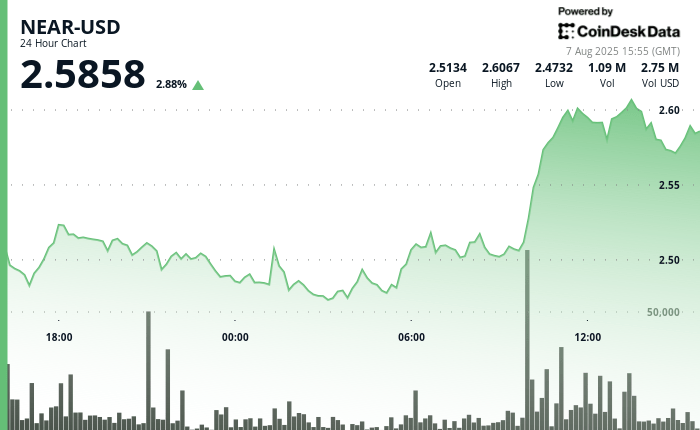

Near the protocol increased from 5% from $ 2.47 to $ 2.60 during the 24 -hour period ending on August 7 at 2:00 p.m. UTC, with strong resilience in the middle of larger market turbulence. Institutional accumulation has contributed to feeding a recovery rally after stockings at the start of the session, with an action price that founded between $ 2.48 and $ 2.52 before a net break around 10:00 am UTC, supported by 3.36 million negotiation volumes. The advance of the assets, partially influenced by the global feeling of risk, reflected the pivot of investors with alternative assets during an increased geopolitical and macroeconomic uncertainty.

Sales caps at the end of the session

Despite its previous strength, the last hour of negotiation of Narch – from 13:06 to 14:05 UTC – transformed an increase in volatility which has erased most of the intraday gains. After briefly testing the resistance at $ 2.61, a peak in volume between 1:39 p.m. and 13:42 coincided with for -profit behavior. The sale pressure has shaped a downhill channel, with retired prices to close at $ 2.60, slightly above fresh support nearly $ 2,598. The decision indicates a possible short -term exhaustion, as institutional distribution can further limit the increase despite an earlier accumulation.

Macro-waonditions continue to shape market dynamics

The backdrop of Narch’s performance remains strongly influenced by the displacement of macroeconomic forces. While large economies recalibrate monetary policy in response to the inflationary effects of current trade disputes, institutional flows in digital assets as well as intensified. The intraday withdrawal of cryptocurrency reflects a broader hesitation on the market, because participants digest global policy changes and their implications for the structure of the crypto market and the appetite for risks.

Technical indicators analysis

- Near the protocol demonstrated considerable resilience during the previous period of 24 hours from August 6 to August 7 to 7, 2:00 p.m., recovering from $ 2.47 for the early session to close at $ 2.60, representing a convincing gain of 5%.

- The cryptocurrency showed a classic accumulation model throughout the 18 initial hours, consolidating between $ 2.47 and $ 2.52 before mounting spectacular at 10:00 on August 7 with an exceptional volume of 3.36 million units, which reports the average of 24 hours of 1.20 million.

- This escape established a robust support at $ 2.51 and a proximity resistance to $ 2.61, the expansion pronounced by the prices suggesting an institutional accumulation followed by immersion focused on the momentum which could expand at $ 2.65 to $ 2.70 depending on the measured moving projections.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.