This is a daily analysis of the upper tokens with CME Futures by Coindesk analyst and approved market technician Omkar Godbole.

Bitcoin: risk a deeper withdrawal

The Bitcoin Multi-Mois rally (BTC) seems to have struck an important wall, with a confluence of lowering signals emerging in weekly and daily graphics.

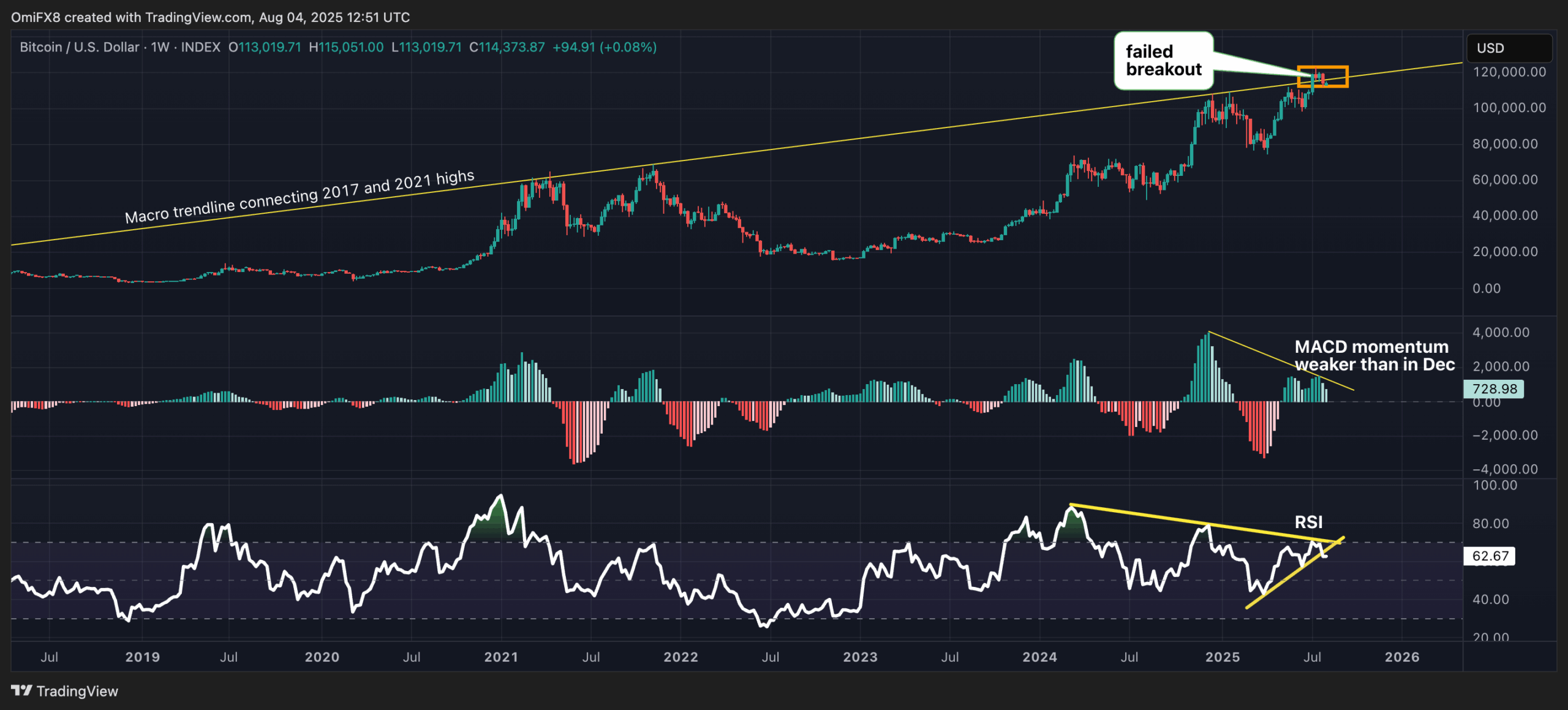

The weekly chandelier table shows that the bulls have failed to set up over the macro-trendy trend line connecting the heights of the Haussier 2017 and 2021 market. This stranded break is supported by the weakening of the momentum, because the MacD histogram, although always positive, is significantly lower than its peak in December 2024 when the Macro trend line was tested for the first times.

The lowering feeling is still reinforced by the 14 -week RSI, which has broken its line of trend upwards while continuing to print a series of upper lower people since March 2024.

Over a short -term daily time, the change in momentum is even more pronounced. The three -line rupture graph, a tool designed to filter minor noise and confirm trend changes, has printed three straight red bricks (bars), a conventional downward inversion signal, confirming that the sellers have taken control.

The combination of these signals – a failed long -term escape, weakening momentum and a short -term confirmed reversal – indicates that a deeper correction is now the track of the slightest resistance and prices could remove immediate support at $ 11,965, the former hit high in May, for a drop -off test at $ 100,000.

Prices must overcome $ 122,056 to invalidate the downstream configuration.

- Resistance: $ 120,000, $ 122,056, $ 123,181.

- Support: $ 111,965, $ 112,301 (the 50 -day SMA), $ 100,000.

XRP: contest the downward trend line

While XRP (XRP) tries to get out of the downline line, which represents recent correction, the crushing momentum of mobile averages through time time and daily time suggests that a sustained break may not occur immediately.

On the daily delay, the price has experienced a modest rebound, but this rally is capped by the level of Fibonacci trace of 38.2%, which acts as a key resistance. This corrective decision occurs in a downward background, the 5 and 10 days (SMAS) movable medium -sized medium -sized tendency to the south, confirming upwards. In addition, SMS of 50, 100 and 200 hours are stacked in a downward configuration, all trendy to the south, a conventional technical signal of a strong downward trend.

If we are closing over $ 3.00, the accent would go to the top of $ 3.33 recorded on July 28.

- Resistance: $ 3.33, $ 3.65, $ 4.00.

- Support: $ 2.72, $ 2.65, $ 2.58.

Ether: Bearish outside the week

The ether fell by almost 10% last week, forming a large outdoor weekly candle, an important bearish model, which indicates that the sellers seek to regain control.

This feeling is reinforced on the daily time. The daily graphic of the candlesticks shows that the 5 and 10 days SMA has executed a downward cross, confirming a break in the short -term trend.

So, while the price has seen a modest rebound since Sunday, its strength is questionable. This is also supported by the three -line daily graphic, which has printed two consecutive red bricks – a decisive lower signal which confirms that the trend has reversed to the disadvantage.

The combination of these long -term and short -term graphics suggests that the path of the slightest resistance is now lower.

- Resistance: $ 3,941, $ 4,000, $ 4,100.

- Support: $ 3,355, $ 3,000, $ 2,879.

Solana: golden cross

The recent decline of Solana seems to meet a critical test, the Bulls successfully defending a level of key support in the last 24 hours. The price rebounded compared to the retracement of fibonacci of 61.8% of its recent rally, a level often looked at by traders as a very potential floor in a upward trend.

Meanwhile, a major long -term signal is on the horizon: the SMA of 50 and 200 days are approaching a “golden cross”. Although it is a late indicator, a successful cross would be a powerful long -term bullish signal, confirming a major change in the momentum and potentially preparing the ground for a new sustained rise trend.

For merchants, the next few days are essential, the FIB level of 61.8% needing to be solid as support while the imminent golden cross provides an optimistic long -term back wind. Also note that in spite of the defense of the FIB level, the short -term trend remains down, the single mobile averages of 5 and 10 days (SMAS) continuing to be lower.

- Resistance: $ 175, $ 187, $ 200.

- Support: $ 156, $ 145, $ 126.