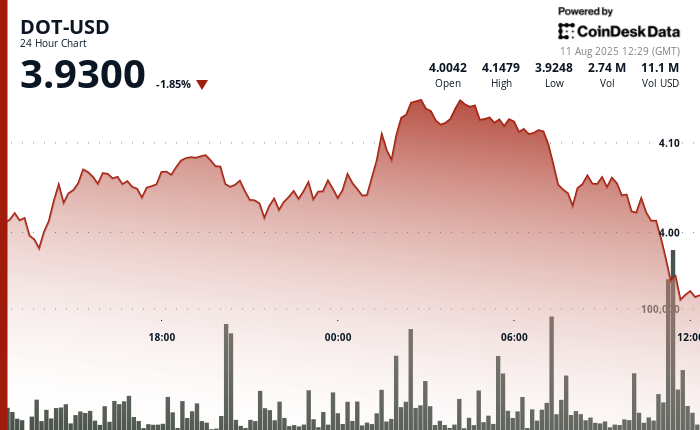

The Polkadot dowry experienced considerable volatility during the 24 -hour negotiation period with a clear drop annihilating previous gains, according to the Technical Analysis model of Coindesk Research.

The model showed that the dowry had dropped 6% in a spectacular overthrow of 24 hours from August 10 from August 11 to 11:00 am, from $ 4.15 to $ 3.91 in an exceptionally robust sales volume.

According to the model, Polkadot faced a high sale pressure as institutional liquidation has lowered prices, breaking the multiple support thresholds, depending on the model.

The drop in the dowry came while the wider cryptography market increased, with the wider market gauge, the Coindesk 20, recently increased by 0.5%.

During recent negotiations, Polkadot was down 2.6% over 24 hours, exchanging about $ 3.91.

Technical analysis:

- Reduction of $ 0.24 representing a volatility of 6% between $ 3.91 and $ 4.15.

- The volume increases to 4.96 million during the drop in the last hour indicating the institutional sale.

- Resistance established at $ 4.15 following an aborted rally attempt.

- Fragile support level nearly $ 3.90 with a risk of potential failure.

- High training duis-A with Reformation of the Strux Bearish Structure of the Market.

- A volume exceeding 300,000 in several intervals from 11:11 a.m. to 11:30 a.m.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.