XRP broke the resistance barriers while the commercial volume reached 300 million people during the institutional purchase, with models of optimistic graphics and a historic legal resolution supplying bets upwards.

The rally combines technical escape pressure with a significant change in the fundamental narrative of the token. The SEC regulation eliminates a trail of multi -year litigation, potentially leaving greater institutional participation in the American markets.

The price action shows a high accumulation greater than $ 3.10, followed by a consolidation greater than $ 3.30 – suggesting a strong conviction among buyers even after the initial tip. The SBI ETF ranking adds a parallel application driver, the XRP positioning for higher beta movements if the entries of FNB Bitcoin have continued to continue.

Preview of technical analysis

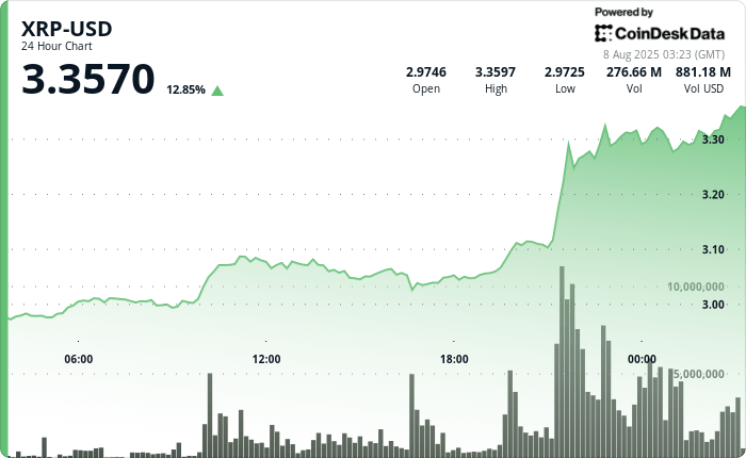

XRP explodes 11% more during the 24 -hour period ending on August 8, going from $ 2.99 to $ 3.30 in a blister of blisters.

The digital acceleration accelerates the most aggressively between 19: 00-22: 00, erase multiple resistance levels. The commercial volume explodes 300 million at 9:00 p.m. only.

The session covers a range of $ 0.35, marking a volatility of 12% of $ 2.97 to peaks of $ 3.33. New forms of resistance at $ 3.33. The high demand emerges greater than $ 3.10 in the last hours of the session.

New context

The Securities and Exchange Commission and Ripple Labs jointly ended their calls in the high -level XRP trial, concluding a multi -year legal battle which has darkened the perspectives of the token since 2020.

In a file Thursday, the court of appeal of the second circuit recognized the dismissal, the two parties agreeing to bear their own costs and costs.

“Following the vote of the Commission today, the SEC and the undulation officially filed directly with the second circuit to reject their calls,” said Ripple’s legal director Stuart Alderoty, on X.

The resolution removes a major overhang for XRP, coming next to other bullish developments such as the deposit of Japanese Holdings SBI to launch an ETF Bitcoin-XRP.

Summary of price action

• XRP increases from 11% from August 7, 01:00 to August 8, 00:00, exploding from $ 2.99 to $ 3.30 on an explosive volume of 300 million

• Consolidats of tokens in a tight band of $ 0.04 between $ 3.30 and $ 3.33 in August 7 23:42 to August 8, 00:41

• Taureau flag training indicates that $ 8.00 – $ 15.00 rupture targets because legal resolution erases the path for institutional entry

Technical indicators analysis

• The volume explodes beyond 300 million at 9:00 p.m., signaling a strong institutional accumulation

• Taurus flag formations point to $ 8.00 – $ 15.00 targets in small groups on longer horizons

• Fresh resistance locks $ 3.33 with volume confirmation

• The key support area holds a company greater than $ 3.30 during consolidation

• Evening hours see multiple resistance ruptures between 19: 00-22: 00

• The demand sustained by the volume materializes above $ 3.10 in the rear half of the session

What traders look at

• Purchase of follow -up in American institutions now that the risk of dispute has been erased

• FNB approval calendar in Japan and potential deposits on other markets

• Retirement of the resistance of $ 3.33 and a possible escape to a short -term target of $ 3.65

• Reference of retail after the titles of the legal victory