Companies that buy Ether (ETH) for their cash strategy are a better purchase for investors than the ETH (ETH) Spot Exchange Funds, said Standard Kendrick Standard analyst.

The analyst noted that these companies attract attention not only for their assets, but also for their financial structure, which is starting to become attractive for investors.

“The Multiples of NAV (market capitalization divided by the value of the ETH detained) also began to normalize for the companies of the Treasury of the ETH,” said Kendrick, adding that this dynamic makes “cash companies now very investable for investors who seek to access the appreciation of ETH prices”.

The purchase of ETH for the balance sheet, after the purchasing strategy of Michael Saylor, Bitcoin (BTC), recently took off. Many companies listed on the stock exchange have jumped on board and given their share of the shares initially, stimulating their market capitalization and their multiple navigation. Now, their multiple navigation have come down from their initial peak.

Some of the best companies enjoying this euphoria market include Bitmine (BMNR) immersion technologies and the Sharplink game (SBET).

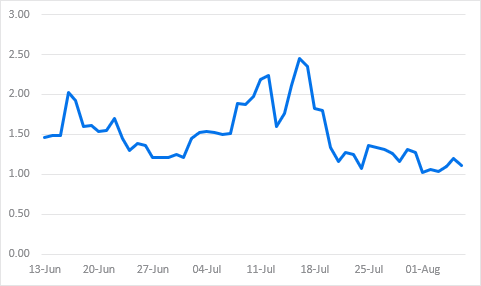

Among these companies, Kendrick underlined NAV Multiple of Sharplink Gaming (SBET), who at his peak was around 2.50 and is now limited to a more normalized level of almost 1.0. This means that its market capitalization is only slightly higher than the value of its ETH assets.

Admittedly, the analyst said he saw no reason for the NAP to be below 1.0, because these cash companies offer investors “regulatory arbitration opportunities”.

Kendrick also pointed out that these cash companies have bought as much eTh as the funds (ETF) listed by American points (ETF) since June.

The two groups now hold approximately 1.6% of the total supply of ETH in circulation – just under 2,000 ETH – during this period, adding to its call according to which the actions of the Treasury and the holders of FNB now provide an exposure similar to the ETH, all the others being equal.

The combination of these two factors now adds to its thesis that ETH cash games are better purchase opportunities than ETF. “Since the multiple Navs are currently just above 1, I see the societies of the ETH treasury as a better asset to buy than the American FNB Spot Eth,” he said.

Standard Charterred maintains its end -of -year price target of $ 4,000 for ether. ETH is currently negotiated at $ 3,652, up 2% in the last 24 hours.

Read more: Ether cash companies to possibly have 10% of the offer: Standard Charterd