While the actions of the strategy listed in NASDAQ (MSTR) continue to lose ground, the downward protection demand from the Bitcoin relaxation company has reached its strongest months.

On Wednesday, the one -year stove is biased – the difference in implicit volatility between the appeal and power options expiring in 12 months – to 3.6%, the highest since April 17, according to the Chameleon data source market.

In other words, the request for put options, which offer protection against price loss, compared to calls, is now the highest in more than three months.

AI taking

An increasing propagation of Put-Adppel IV means that the implicit volatility of put options (what profit if the course of action drops) increases much faster, or is much higher than the implicit volatility of Call options (which benefits if the course of action increases). This suggests that optional traders are ready to pay a much higher bonus for downward protection or more aggressively on a drop in MSTR’s action.

It reflects an increasing apprehension or a pure and simple lowered feeling among the merchants of options concerning the future performance of MSTR in the next year. They tariff a higher probability of a significant drop in stock.

A sale option gives the buyer the right, but not the obligation, to sell the underlying assets, MSTR, at a predetermined price at the latest at a later date. A put buyer is implicitly lower on the market, while a call buyer is optimistic.

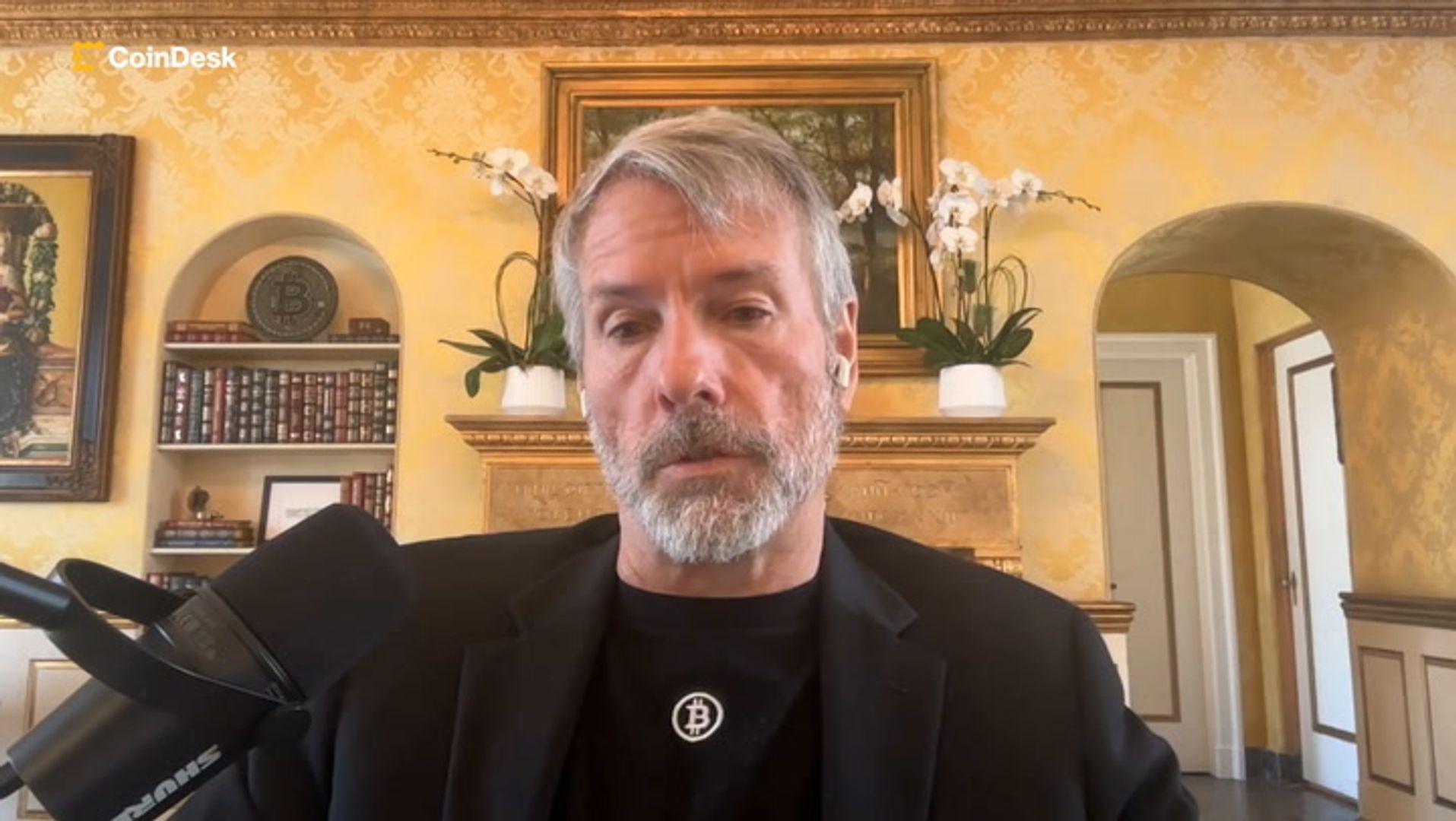

MSTR is the largest Bitcoin holder on the world on the world, with a reserve of parts of 628,791 BTC ($ 74.7 billion). The company buys Aggressively BTC as a record asset for five years in a trend decision for businesses around the world.

However, his stock market has had difficulties lately. MSTR fell by more than 14% to $ 292 in two weeks, ending just below the 50 -day simple mobile average (SMA) on Wednesday.

Correct (July 31, 08:30 UTC): Corrects the company’s name to the strategy throughout. An earlier version of this story used the old name, microstrategy. Replaces the image of lead.