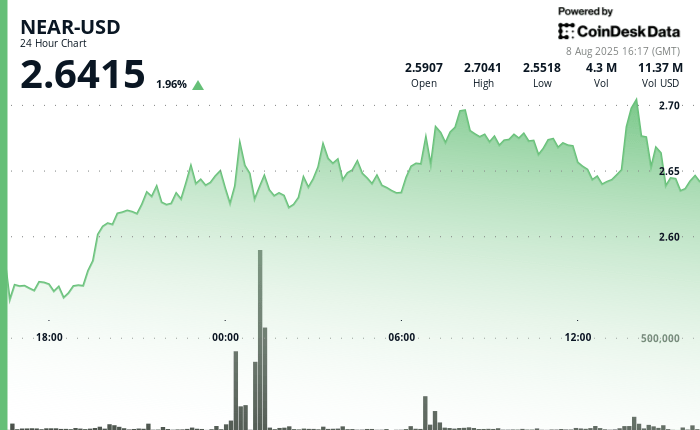

Near the protocol increased 1.93% within 24 hours at 3:00 p.m. UTC on August 8, from $ 2.59 to $ 2.64. The token exchanged between $ 2.54 and $ 2.71, a fork of 6.84% which, according to industry managers, highlights the structural weaknesses in progress on cryptographic markets and the need for clearer regulations. “These volatile trading models highlight the need for more robust market infrastructure and lighter regulatory executives,” said a large manager of a large digital active trading company.

Institutional flows have led a large part of the activity, the volume of 18.9 million units. Analysts indicated the area from $ 2.62 to $ 2.66 as a target for treasury bills and hedge funds. A net rejection at $ 2.67, accompanied by more than 120,000 units sold in four minutes, reflected algorithmic trading models that attracted the attention of regulators.

Market observers claim that the mixture of institutional purchasing and heavy sales shows the sophistication of companies’ participation in the crypto but also raises stability problems.

Financial metrics and investment analysis

- Almost fluctuation in a strip of $ 0.18 representing a volatility of 6.84% between $ 2.54 support and the resistance levels of $ 2.71.

- Institutional commercial activity culminated at 18.9 million units during Asian market hours, going beyond the trading models of typical companies.

- $ 2.62 – $ 2.66 Consolidation attracted business investment flows and institutional accumulation strategies.

- The level of $ 2.67 sparked systematic sales protocols with more than 120,000 units executed during algorithmic trading sequences.

- The 1.13% drop in session peaks during the concentrated sales window indicates that institutional risk management protocols remain active.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.