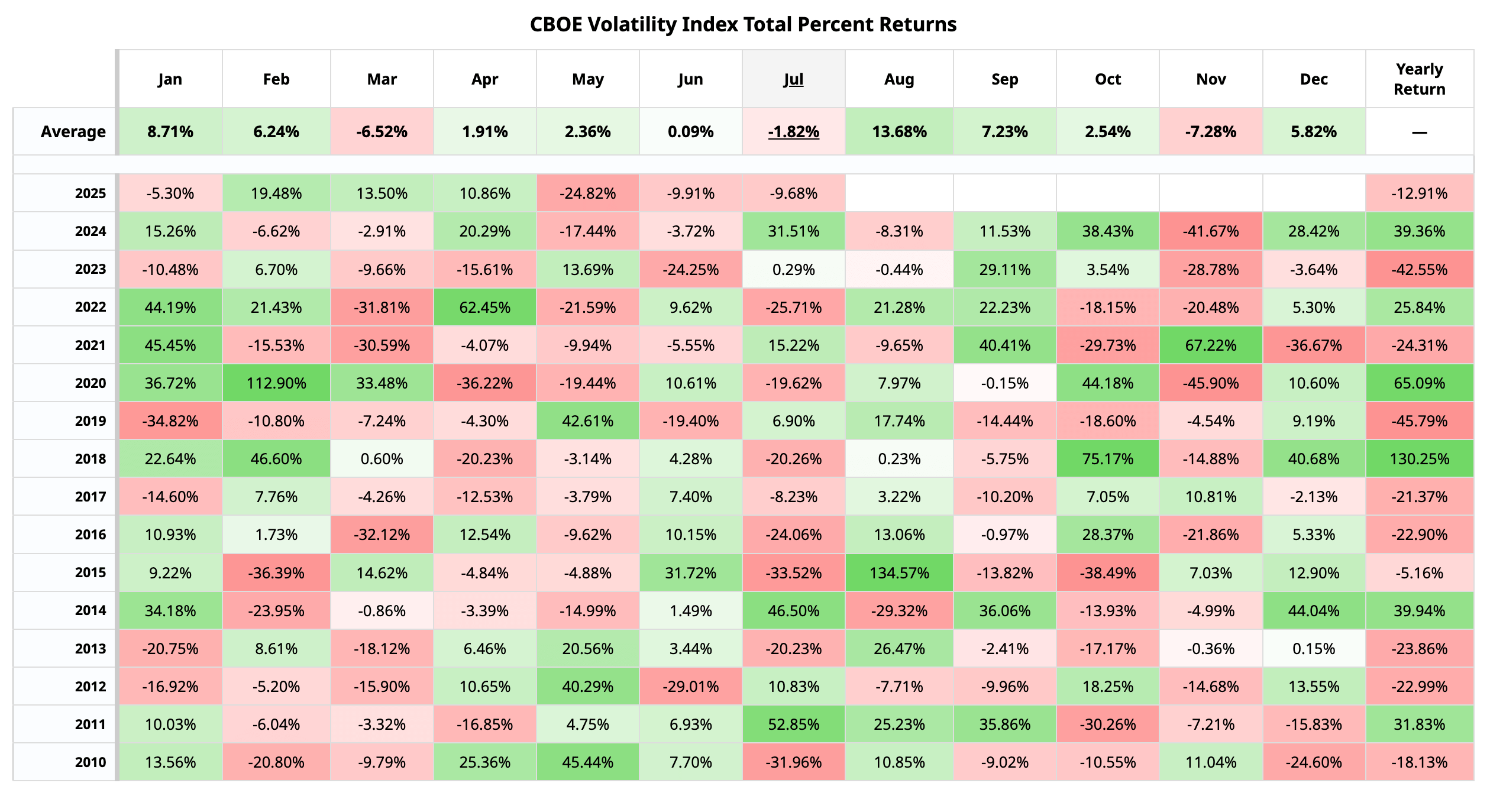

The VIX measures the oscillations scheduled 30 days of the reference S&P 500. According to Barchart.com, its historic model shows a frequent increase in August, often preceded by a drop in July.

August is distinguished as having the highest average monthly gain, 13.68%, in the past 15 years, increasing in 10 of these years, including a monumental peak of 135% in 2015.

History repeating itself?

The VIX fell for a third consecutive month in July, extending the slide for the April summits. He reached a five -month lower 14.92 Friday, according to Data Source TradingView.

If history is a guide, this drop is probably preparing the field for the August boom for volatility and risk aversion to Wall Street. The VIX, which has been nicknamed the fear gauge, increases when the equity prices decrease and decrease when they increase.

In other words, the expected volatility boom by Wall Street could be marked by a stock market escape, which could spread on the Bitcoin market.

Bitcoin tends to follow the feeling of Wall Street, especially in technological actions, quite closely. BTC’s implicit volatility indices have developed a strong positive correlation with the VIX, signaling a regular evolution in gauges of VIX type. Since November, the 30 -day implicit volatility indices of the BTC have decreased sharply, ending the positive correlation with the cash price.

Read: The rally of Bitcoin’s “low volatility” from $ 70,000 to $ 118,000: a story of transition from Wild West to Wall Street-Like Dynamics