Cryptographic investors turn their attention to Ondo after an Ondo Finance, in July, announced several acquisitions, very publicized partnerships and regulatory milestones which, according to analysts, could pave the way for explosive price action in August.

On Sunday, Kyren, a popular crypto analyst on X, called last month “a big one for $ Ondo”, highlighting the launch of Ado Catalyst with Pantera Capital, the acquisitions of Strangelove and Oasis Pro, recognition in a White House report and expanding integrations for Usdy, the product of the American Treasury of Ondo, Ondo. The analyst thinks that these developments are only the beginning, saying that he feels “we are preparing for an explosion for August.”

Behind this feeling is a wave of corporate activities. In early July, Ondo Finance launched Ondo Catalyst, a strategic investment initiative of 250 million dollars supported by Pantera, aimed at setting up real asset markets in token (RWA). The company has also acquired Strangelove, a blockchain development studio, and Oasis Pro, an American broker recorded by the SEC and an alternative trading system. These transactions overlook the technical infrastructure and the legal framework to extend compliant token securities – in particular on the American market.

The Stablecoin Usdy d’Ondo also gains ground. In July, it was approved for integration both with the SEI network, a quick-optimized layer and alchemy remuneration, a Fiat-to-Cryptto payment gateway. Together, integrations aim to improve the accessibility and adoption of USDY.

Beyond corporate partnerships, the report on the digital asset markets of the White House in July 2025 specifically mentioned Ondo Finance as a compliant tokenized finance leader, recognition which, according to analysts, lends institutional credibility. Meanwhile, the Global Markets Alliance of the company extended to 25 members, including BNB Chain and Bitget Global, as part of a wider thrust to normalize asset infrastructure in token in the world.

This explosion of activity has aroused renewed interest in what Ondo finance really does. The company operates at the intersection of traditional finances and blockchain, offering a series of tokenized investment products which aim to make financial instruments of institutional quality accessible through decentralized protocols.

Its operations cover two main areas: the management of assets, which designs tokenized products generating yields such as USDY and OSG (Tokenized US Treasury and Bond Products); And the development of technology, which builds the intelligent contract infrastructure fueling these offers. Key loan platforms as a finance flow are part of this ecosystem, supporting loans and loans based on DEFI with open and authorized cryptography assets.

The Ondo token is the native utilitarian asset of this ecosystem. It grants holders of the right to participate in governance via the ONDO DAO, makes it possible to stimulate, reduces protocol costs and can be used as a guarantee within the platform. It also supports the liquidity incentive mechanisms as Ondo develops through new channels.

In February 2025, the company launched Ondo Chain, a layer 1 blockchain designed specifically for the Rwas to tokenized. The chain combines the public opening of the blockchain with the characteristics of regulatory compliance, including the implementation mechanisms which oblige institutional participants to collateralize their activities with tokenized active assets. It also supports native transversal messaging and integrates into the traditional financial infrastructure to minimize latency and cost.

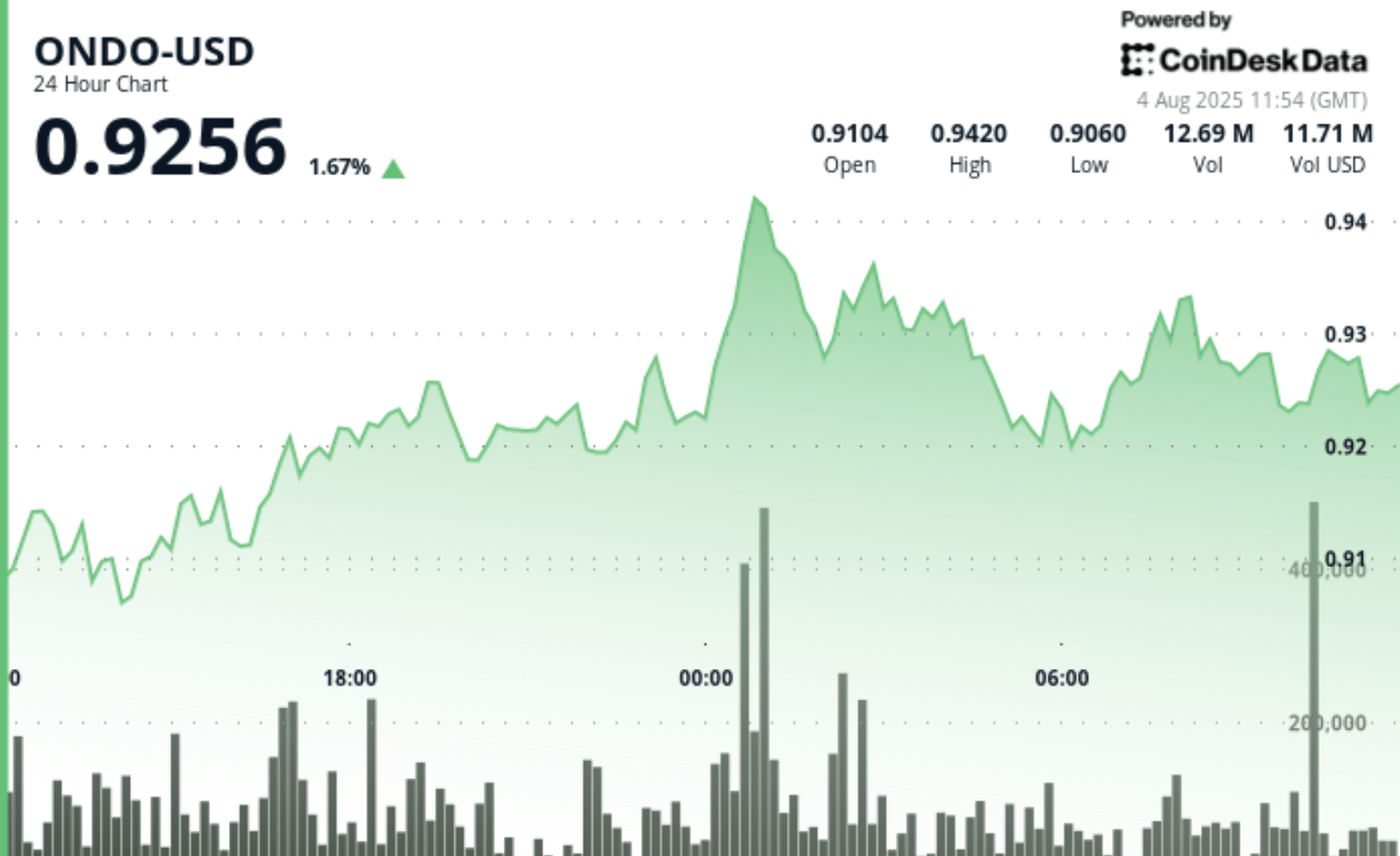

Monday morning, Ondo is negotiated at $ 0.9256, up 1.67% in the last 24 hours, according to Coindesk data.

Strengths of technical analysis

- According to the Technical Analysis Data model of Coindesk, Ondo went from $ 0.90 to $ 0.93 between August 3 at 9:00 a.m. and August 4 at 8:00 a.m., marking an intraday gain of 5% on a negotiation range of $ 0.044.

- The largest price movement occurred at 00:00 UTC on August 4, when Ondo interrupted $ 0.92 to $ 0.94 supported by 7.90 million units in volume – more than double the daily average.

- The resistance established nearly $ 0.945, coinciding with high volume rejection after rupture.

- The 24 -hour volume wave confirms the bullish momentum and institutional participation at high price levels.

- Ondo added another 1% in the last 60 minutes from 07:16 to 08:15 UTC on August 4, going from $ 0.927 to $ 0.932.

- The price culminated at $ 0.932 during a strong push between 07:35 and 07:50 UTC, supported by several peaks in volume greater than 150,000 units.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.