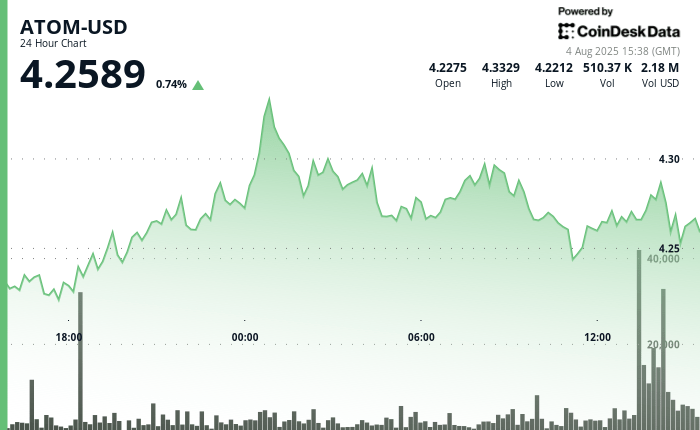

Atom oscillated in a corridor of $ 0.12 between $ 4.22 and $ 4.33, a range of 3% which reflects the strategic positioning of the room in the middle of opposite winds. Despite intra -day volatility, the price action was largely constructive, the bulls organizing an escape almost UTC on August 4 which pushed the token to a session of $ 4.33. The rally was supported by a heavy trading volume, culminating at 723,991 units during the ascending overvoltage, before facing the resistance to high -shape.

A reliable support floor solidified at $ 4.26 after several successful tests throughout the session. Meanwhile, the fork from $ 4.29 to $ 4.30 has become an immediate resistance to general costs, which suggests that a short -term consolidation channel is formed.

Instant intra -day: fast gains in the last hour

The most dramatic price movement came in a one -hour window between 1:08 p.m. and 14:07 UTC on August 4. Atom initially consolidated in the band of $ 4.26 to $ 4.27 before triggering an escape at 13:35. This decision increased the price to $ 4.29 with 1%intrajournal gains. The volume increased by 288,000 units during this rapid ascent, indicating a robust influx of immersed shopping.

At the end of the hour, the atom had stabilized between $ 4.28 and $ 4.29, because the volume collapsed, but the price held near local vertices – the conviction of the signaling buyer and the reduction in for profit.

Technical analysis: Haussiers indicators in the accent put

- Escape: Strong up goes from $ 4.28 to $ 4.33 during a high volume point (723,991 units)Signaling breakout with conviction.

- Support training: $ 4.26 tested several times and held, strengthening as a level of critical short -term support.

- Resistance strip: $ 4.29 – $ 4.30 now acting as a short -term ceiling, potential pivot area for the next leg.

- Rally led by volume: More than 288,000 units exchanged for 13:37 Breakout confirms the activity of institutional traffic or Momentum.

- Biphase: The initial consolidation phase followed by net rupture and stabilization indicates a potential continuation model.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.