Preview of technical analysis

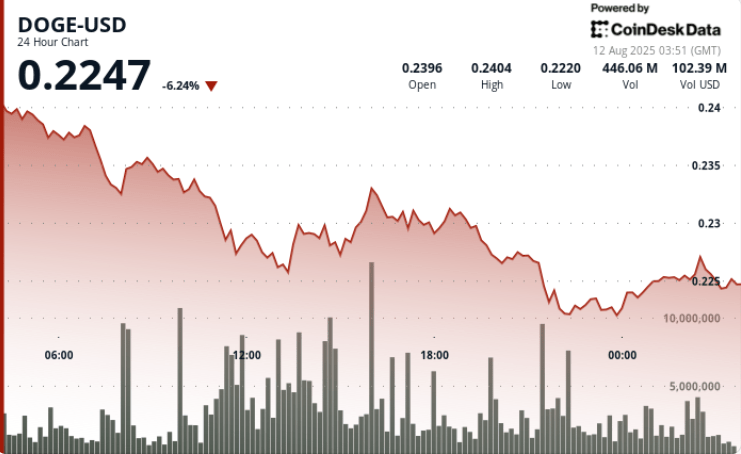

DOGE drops by 6.88% during the 24 -hour period ending on August 12, from $ 0.24 to $ 0.22 while sellers overwhelm the liquidity on the auction side. The heaviest pressure hit at 07:00 on August 11, the price going from $ 0.238 to $ 0.233 out of 485.69 m of volume – 31% greater than the daily average of 371.45 m. This establishes $ 0.238 as a major resistance level.

Buyers intervene at $ 0.226 during the 11:00 am session, generating 793.38 m of volume. Secondary resistance forms at $ 0.231 as multiple rally attempts fail. The final hour trade sees Dogee linked between $ 0.2,247 and $ 0.2253 with volume compression, suggesting the seller’s potential exhaustion.

New context

The sale occurs in the middle of a broader weakness of digital assets, with regulatory uncertainty and global trade tensions weighing on the feeling of risks. Large economies increase pricing disputes, put pressure on multinational supply chains, while central banks signal potential policy changes – a mixture that has caused institutional disinches through cryptographic participations.

Summary of price action

• DOGE decreases by 6.88% from $ 0.24 to $ 0.22 in August 11,01: 00 – window 12,00:00

• $ 0.238 Locked resistance after 07:00 Selli Alimax on 485.69 m of volume

• The $ 0.226 support sees 793.38 million purchase flows; $ 0.231 rebound secondary resistance baps

• The last hour is negotiated in a tight range of 0.2247 to $ 0.2253 with a drop in volume

Market analysis and economic factors

The whale and institutional profit at $ 0.238 of resistance set the tone for the session, triggering ventilation less than $ 0.23 and forcing repetitions of $ 0.226. The purchase of support was obvious on two major volume peaks (11:00 a.m. and 9:00 p.m.), but repeated refusals nearly $ 0.231 kept Doge to pin.

With volume clarification at the bottom of the session, the structure refers to a possible basic construction – although the macro opposite winds can review $ 0.22 tested.

Technical indicators analysis

• Resistance: $ 0.238 (high volume rejection), $ 0.231 (secondary ceiling)

• Support: $ 0.226 Initial defense, $ 0.2247 – $ 0.2249 Floo intraday

• 24 -hour beach: $ 0.019 (7.89% volatility)

• Volume compression near low signals

• Multiple eruptions stranded over $ 0.231 confirm the overall food costs

What traders look at

• Rettest of $ 0.22 and if buying flows reappear with a key support

• Breakout attempts more than $ 0.231 as the first step towards recovery

• Impact of macro titles on the wider feeling of the piece even

• Signs of renewed whales accumulation after having sold the highest point