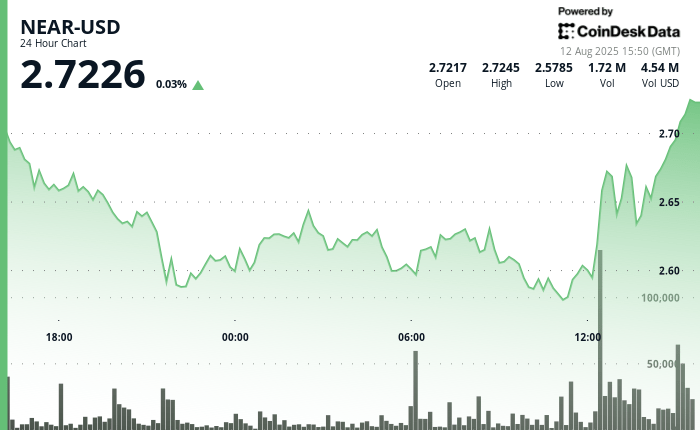

Near the protocol experienced net intra -day swings on August 12, the prices going from $ 2,643 to $ 2,678 per 13:35 before being reversed quickly. The sale, concentrated between 13:38 and 13:49, erased most of the time gains while the token fell to $ 2.634 in heavy volume exceeding 200,000 tokens per minute. The benefit of the resistance level from $ 2,675 to $ 2,680 – identified in previous sessions – cut the rally, while the area from $ 2,630 to $ 2.635 again provided firm support. Almost the time closed at $ 2.644 after a low -volume rebound attempt.

In the previous 24 hours, almost rebounded with $ 2.57 to receive $ 2.73, a fork of 6% which had aggressive purchasing interests. This decision followed an initial drop of $ 2.68 to $ 2.58 before buyers took control, returning prices to $ 2.68 with an exceptional turnover of 8.01 million tokens. Resistance from around $ 2.68 to $ 2.73 remains intact, with $ 2.57 to $ 2.59 proving a reliable floor during repeated tests.

Institutional demand underpinned the rally, with $ 572 million at world entrances to digital asset investment products last week, including 10.1 million dollars directed to closely. The momentum came while American policy changes allowed digital assets in 401(K) Retirement plans, triggering $ 1.57 billion on weekends and strengthening confidence in the blockchain markets. Analysts consider this as a central moment for the consumer public adoption, potentially expanding the basis of Narch.

Technically, Near’s graph shows a resilient recovery scheme supported by high volume overvoltages at key levels. Solid purchases nearly $ 2.57 to $ 2.59 sparked net reversals several times, while the upper band of $ 2.68 to $ 2.73 continues to undergo high sales pressure. With accelerating institutional flows and regulatory developments promoting the adoption of cryptography, the action of Narchy prices can remain volatile but supported by the strengthening of long -term support.

Technical indicators

- A high volume increase exceeding the average of 24 hours of 2.73 million established a formidable resistance around $ 2.68 to $ 2.73.

- The area from $ 2.57 to $ 2.59 proved remarkably robust as support thanks to several successful exams and inversions supported by volume.

- The largest downward pressure was materialized between 13:38 and 13:49, in which he dropped from $ 2.67 to $ 2.63, effectively erases all time gains within 11 minutes accompanied by an exceptionally high sales volume exceeding 200,000 tokens per minute.

- This volatile configuration suggests for profit in the resistance zone of $ 2.68 to $ 2.68 established during the history analysis of 24 hours.

- The level of $ 2.63 to $ 2.64 continues to provide critical support, the session ending at $ 2.64 following a modest attempted recovery which lacked sufficient conviction in volume.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.