Yesterday, July 30, was the 10th anniversary of the launch of Ethereum. In today’s Crypto for Advisors Newsletter, Alec Beckman of Psalion written on Ether’s growing role as a treasure reserve ratio and highlights increasing trends.

Then, Eric Tomaszewski of Verde Capital Management answers questions on Ether as an investment in Ask A Expert.

Thank you to our sponsor of this week’s newsletter, Grayscale. For financial advisers: Register for the next Minneapolis event on September 18.

– Sarah Morton

Ethereum: the active assets revolving the financing of companies

Ether, the cryptocurrency of the Ethereum blockchain, is quickly adopted by public enterprises as a strategic treasury, an evolution which contributes to reshaping the financing of companies and changing the dynamics of the ETH market.

Bitcoin has long dominated the conversation of the digital treasure. Its capped supply and decentralized nature make it a coverage against inflation and a reserve of value. Ether catches up with its delay, thanks to its yield potential, its economy, its real usefulness and its institutional infrastructure at maturity.

Why Ethereum calls on treasury bills

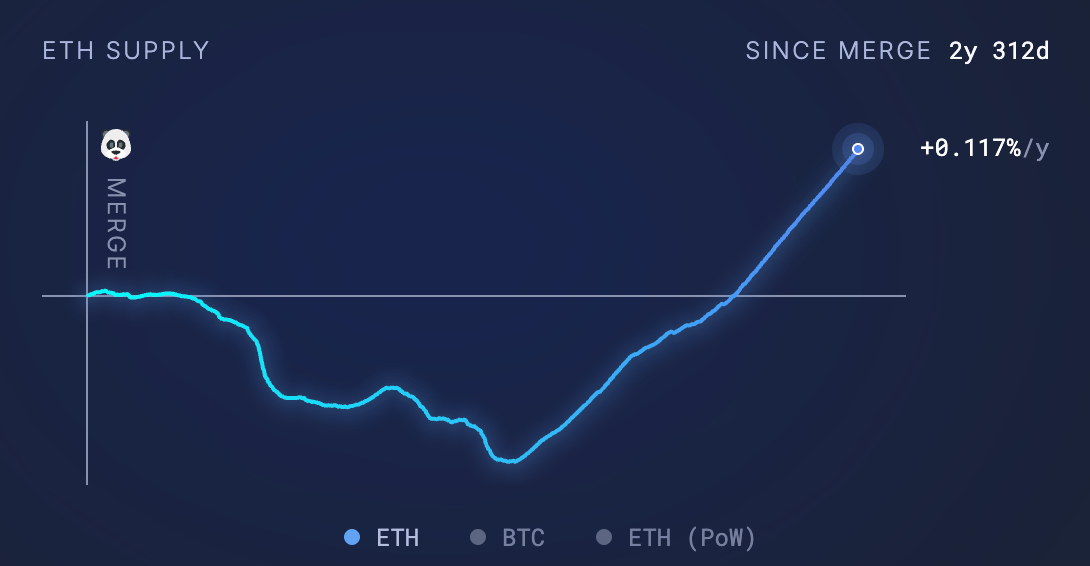

Ethereum’s transition in 2022 to evidence allowed holders to obtain annual implementation yields between 2% and 4%, creating a passive layer of income that Bitcoin does not offer. The asset has also sometimes been deflationary, with more burned ethn than delivered, supporting a value store thesis.

At the same time, Ethereum feeds an ecosystem of decentralized applications, tokenized assets and intelligent contracts. For companies, it can function not only as a reserve asset, but also as a capital for the deployment of services and infrastructure.

The wave of the Treasury ETH

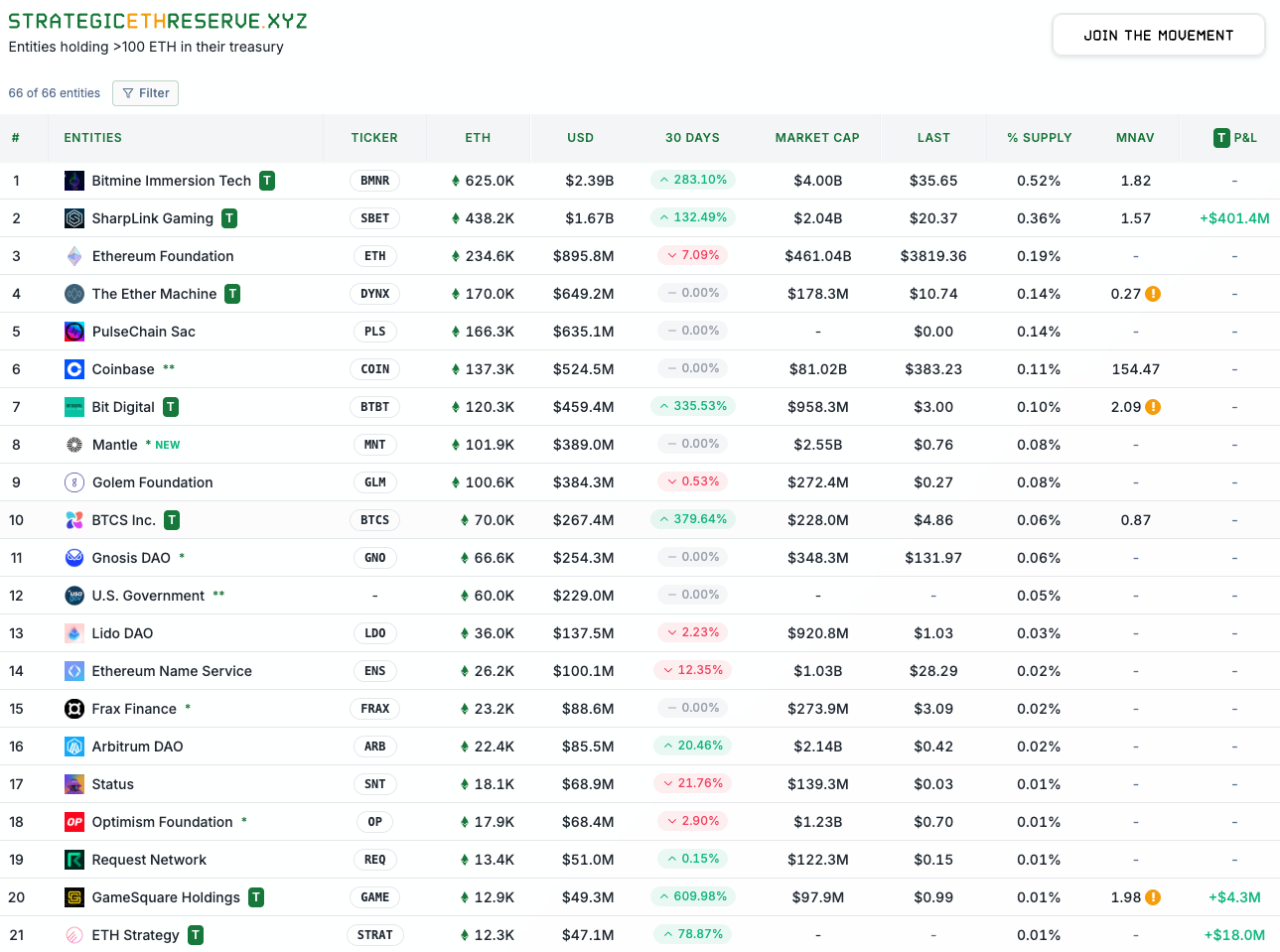

Several public companies now build cash strategies around ETH, after the first movers such as Bitcoin microstrategy:

- Digital bit Has more than 120,300 ETH and encourages all its allowance. CEO SAM Tabar calls it a “steering wheel model”, where the implementation of performance fund operations. They plan to add more to> $ 1 billion.

- Btcs Recently increased its assets to more than 70,000 ETH and was among the first public companies to play ETH as a cash strategy.

- Bitmini immersion aims to acquire 5% of the total ETH offer. Supported by significant funding led by Tom Lee, it now contains more than 625,000 ETH.

- Gaming Sharplink Has more than $ 1.67 billion ETH, adding nearly 80,000 pieces in a single week and continuing the markup as a basic strategy. Joe Lubin is a member of the board of directors and directs his ETH acquisition strategy.

- Gamesquare Awarded a first 30 million dollars of ETH with approval to reach $ 250 million. It also plans to integrate the yield of DEFI and NFT as a differentiators. Gamesquare sees the Ethereum network like Manhattan, with a financial district (DEFI), an artistic district (NFTS), and more. It is essential to invest in future value and use.

- The ether machineA vehicle supported by the SPAC came out of the listed dynamix, targets 1.5 billion dollars of ETH while it is preparing to become public.

The companies listed above all plan to add much more. Other companies have just announced their assets such as Ethzilla.

These companies are not only buying … they signal a long -term conviction and, in many cases, the construction of products and sources of income directly on Ethereum. An example is Gamesquare, whose strategy aligns closely with their audience in the industries of games, media and entertainment and sees the connection with chain products built on Ethereum. It is important for them to promote financial alignment with their audience.

BTCS implements a similar strategy for aligning with its audience, because the construction and jalitude of blocks create a vertical battery on the Ethereum network, which leads to efficiency gains in transactions and jalitude.

The imbalance of demand

The price of ETH has increased regularly in recent months, and public purchases is one of the main catalysts of this increase. In a recent period of 30 days, on 32 times more eTh has been bought than the program. This includes the purchase from Treasury Benefits, Etased Vehicles and newly approved ETFs. A continuation of this trend will create a supply shock.

Unlike Bitcoin, where minors often have to sell their bitcoin to cover operational costs, the transition from Ethereum to the proof of implementation reduces the pressure of the sale and aligns the network security holders.

Conclusion

Ethereum is no longer a platform for developers; It is now a financial asset that public enterprises adopt on a large scale. With an integrated yield, a deflationary dynamic and an increasing institutional demand, the ETH emerges as a cornerstone of the strategy of the corporate treasury. While more and more companies are going from “interested” to “allocated”, this new wave of ETH buyers can help define the next phase of the cryptographic cycle.

Thank you special to Sam Tabar, CEO of Bit-Digital, Charles Allen, CEO of BTCS, Justin Kenna, CEO of Gamesquare and Rhydon Lee, Director of Goff Capital (affiliated with Gamesquare) on the sharing of their ideas with me on ETH Treasure companies, differentiation and Ethereum network in general.

– Alec Beckman, Vice-President of Growth, Psalion

Ask an expert

Q: Why is ETH discussed as a strategic reserve asset?

A: Ethereum has quietly become financial infrastructure, not just a speculative asset.

Unlike Bitcoin (which is mainly a “value store”), ETH feeds a real economy that links intelligent contracts, tokenized assets, stablecoin transactions and decentralized financial services. While more economic activity settles in Ethereum, the ETH is considered to be a reserve asset by institutions, Fintech companies, DAOS and even sovereign actors.

The reason is that the ETH is the fuel that operates the system. It is similar to the holding of oil in an energy economy or treasury bills in a dollar system.

Q: Should business treasury bills treat ETH as an equivalent in cash, long-term equity, or an intangible form of infrastructure?

A: In practice, I see this as a new round in the portfolio that I would call a “digital infrastructure reserve”. It includes technological and regulatory risks, but also offers operational utility (sequestration with intelligent contract, regulations, tokenization rails). It is neither in cash nor in equity.

Q: How do you translate “ETH as a strategic reserve” into practical implications?

A: For institutions and treasury bills:

- ETH serves as cash and guarantee to manage companies on a chain.

- It generates a yield (marked out) like T tickets.

- It is held on the balance sheets, declared in treasure and audited policies.

For individuals and families:

- ETH is treated as a long -term strategic asset.

- Allocated thoughtfully (at least 1 to 5%) and separated from short -term needs.

- Used to gain impairment of development, to shake against the devaluation of the FIAT and to expose the growing role of Ethereum in finance and token infrastructure.

Q: What proves that ETH deserves to be treated as a serious reserve asset over the next 10 years?

A: If a larger part of global financial activity such as tokenized real estate, stabbed and major international payments are satisfied with Ethereum directly, this shows increasing confidence in the network. As Ethereum becomes a central infrastructure for the transfer of global value, the ETH goes from speculation to a legitimate strategic reserve.

Strategicethreve.xyz is an excellent source to measure progression. Beyond that, it is useful to look at innovation and creativity of names like Robinhood and The Ether Machine, to name only a few.

– Eric Tomaszewski, financial advisor, Verde Capital Management

Continue to read

- The White House published its first digital asset policy report on Wednesday July 30.

- The billionaire Ray Dalia recommends an exposure to Bitcoin of 15% in the portfolios to cover himself against the discharge of Fiat.

- Samsung has teamed up with Coinbase to integrate cryptographic payments for Samsung users.