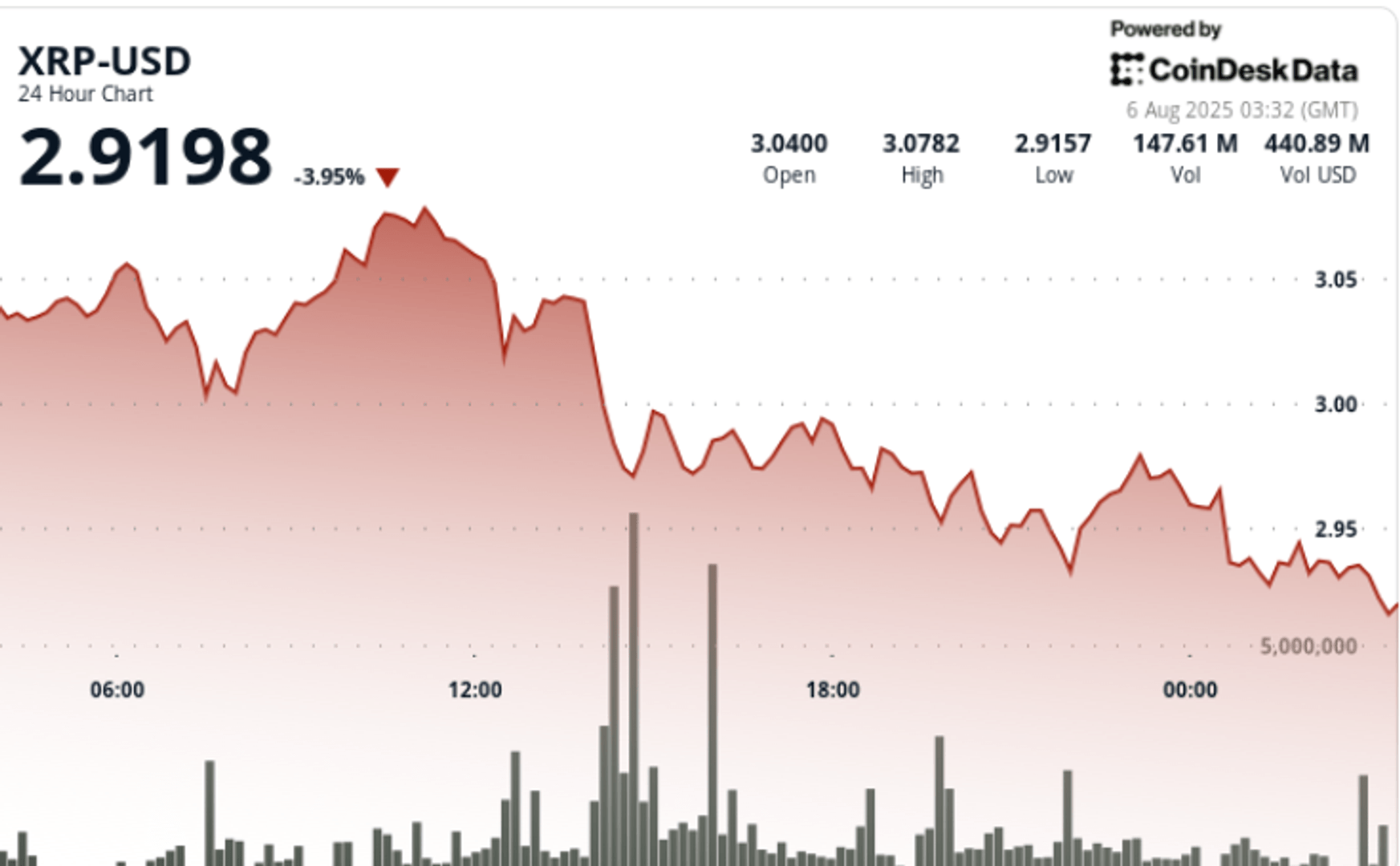

Merchants are preparing for continuous decrease as resistance caps at $ 3.04 and a floor of $ 2.93 emerged after 169 million volume.

What to know

XRP dropped 4.2% during the 24 -hour session ending on August 6 at 02:00, from $ 3.06 to $ 2.93 in a volume -oriented ventilation. The $ 3.08 summit in the session was affected at 10:00 am before a net inversion was fixed.

Last hour price action confirmed the lowering control. XRP slipped 1% from $ 2.94 to $ 2.92 between 01:15 and 02:14, ending a high volatility session which experienced a swing of $ 0.13, or an intra -day range of 4.2%. A burst of volume of 1:11 of 1.6 million sealed the decline while the token has printed intrajournal hollows.

Summary of price action

- XRP exchanged in a range of $ 0.13 between $ 3.08 and $ 2.93.

- The price collapsed by 4.2% out of 169.41 million in total volume.

- A peak drop occurred between 2:00 p.m. and 3:00 p.m. with the highest time sales volume.

- The last hour saw 1% additional drop, led by an exchange of 1.6 million at 02:11.

- Resistance caps at $ 3.04; Support forms at $ 2.93.

- The consolidation range is now between $ 2.96 and $ 2.97.

Technical analysis

The price structure confirms rejection at $ 3.04 with an immediate drawback at $ 2.93 over a volume above average. The violation of short-term moving averages and non-compliance with $ 3.00 at the risk of continuation. The volume tips during key sales windows support the lower bias.

Volatility remains high without printed clear reversal signals. If $ 2.92 fail, the next support areas are nearly $ 2.87 and $ 2.80 depending on historical volume nodes.

What traders look at

- Reclaim of $ 3.00 Psychological Nivel and Defense of $ 2.93 Zone.

- That the optimistic divergence emerges on indicators of Momentum intraday.

- Watest impact of the macro-risk feeling market motivated by geopolitical tensions and renewed commercial instability.