Bitcoin (BTC) was negotiated in an excruciatingly tight range just below $ 120,000, but the rally is quickly lost when the market is on what was historically a soft month for the crypto, a 10x Research report warned.

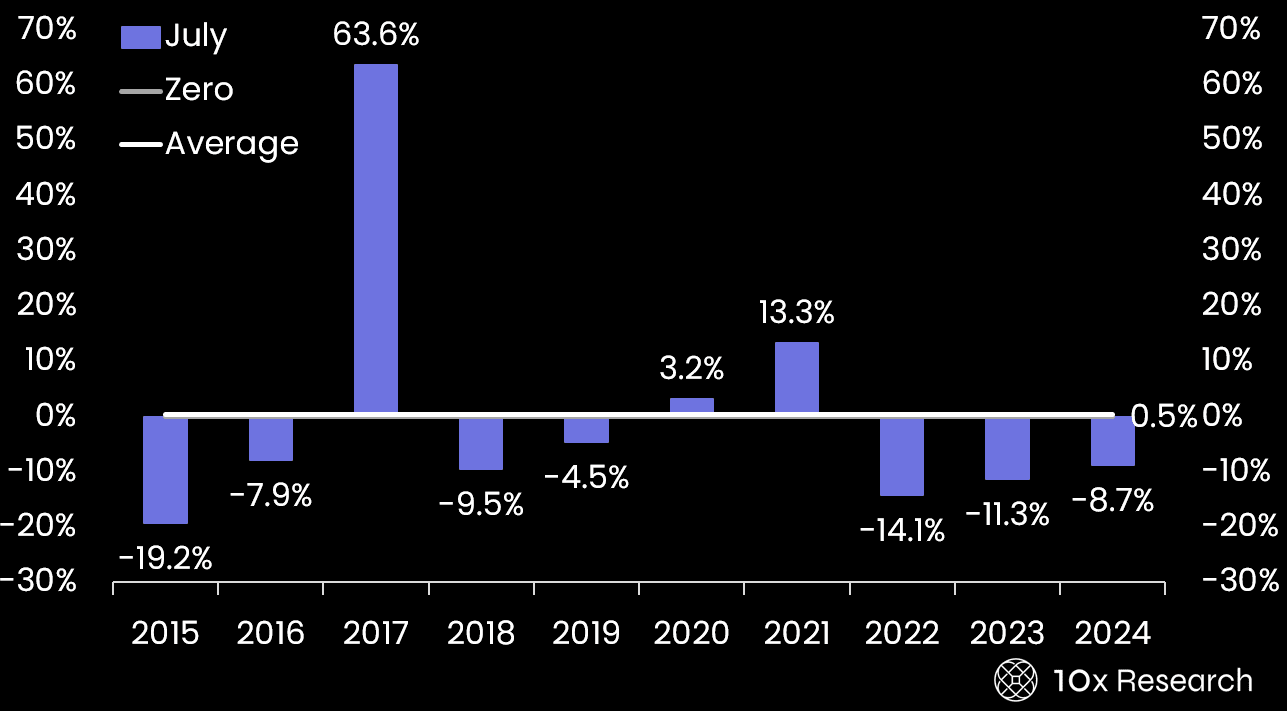

August was the lowest month of Bitcoin in the last decade, with only three positive years and others providing losses of 5 to 20%, noted the report.

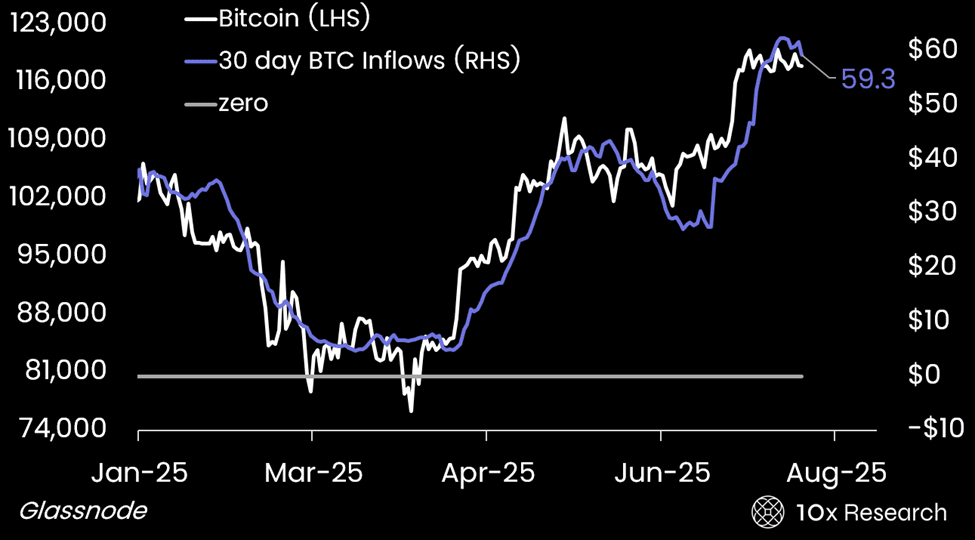

The report also reported a slowdown in capital flows in the Bitcoin network, a key engine of pricing this year. Total cumulative entries in the network now exceed $ 1 billion, with 206 billion dollars arriving in 2025.

But the 30 -day rolling average increased from $ 62.4 billion to $ 59.3 billion, which could mark the start of a consolidation phase, according to the report, reflecting the peaks passed in this metric as in the first quarter and in the first quarter of 2024.

“Time is short, and despite billions of capital entries for business treasury bills, the actual price impact has been surprisingly attenuated,” wrote Markus Thielen, co-founder and main analyst at 10x. “This raises the possibility that even with continuous support, the market may not offer the type of increase that many hope.”

The report provides for a likely break of less than $ 117,000, with support for $ 112,000 and a deeper floor around the threshold of $ 106,000 to $ 110,000.

However, BTC Bulls can cling to hope that the gains of aberrant values in August occurred in 2013, 2017 and 2021, during the post-answers of Bitcoin, coinciding with the roaring bull markets.

And 2025 could be a year like these.

Read more: BTC faces Golden Fibonacci Hurdle at $ 122,000, XRP holds the support at $ 3