The Ripple XRP displayed a 5% gain during the day while the traders raised the shoulders of a new wave of opposition from traditional banks to the request for a license of Ripple.

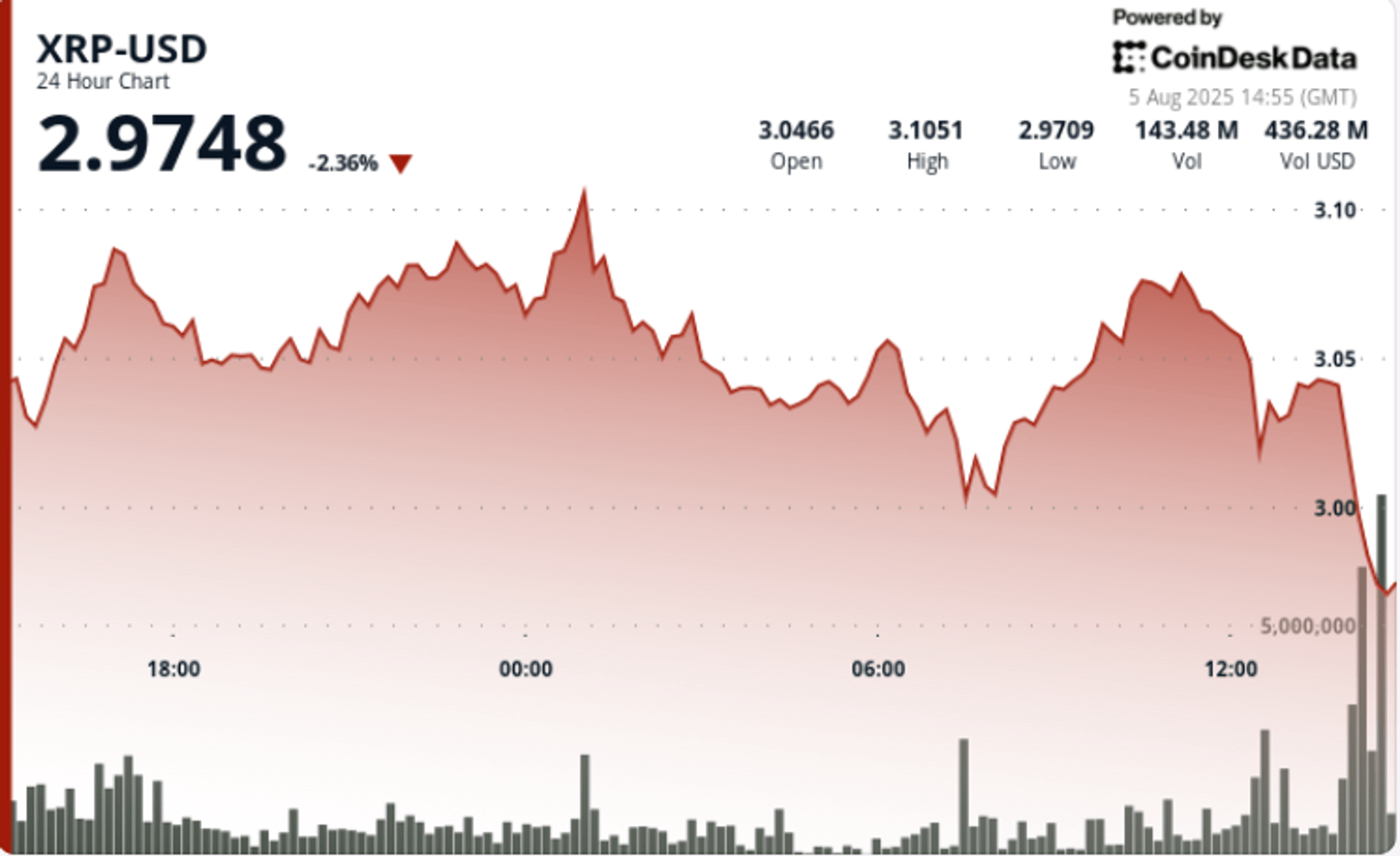

Price action remained volatile between $ 2.83 and $ 3.11, with a short -term increase in resistance levels while volumes exceeded 110 million XRP – including a transaction of $ 33 million one minute that frightened orders.

What to know

- BPI, which represents 42 banks, has tabled objections to the banking license in the process of Ripple, injecting a new uncertainty within the regulatory deadlines.

- XRP joined $ 2.83 to $ 3.11 before closing at $ 3.04, with an intraday swing of 9.8% on the session.

- Support at $ 3.00 owned despite midday sales and the discoloration of the momentum greater than $ 3.09.

- Institutional flows remained neutral neutral: 2.1 billion dollars of divestment in tokens compensate for $ 14 million in long positions.

- The models led by AI project a decision of $ 3.12 by the end of August – although sequential TD flags The risk of short -term reversal.

New context

The coordinated deposit of the banking sector against the license effort of Ripple marks the most concentrated resistance that the company has been faced since its partial victory against the dry. For merchants, the news was mainly background noise – because the price of XRP maintained a company greater than $ 3.00 and saw liquidity bursts generally associated with large players who were moving inward and out of the assets.

Summary of price action

- Coindesk Analytics shows that XRP has reached a session top of $ 3.11 around 5:00 p.m. before reversing on volume tips of 69.89 million XRP.

- Support formed at $ 2.97 during the session in Asia (05: 00 to 06: 00), reinforced by consecutive transactions of 50m + XRP.

- The action of the last hour (13: 09–14: 08) showed that XRP holding flat at $ 3.03, with 2.1 million XRP sold during the attempted breakdown.

Technical analysis

- The price structure shows a clean consolidation strip between $ 3.00 and $ 3.02, without any structural distribution.

- The bulls failed several times at $ 3.09 to $ 3.11, reporting short -term exhaustion near this resistance cluster.

- The negotiation volume remained above the daily average (47.7 million) in five separate time windows – showing sustained interest.

- Sequential TD on the 3 -day graph indicates a number of 9 completes – generally a local high.

- The escape level remains $ 3.05, with upward extensions at $ 3.15 possible if the volume returns above 50 m / hour.

What traders look at

- If Ripple responds publicly to the challenge of the banking sector and how regulators react.

- If $ 3.00 to $ 3.02 continues to act as an accumulation range for the biggest holders.

- Participation of the volume in the weekend – Any slowdown could be established for a new test of $ 2.92 to $ 2.97.

- The trend returns to confirmation greater than $ 3.05 over a large hourly volume, targeting $ 3.12 to $ 3.25.